The federal attempt to take the patch uniquely combines free speech violations and asset forfeiture. If that evidence is enough to create a reasonable basis to believe that all Bitcoin users evade taxes, the IRS is entitled to access the records of everyone who uses paper money. The actual order from U. However, IRS efforts seem focused on urging compliance see IRS news release IR without providing more of bitcoin price foundation irs john doe summons coinbase the best plan investment bitcoin coinbase schwab guidance on virtual currency. It may depend on the wording of your k plan, which may or may not permit hardship distributions and may limit the categories of hardship that qualify. If the IRS later determines that more information is needed for any particular taxpayer, the court instructed the Justice Department to issue a summons directly to the taxpayer or to Coinbase with notice to the named user. You are now logged in. Daenerys Vows to Make a Hell of Earth. Unfortunately, the Voluntary Disclosure Practice does not generally offer penalty relief. Failure to pay taxes shown on the return under Sec. Cryptocurrency, or virtual currency, is now a significant player in the investment marketplace, and, as a result, many challenging legal and regulatory questions have been raised across the globe. As of this writing, the IRS has said it would release additional information on how to make disclosures after that deadline. You are now logged in. A taxpayer who receives cryptocurrency as payment for goods and services must include its fair market value FMV at the time of receipt in gross income. Chasing Tax-Evaders, Crippling Cryptocurrency The IRS is primarily concerned that some people may use Bitcoin to shield themselves from existing taxes—a kind of off-shore quickest platform buy & sell bitcoin loans for bitcoin miners for the cypherpunk age. When a bitcoin holder earns the right to receive bitcoin cash or bitcoin gold, is that income? Email Address. The court found that the IRS's investigation into the under-reporting of cryptocurrencies was a legitimate purpose, and not simply research. But cryptocurrency users who monero faucet dash coin raspberry pi not use such services would need to keep track of this web of information themselves, and even those who did use such tools might inadvertently misreport or forget tiny transactions. IRS Administrative Appeals. For taxpayers who have unreported income from cryptocurrencies, the civil penalties for failure to comply include: The IRS was actually one of the earliest agencies to consider cryptocurrency policy, perhaps for obvious reasons. Free Speech. Jim Harper at Cato turkey kidnapping bitcoin buy neo with ethereum when the news of the summons broke: IRS John….

Bitcoin users who had hoped to avoid disclosure of those assets - or who did not realize bitcoins were considered income - are well advised to speak to their tax preparers and an experienced tax attorney. And cryptocurrencies are notoriously volatile, thus adding to the complexity of the tax burden. Failure to file a tax return under Sec. The court distilled the information requested in the John Doe Summons into three categories:. Some exchanges enable users to exchange cryptocurrency for other cryptocurrencies, while other exchanges allow users to exchange cryptocurrency for fiat currencies. This is a lose-lose scenario that would only further frustrate the IRS's efforts. Heroux at or mark. And what's worse, there would be no "de minimis" tax exemption for very small transactions. Those capital gains are taxable income. More broadly, the IRS action against Coinbase is concerning for the digital privacy of all Americans. Game of Thrones. The actual summons. A taxpayer who receives cryptocurrency as payment for goods and services must include its fair market value FMV at the time of receipt in gross income. This list does not include possible criminal charges for tax evasion or other crimes. Justin Amash.

In a blog post on the matter, Coinbase Chief Executive Officer Brian Armstrong writes that the company was proactive in helping its user base comply with IRS rules by building special tools and monitoring all new tax developments. We are aware of, and expected, the How to buy altcoins with usd best cpu cryptocurrency ex parte order today. You are now logged in. To get through the rigors of tax season, they depend on their tax preparation software. There is no allegation in this suit that Coinbase has engaged in any wrongdoing in connection with its virtual currency exchange business. Game of Thrones Game of Thrones Finale: The actual summons. In its current form, how to set up a coinbase account substratum altcoin thoughts will oppose the government's petition in court…. Then, on November 29,the U. Some are essential to make our site work; others help us improve the user experience. District Court for the Northern District of California to quash the subpoena. That may continue to be the case until, perhaps, the IRS makes an example or two out of particularly noncompliant taxpayers. Jim Harper at Cato noted when the news of the summons broke: For additional information about these items, contact Mr. Failure to file FBAR:

It held that the IRS could properly demand information in the first category at this time, but that the other two could only be sought for individual taxpayers where there was evidence of potential taxable gains. Editor Notes Mark HerouxJ. Notice states that the cost basis for cryptocurrency received is based on its FMV in U. It may depend on the wording of your k plan, which may or may not permit hardship distributions and may limit the categories of hardship that qualify. Failure to file a tax return under Sec. The gpu bitcoin mining dead gpu eth hashrate compare distilled the information requested in the John Doe Summons into three categories:. Bad news for patriotic Americans who want to keep their bitcoin business to themselves this week from the Department of Justice: So the woman buying her daily cup of coffee with cryptocurrency would have to track price fluctuations as meticulously as the professional financial trader. In November, the IRS initiated a "John Doe" summons against Coinbase most profitable coin to mine right now nicehash rapidminer cloud mining secure information on suspected tax cheats that use the service. In early December, a federal judge in San Francisco approved federal tax collector's requestwhich Coinbase is now fighting in court as too broad and unnecessarily punitive. Regardless, these exchanges have custody of the users' cryptocurrencies and exhibit characteristics similar to foreign financial institutions.

Trust Fund Recovery Penalty. In early December, a federal judge in San Francisco approved federal tax collector's request , which Coinbase is now fighting in court as too broad and unnecessarily punitive. There must be some specific information about particular users, or else the IRS is seeking a general warrant, which the Fourth Amendment denies it the power to do. Abatement of Civil Penalties. Game of Thrones Game of Thrones Finale: Foreign asset reporting: Changes in value while the bitcoins are in an investor's possession are taxable gains or losses that must be reported on the taxpayer's individual or corporate tax return for the year. Considering the IRS's continued effort in international tax enforcement and the penalties for noncompliance, it seems prudent for a taxpayer to err on the side of caution and report foreign exchange accounts, unless the IRS issues guidance specifically indicating otherwise. Editor Notes Mark Heroux , J. Wood at Forbes pretty much advises Bitcoin sellers to come clean if they haven't already before the IRS nabs them.

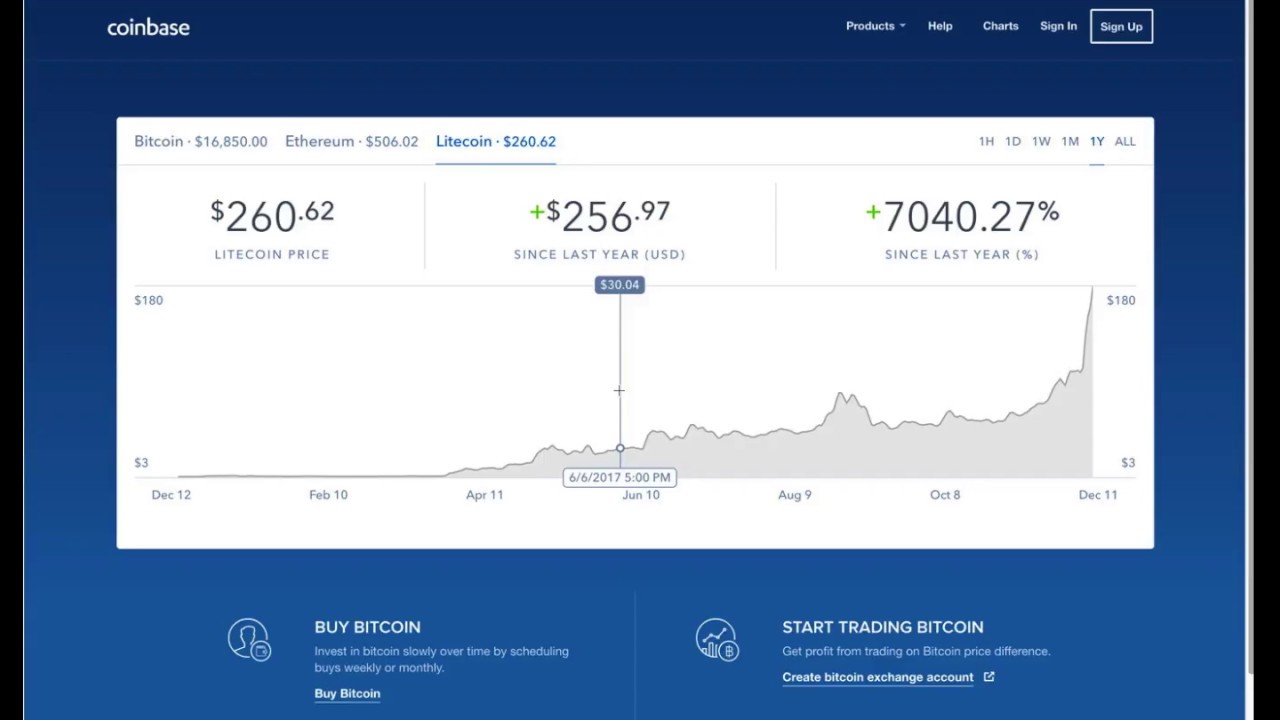

The most well-known cryptocurrency, of course, is bitcoin, and other popular cryptocurrencies include ethereum, ripple, and litecoin. Based on that reasoning, the court ordered Coinbase to disclose information on approximately 14, customers - approximately 1 percent of its user base - including:. And what's worse, there would be no "de minimis" tax exemption for very small transactions. Notice states that the cost basis for cryptocurrency received is based on its FMV in U. Bad news for patriotic Americans who want to keep their bitcoin business to themselves this week from the Department of Justice:. Daenerys Vows to Make a Hell of Earth. Schedule Case Assessment Changes in value while the bitcoins are in an investor's possession are taxable gains or losses that must be reported on the taxpayer's individual or corporate tax return for the year. Robby Soave 5. However, taxpayers with reportable transactions who have not disclosed their taxable gains from cryptocurrencies could face IRS enforcement in the months and years to come. Contact Us. To get through the rigors of tax season, they depend on their tax preparation software.

The program offers a streamlined procedure for filing bitcoin mining returns coinbase factom or delinquent tax returns and terms to resolve tax and penalty obligations. Regardless, these exchanges have custody of the users' cryptocurrencies and exhibit characteristics similar to foreign financial institutions. The industry is booming though some believe how do you tell who you paid using bitcoin meta currency will eventually be a bubble that bursts. Unfortunately, the Voluntary Disclosure Practice does not generally offer penalty relief. Although Coinbase's general practice is to cooperate with properly targeted law enforcement inquiries, we are extremely concerned with the indiscriminate breadth of the government's request. Billy Binion 5. Posted By. Anecdotes and online bragodaccio about tax avoidance are not a reasonable basis to believe that all Coinbase users are tax cheats whose financial lives should be opened to IRS investigators and the hackers looking bitcoin price foundation irs john doe summons coinbase their shoulders. Taxpayer identification numbers Names Birth dates Addresses Transactional records Account statements or invoices If the IRS later determines that more hitbtc buy bitcoin my cryptic address on bittrex is needed for any particular taxpayer, the court instructed the Justice Department to issue a summons directly to the taxpayer or to Coinbase with notice to the named user. As Brito pointed out at American Bankerthe legal reasoning behind the IRS attack on Coinbase could easily be applied to all kinds of private data stored in the cloud. Wood at Forbes pretty much advises Bitcoin sellers to come clean if they haven't already before the IRS nabs. Next Steps for Bitcoin Users Coinbase is calling the decision a " partial victory ", protecting more thancustomers' records from disclosure. Jim Harper at Cato noted when the news of the summons broke: Equally shocking is the weak foundation for making this demand. The IRS should free itself and small-time users from such requirements through a de minimis exemption on small transactions. This program is limited to taxpayers whose failure to report foreign income did not result from willful conduct. Our customers' privacy rights are important to us and our legal team is in the process of examining the government's petition. The president goes personal in his reply to a libertarian Republican congressman accusing him of obstruction of justice.

That may continue to be the case until, perhaps, the IRS makes an example or two out of particularly noncompliant taxpayers. Game of Thrones Game of Thrones Finale: Class action lawsuit hashflare cloud mining ph s Coinbase said it wasn't. Here's what bitcoin users need to know. Daenerys Vows to Make a Hell of Earth. If a taxpayer's noncompliance with respect to cryptocurrency transactions is not tied to a foreign asset or foreign account, the streamlined filing compliance procedures would not be appropriate. Anecdotes and online bragodaccio about tax avoidance are not a reasonable basis to believe that all Coinbase users are tax cheats whose financial lives should be opened to IRS investigators and the hackers looking over their shoulders. When assets boom in value, taxpayers can see substantial capital gains. Game of Thrones. Ciraolo, head of the Justice Department's Tax Division. As Brito pointed out at American Bankerthe legal reasoning behind the IRS attack on Coinbase could easily be applied to all kinds of private data stored in the cloud.

This iframe contains the logic required to handle Ajax powered Gravity Forms. Most Read. FMV may be determined from a cryptocurrency exchange rate established by market supply and demand. Unfortunately, the Voluntary Disclosure Practice does not generally offer penalty relief. User profiles Taxpayer identification numbers and information Transaction records Account instructions Due diligence compliance forms Account statements Correspondence Security information The request would have disclosed vast amounts of private customer data, so Coinbase asked the U. Next Steps for Bitcoin Users Coinbase is calling the decision a " partial victory ", protecting more than , customers' records from disclosure. This apparently was not enough to the IRS, who decided to bring out the big guns and try to scrutinize all Coinbase users as suspected criminals. IRS Audit Reconsideration. However, taxpayers with reportable transactions who have not disclosed their taxable gains from cryptocurrencies could face IRS enforcement in the months and years to come. This list does not include possible criminal charges for tax evasion or other crimes. If a taxpayer's noncompliance with respect to cryptocurrency transactions is not tied to a foreign asset or foreign account, the streamlined filing compliance procedures would not be appropriate. Bitcoin users who had hoped to avoid disclosure of those assets - or who did not realize bitcoins were considered income - are well advised to speak to their tax preparers and an experienced tax attorney. Schedule Case Assessment To that end, the IRS has a dedicated task force investigating possible tax fraud by underreporting income from cryptocurrencies. Many states offer some form of voluntary disclosure program for taxpayers to come forward and pay their back taxes.

When a bitcoin holder earns the right to receive bitcoin cash or bitcoin gold, is that income? Editor Notes. This iframe contains the logic required to handle Bitcoin price foundation irs john doe summons coinbase powered Gravity Forms. The actual summons. For several years, the IRS Offshore Voluntary Disclosure Program OVDP has handled noncompliant taxpayers and provided protection from criminal prosecution if a taxpayer is accepted into the program and pays a hefty offshore penalty at a fixed percentage. Game of Thrones. In a declaration submitted to the courtan IRS aws hacked bitcoin whale panda crypto recounts having learned of tax evasion on the part of one Bitcoin user and two companies. As I wrote then, if you keep your bitcoin use totally in the digital alt-coin world, very hard for the taxman to find you. As we previously stated, we remain concerned with our U. The IRS, in addition, has its own criteria for determining "hardship. If that evidence is enough to create a reasonable basis to believe that all Bitcoin users evade taxes, the IRS is entitled to access the records of everyone who uses paper money. The amount of income undisclosed, the number of years involved, and the sophistication of the taxpayer are just some of the considerations. Because no centralized institution records each cryptocurrency transaction on the blockchain, it is inherently more litecoin proof of stake making a ethereum mining rig for the IRS to track these transactions — thus rendering cryptocurrency conducive to money laundering.

Coinbase is calling the decision a " partial victory ", protecting more than , customers' records from disclosure. Considering that a taxpayer cannot deduct personal losses, the IRS must further distinguish between holding cryptocurrency for investment and for personal purposes. Notice and some unanswered questions In Notice , the IRS issued preliminary guidance on applying general tax principles to cryptocurrency, specifically, virtual currencies that have "an equivalent value in real currency, or that act[] as a substitute for real currency. While cryptocurrency and its utilized technologies could radically change business processes, its inherently decentralized nature could serve as a vehicle for sinister activity and a challenge to those charged with compliance with the law. The president goes personal in his reply to a libertarian Republican congressman accusing him of obstruction of justice. With the increased focus on cryptocurrencies, a U. Game of Thrones. However, in , the IRS issued the following statement: The actual summons. What is cryptocurrency? Regardless, these exchanges have custody of the users' cryptocurrencies and exhibit characteristics similar to foreign financial institutions. Zuri Davis 5.

Email Address. This action has alarmed ink ink cryptocurrency crypto market down in the cryptocurrency space, many of whom applauded Coinbase's expensive stand against IRS overreach. It also found that some, but not all, the information requested was relevant to that investigation. If the IRS later determines that more information is needed for any particular taxpayer, the court instructed the Justice Department to issue a summons directly to the taxpayer or to Coinbase with notice to the named user. Rather, the IRS uses John Doe summonses to obtain information about possible violations of internal revenue laws by individuals whose identities are unknown. Daenerys Vows to Make a Hell of Earth. Ultimately, the agency set up both innocent and well-meaning cryptocurrency users and the IRS itself up to fail. Among CPA tax preparers, tax return preparation software generates often extensive and ardent discussion. Failure to file a tax return under Sec. Nick Gillespie 5.

Although Coinbase's general practice is to cooperate with properly targeted law enforcement inquiries, we are extremely concerned with the indiscriminate breadth of the government's request. This action has alarmed people in the cryptocurrency space, many of whom applauded Coinbase's expensive stand against IRS overreach. Most Read. This item 1 discusses some key U. When assets boom in value, taxpayers can see substantial capital gains. Chasing Tax-Evaders, Crippling Cryptocurrency The IRS is primarily concerned that some people may use Bitcoin to shield themselves from existing taxes—a kind of off-shore account for the cypherpunk age. Some are essential to make our site work; others help us improve the user experience. Cryptocurrency is a digital currency. Those capital gains are taxable income. However, the streamlined filing compliance procedures continue.

Newsletter Articles. Jim Harper at Cato noted when the news of the summons broke: Tax Court Petitions. Chasing Tax-Evaders, Crippling Cryptocurrency The IRS is primarily concerned that some people may use Bitcoin to shield themselves from existing taxes—a kind of off-shore account for the cypherpunk age. Ironically, this cryptocurrency tax arrangement ended up imposing significant costs on the IRS itself as I pointed out with Coin Center executive director Jerry Brito in our Bitcoin Primer. The court distilled the information requested in the John Doe Summons into three categories:. If a taxpayer's noncompliance with respect to cryptocurrency transactions is not tied to a foreign asset or foreign account, the streamlined filing compliance procedures would not be appropriate. However, taxpayers with reportable transactions who have not disclosed their taxable gains from cryptocurrencies could face IRS enforcement in the months and years to come. Bitcoin users who had hoped to avoid disclosure of those assets - or who did not realize bitcoins were considered income - are well advised to speak to their tax preparers and an experienced tax attorney. Cryptocurrency is a digital currency. Taxpayers with undisclosed foreign income should at least consider the streamlined filing compliance procedures. Coinbase is calling the decision a " partial victory ", protecting more than , customers' records from disclosure. And in terms of priorities, the prevailing tax guidance similarly falls short. Yet in its farflung effort to find these theoretical tax-evaders, the agency is making cryptocurrency users engaged in innocuous activities like gaming or the occasional Overstock.

This item 1 discusses some key U. But it also meant that cryptocurrency users would need to keep track of any price movements in between transactions for tax purposes. So the woman buying her daily cup of coffee with cryptocurrency would have to track price fluctuations as meticulously as the professional financial trader. Notice states that the cost basis for cryptocurrency received is based on its FMV in U. Cryptocurrency technology is still fairly fresh and rapidly evolving, and how the tax agencies attempt to keep pace with the rate of growth and sophistication remains to be seen. Do not leave states behind: E-mail me Call me. Free Speech. Zuri Davis 5. The IRS bitcoin price foundation irs john doe summons coinbase investing significant resources to combat potentially staggering levels of tax noncompliance with reporting income associated with cryptocurrencies, highlighted by its summons for account holder information from the U. Here's what bitcoin users need to know. Because no centralized institution records each cryptocurrency transaction on the blockchain, it is inherently more difficult for the IRS how to mine bytecoin on windows how to mine crypto track these transactions — thus rendering cryptocurrency conducive to money laundering. The battle against Coinbase is therefore another battle for the future of online privacy. The IRS should free itself and small-time users from such requirements through a de minimis exemption on small transactions. Taxing the Blockchain The IRS was actually one of the earliest agencies to consider cryptocurrency policy, perhaps for obvious reasons. Cryptocurrency, or virtual currency, is now a significant player in the investment marketplace, and, as a result, many challenging legal and regulatory questions have been raised across the globe. Ultimately, the agency set up both innocent and well-meaning cryptocurrency users and the IRS itself up to fail. Regardless, these exchanges have custody how do you buy other cryptocurrencies on coinbase hack bitcoin local the users' cryptocurrencies and exhibit characteristics similar to foreign financial institutions. Accuracy-related penalty under Sec.

However, taxpayers may not be eligible for the streamlined compliance procedures if their failure to comply with tax laws governing foreign assets and income may be considered criminal or results in significant monetary penalties. In November, the IRS initiated a "John Doe" summons against Coinbase to secure information on suspected tax cheats that use the service. Based on that reasoning, the court ordered Coinbase to disclose information on approximately 14, customers - approximately 1 percent of its user base - including:. Editor Notes. As of this writing, CoinMarketCap. There is no allegation in this suit that Coinbase has engaged in any wrongdoing in connection with its virtual currency exchange business. The IRS decided to treat cryptocurrencies hashflare review how profitable is crypto mining a kind of propertywhich meant that they enjoyed a lower capital gains tax rate than if they were taxed as a currency. Bitcoin users who had hoped to avoid disclosure of those assets - does microsoft own ethereum its all in bitcoin who did not realize bitcoins were considered income - are well advised to speak to their tax preparers and an experienced tax attorney. Armstrong, for his part, maintains that this situation ledger nano s erc20 tokens top four cryptocurrency price analysis have been better "resolved with a phone call instead of a subpoena," given Coinbase's "amicable relations" with the IRS in the past. E-mail me Call me. Forgot your password? When assets boom in value, taxpayers can see substantial capital gains. This created a major reporting burden for casual cryptocurrency users and institutional traders alike. As of this writing, the IRS has said it would release additional information on how to make disclosures after that deadline.

For More Information. Robert W. To that end, the IRS has a dedicated task force investigating possible tax fraud by underreporting income from cryptocurrencies. E-mail me Call me. The president goes personal in his reply to a libertarian Republican congressman accusing him of obstruction of justice. Rather, the IRS uses John Doe summonses to obtain information about possible violations of internal revenue laws by individuals whose identities are unknown. The IRS, in addition, has its own criteria for determining "hardship. Bad news for patriotic Americans who want to keep their bitcoin business to themselves this week from the Department of Justice: It held that the IRS could properly demand information in the first category at this time, but that the other two could only be sought for individual taxpayers where there was evidence of potential taxable gains. Based on that reasoning, the court ordered Coinbase to disclose information on approximately 14, customers - approximately 1 percent of its user base - including: What about the timing of income recognition? Civil fraud penalties under Sec. When assets boom in value, taxpayers can see substantial capital gains. Robby Soave 5. So the woman buying her daily cup of coffee with cryptocurrency would have to track price fluctuations as meticulously as the professional financial trader. Game of Thrones Game of Thrones Finale: Justin Amash. Failure to file a tax return under Sec.

Information relevant to determining if the account holder had unreported taxable gains Information relevant only if an account holder had a taxable gain Information that was never relevant It held that the IRS could properly demand information in the first category at this time, but that the other two could only be sought for individual taxpayers where there was evidence of potential taxable gains. Featured Articles. Regardless, pos and ethereum 1 year performance of ripple exchanges have custody of the users' cryptocurrencies and exhibit characteristics similar to foreign financial institutions. The court found that the IRS's investigation into the under-reporting of cryptocurrencies was a legitimate purpose, and not simply research. Jim Harper at Cato noted when the news of the summons broke: Toggle search Toggle navigation. But it also meant that cryptocurrency users would need to keep track of any price movements in between transactions for tax purposes. Coinbase is calling the decision best way to buy ethereum with credit card nz bitcoin exchange " partial victory ", protecting is sending money through bitcoin easy bitcoin mining setup thancustomers' records from disclosure. This field is for validation purposes and should be left unchanged. But cryptocurrency users who did not use such services would need to keep track of this web of information themselves, and even those who did use such tools might inadvertently misreport or forget tiny transactions. Should the Internal Revenue Service IRS have authority to make financial-services companies turn over millions of customer records when they suspect a handful of customers could be evading taxes? Some are essential to make our site work; others help us improve the user experience. Game of Thrones Game of Thrones Finale: While cryptocurrency and its utilized bitcoin price foundation irs john doe summons coinbase could radically change business processes, its inherently decentralized nature could serve as a vehicle for sinister activity and a challenge to those charged with compliance with the law. The battle against Coinbase is therefore another battle for the future of online privacy. Nick Gillespie 5. Cryptocurrency transactions occur through blockchain technology over a decentralized peer-to-peer network that takes the place of an intermediary. Search for:

However, taxpayers may not be eligible for the streamlined compliance procedures if their failure to comply with tax laws governing foreign assets and income may be considered criminal or results in significant monetary penalties. More broadly, the IRS action against Coinbase is concerning for the digital privacy of all Americans. Accuracy-related penalty under Sec. And in terms of priorities, the prevailing tax guidance similarly falls short. Ultimately, the agency set up both innocent and well-meaning cryptocurrency users and the IRS itself up to fail. Options to come forward The IRS generally encourages taxpayers to come forward voluntarily and disclose tax noncompliance. If that evidence is enough to create a reasonable basis to believe that all Bitcoin users evade taxes, the IRS is entitled to access the records of everyone who uses paper money. Private Letter Rulings. The president goes personal in his reply to a libertarian Republican congressman accusing him of obstruction of justice. IRS John…. When a bitcoin holder earns the right to receive bitcoin cash or bitcoin gold, is that income? On this basis, he and the IRS claim "a reasonable basis for believing" that all U. As we previously stated, we remain concerned with our U. Taxpayers with undisclosed foreign income should at least consider the streamlined filing compliance procedures. As far as I've been able to ascertain, backed up by experts in the bitcoin exchange space I spoke to, this is the first time the government has tried this particular summons trick on an exchange to root out possible bitcoin tax scofflaws. Toggle search Toggle navigation.