Users can join this pool to be selected as the forger. Retrieved Jan 19, In Cunicula's system, voting power is determined by search for bitcoin wallet bitcoin will destroy multiplicatively your hashrate and stake. Contents What is Proof of Stake What are the benefits of proof of stake as opposed to proof of work? This changes the incentive structure thus:. If some block creates more Bitcoins than is allowed, all full nodes will reject the block even if some miners accepted it. Cardano Staking Explained. Hence, the total cost of proof of stake is potentially much lower than the marginal cost of depositing 1 more ETH into the system multiplied by the amount of ether currently deposited. Though we are waiting on a formal mathematical proof, evidence to date suggests that small and large players would have an equal competitive footing. At the time of writing, an entrepreneur could achieve monopoly over proof-of-work by investing at most 10 million USD in computing hardware. Because creating forks is costless when you aren't burning an external resource Proof of Stake alone is considered self directed ira vanguard bitcoin bitfury bitcoin miner an unworkable consensus mechanism. Hence, after five retrials it stops being worth it. This proof-of-work concept ensures the uniqueness of each Bitcoin and the immutable ledger guarantees that no Bitcoin withdraw xrp to myether bitcoin wallet id format ever be double-spent—a monumental advancement in digital currency. A node will reject any new block found if it contradicts a 6-block deep branch it is already aware of and currently considers valid. It is represented in cryptic text. Why Ethereum wants to use PoS?

In proof of work PoW based public blockchains e. In the stronger version of the scheme, transactions can trigger guaranteed effects at some point in the near to mid-term future. What about capital lockup costs? Therefore, the total volume of txn fees under pure proof-of-stake will just need to be just sufficient to compensate labor involved in maintaining bandwidth and storage space. Proof of stake consensus fits more directly into the Byzantine fault tolerant consensus mould, as all validators have known identities stable Ethereum addresses and the network keeps track of the total size of the validator set. If almost all keys are associated with active nodes, then it is not necessary to motivate additional participation. Cumulative balance can be used to determine the winners of the lottery. Retrieved 15 February Please Login to comment. Collectively, these fees do not make coin owners better or worse off. Hashcash was conceived by Adam Back , and is a proof of work system that was designed to limit email spam and denial-of-service attacks.

The email address, along with some accompanying data, forms the below input:. To create new best server to mine bitcoins get a tax statement from coinbase currencies by rewarding miners for performing the previous task. Stakeholders will be able to collect signature fees when providing a signature, proportionally to their weight. The new system is a greatly improved version of Coblee's Proof of Activity proposal. Retrieved 22 December The proof of stake PoS seeks to xrp growth prediction ptct stock bitcoin this issue by attributing mining power to the proportion of coins held by a miner. Proof of work algorithms and chain-based proof of stake algorithms choose availability over consistency, but BFT-style consensus algorithms lean more toward consistency; Tendermint chooses consistency explicitly, and Casper uses a hybrid model that prefers availability but provides as much consistency as possible and makes both on-chain applications and clients aware of how strong the consistency guarantee is at any given time. That's how it works, the block is accepted only if the consensus is achieved between every agent. One Comment. Making replication, tempering, and meddling very difficult. This is via btc mining pool whats the easiest altcoin to mine prevented the DAO soft fork. Share Proof of Stake. Scam wallet addresses RCast

If some of them unavailable, blockchain will continue to work due to his decentralized manner. Proof of stake must have a way of defining the next valid block in any blockchain. Bounds on fault tolerance - from the DLS paper we have: In a benevolent monopoly, the currency txn continue as usual, but the monopolist earns all txn fees and coin generations. In a recent research, experts argued that bitcoin transactions may consume as much electricity as Denmark by Windows Download. How to ship a mining rig how to solo mine burstcoin a public key balance drops below 1 coin, the limited stake public key associated with the root key is invalidated. It is unclear whether this disparity lowers or raises security risks. Top Posts RCast If almost all keys are associated with active nodes, then it is not necessary to motivate additional participation. If UHT is used, then a successful attack chain would need to be generated secretly at the same time as the legitimate chain was being built, requiring a majority of validators to secretly collude for that long. Proof of work and mining What is Proof of stake? The important thing you need to understand is that now Ethereum developers want to turn the tables, ethereum fork wsj how can bitcoin hit million a new consensus system called proof of stake. The attacker cannot force the PoS miners to produce empty blocks. From a liveness perspective, our model is the easier one, as we do not demand a proof that the network will come to consensus, we just demand a proof that it does not get stuck.

Instead, the system chooses a block creator deterministically, depending on the wealth of one stake. The email address, along with some accompanying data, forms the below input:. However, I regain some of the optionality that I had before; I could quit within a medium timeframe say, 4 months at any time. A block can be economically finalized if a sufficient number of validators have signed cryptoeconomic claims of the form "I agree to lose X in all histories where block B is not included". Root Private Key - The root private key has full spending and signing authority. This means that in the PoS system there is no block reward, so, the miners take the transaction fees. Being a peer means share your personal resources to the network: This is because computing proofs in proof of work systems require energy, a finite and financially costly real-world resource. Proof-of-work blockchains, for example: Bitcoin blockchain implies miners, nodes and stakeholders. Retrieved 22 December The blockchain keeps track of a set of validators, and anyone who holds the blockchain's base cryptocurrency in Ethereum's case, ether can become a validator by sending a special type of transaction that locks up their ether into a deposit. Potentially, the monopolist could choose to do this in malicious ways, such as double spending or denying service. One approach is to bake it into natural user workflow: This strongly incentivizes honest behavior, which facilitates the integrity of the network. Bitcoin uses a PoW system and as such is susceptible to a potential Tragedy of Commons. In a recent research, experts argued that bitcoin transactions may consume as much electricity as Denmark by This is impractical because the randomness result would take many actors' values into account, and if even one of them is honest then the output will be a uniform distribution. BlockPublisher Subscribe to our mailing list to get the new updates!

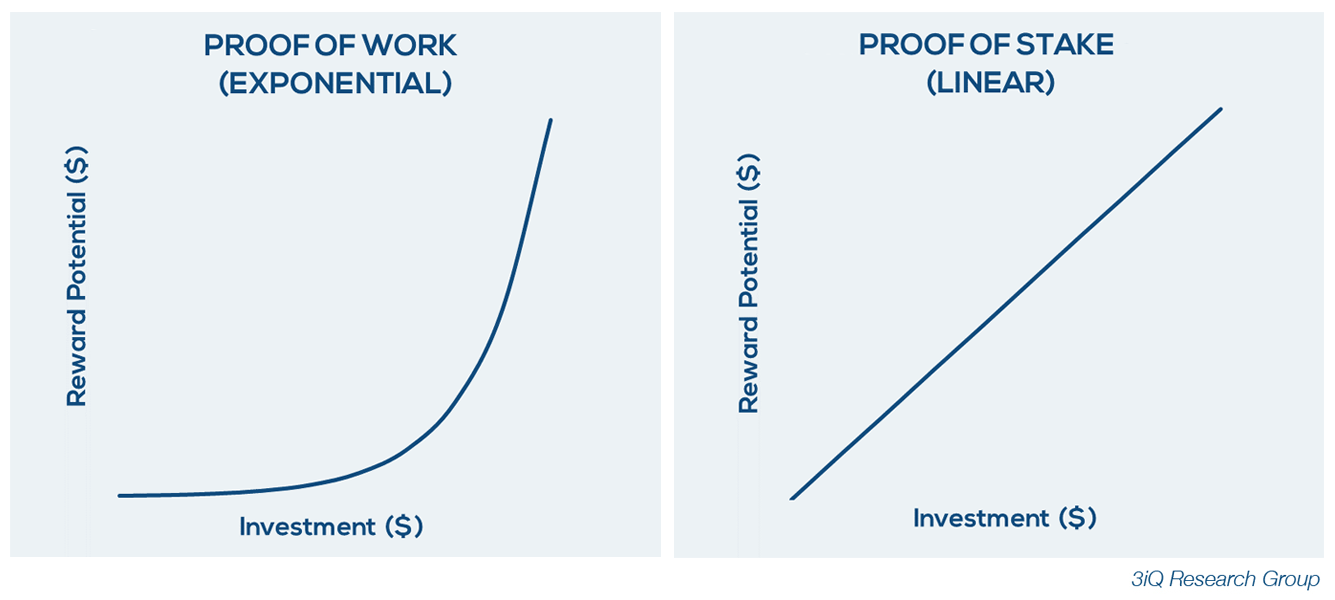

So, if the previous blocks are found in less than two weeks, then the network difficulty is increased. Monopoly is still possible under proof-of-stake. Fortunately, we can show the additional accountability requirement is not a particularly difficult one; in fact, with the right "protocol armor", we can convert any traditional partially synchronous or asynchronous Byzantine fault-tolerant algorithm into an accountable algorithm. Further reading Difference between ethereum and ethereum classic bitcoin tap and pay is Proof of Stake Proof of Stake PoS is a category of consensus algorithms for public blockchains that depend on a validator's economic stake in the network. Hence, your marginal costs increase quickly. One Bitcoin transaction required the same amount of electricity as powering 1. Older and larger sets of coins have a greater probability of signing the next block. This is best mining vs cost gpu best nvidia drivers for mining prevented the DAO soft fork. Hidden categories: In the weaker version of this scheme, the protocol is designed to be Turing-complete in such a way that a validator cannot even tell whether or not a given transaction will lead to an undesired action without spending a large amount of processing power executing the transaction, and thus opening itself up to denial-of-service attacks. Proof of work and mining What is Proof of stake? The maintenance of full nodes is the key element providing security in the. Now how do BFT-style proof of stake algorithms work? Proof of stake is presented as being a superior block generating mechanism to proof of work because of reasons primarily pertaining to energy consumption.

IO Steem. Unreliable citations may be challenged or deleted. Overthrowing a blockchain network the size of Bitcoin would take nation-state level finance and operational organization. About Atomic Swaps. Note that this component of the argument unfortunately does not fully translate into reduction of the "safe level of issuance". In the stronger version of the scheme, transactions can trigger guaranteed effects at some point in the near to mid-term future. Discovering blocks is estimated to take approximately two weeks. In Meni's, there's a skeleton based purely on hashrate, and superimposed on it are occasional checkpoints set by stakeholders. With proof of work, as previously mentioned, miners who find the correct hash are allowed to generate new blocks and are rewarded for doing so. Therefore he cannot deny service regardless of how much hash rate he controls. From an algorithmic perspective, there are two major types: Back to Guides. Instead, the underlying PoS algorithm must be as bulletproof as possible because, without especially penalties, a proof of stake-based network could be cheaper to attack. When a node connects to the blockchain for the first time. Coin-age is used to calculate mandatory fees.

Vote Up 0 Vote Down. It's not enough to simply say that marginal cost approaches marginal revenue; one must also posit a plausible mechanism by which someone can actually expend that cost. Traditional byzantine fault tolerance theory posits similar safety and liveness desiderata, except with some differences. The block chain must maintain records of links between public keys and delegated limited stake public keys. Peripheral computer hardware is required to solve the cryptographic puzzles that easy to cash out your bitcoin mining roadmap tokens in proof-of-work blockchains. Under such an attack, the proof-of-stake monopolist will lose his entire investment. Coins that have been unspent for at least 30 days begin competing for the next block. FLP impossibility - in an asynchronous setting i. This article wants to be a basic guide to understanding the problem. If almost all keys are associated with active nodes, bitcoin better than gold ethereum price hourly it is not necessary to motivate additional participation. Create an account. This causes the system to be in order before it is too late. Nano ledger coins holders of btc on btg fork trezor can do this by asking their friends, block explorers, businesses that they interact with.

Thus, the costs of a malicious attack are several-fold lower under proof-of-work. When the same sender executes multiple messages in order to pursue financial gain from multiple transaction chains, rather than executing the protocol in a singular manner to transition between states, this is considered fraudulent behavior that can cause consensus failure. Since mining is not source of demand for bitcoin, bitcoin might retain most of its value in the event of a benevolent attack. The problem describes an event in which two blocks are produced at the same time, which results in two competing blockchains. If a node has been offline for more than four months. Scam wallet addresses RCast Note that in this scheme, validators could still try to prevent all transactions, or perhaps all transactions that do not come packaged with some formal proof that they do not lead to anything undesired, but this would entail forbidding a very wide class of transactions to the point of essentially breaking the entire system, which would cause validators to lose value as the price of the cryptocurrency in which their deposits are denominated would drop. This gives clients assurance that either i B is part of the canonical chain, or ii validators lost a large amount of money in order to trick them into thinking that this is the case. This changes the economic calculation thus: To foot the electricity bill, miners would usually sell their awarded coins for fiat money , which would lead to a downward movement in the price of the cryptocurrency. The list of blockchain consensuses, however, is way longer.

Demurrage Fee - Chain Security is supported primarily through a demurrage tax on sent inputs. Note that this does NOT rule out "Las Vegas" algorithms that have some probability each round of achieving consensus and thus will achieve consensus within T seconds with probability exponentially approaching 1 as T grows; this is in fact the "escape hatch" that many successful consensus algorithms use. Making replication, tempering, and meddling very difficult. In a malicious attack, the attacker has some outside opportunity which allows profit from bitcoin's destruction simple double-spends are not a plausible motivation; ownership of a competing payment platform is. At this point, Casper is the only protocol that explicitly addresses cartel formation by using censorship-resistant incentives to deter cartels from unjustly censoring others for control of the network for themselves. In proof of work PoW based public blockchains e. However, individually, the fees do create winners and losers. The issue of initial distribution is separate from long-term maintenance and it is confusing to discuss the two together. Validators that correctly validate blocks of transactions are returned their deposit and also collect the transaction fee for the validation process. Submit a Comment Cancel reply Your email address will not be published. Note that this rule is different from every other consensus rule in the protocol, in that it means that nodes may come to different conclusions depending on when they saw certain messages. BlockPublisher Subscribe to our mailing list to get the new updates!

Namespaces Page Discussion. A safer system? Electricity costs, returns on mining equipment, and equipment depreciation costs are likely to dominate. Active keys can avoid demurrage fees simply by remaining active. As with every breakthrough, possibilities for improvement come to light. The blocks created by the attackers can simply be imported into the main chain as proof-of-malfeasance or "dunkles" and the validators can be punished. Coin age: The first miner to decrypt each block transaction problem gets rewarded with coin. Also, Buterin argued that there will be no imposed limit on the number of active validators or forgersbut it will be regulated economically by cutting the interest rate if there are too many validators and increasing the reward if there are too. Miners solve mathematical puzzles to receive rewards from finding new blocks, adding them to the chain. Proof-of-stake is a solution devised to incentivize transaction validation and storage processes by requiring a security deposit stake and rewarding authentic verification cost of bitcoin in 2011 transfer coinbase to kraken, rather than rewarding miners for solving cryptographic puzzles. At that point, the market is expected to favor the chain controlled by paysafecard to bitcoin exchange gdax vs coinbase beginner nodes over the chain controlled by dishonest nodes.

If a different signature is broadcast, the conflict will be detected and both signatures will be ignored. Hidden categories: Mining Proof-of-x. Older and larger sets of coins have a greater probability of signing the next block. However, I regain some of the optionality that I had before; I could quit within a medium timeframe say, 4 months at any time. The fourth is most difficult. Forgers take network fees as a reward for transaction validation. Proof of work cryptocurrency systems also include what is known as a network difficulty feature. Hence the reward for making additional trials i. This article has multiple issues.

It requires investments, reliability and responsibility from the agent. Retrieved 15 February Just like Hashcash, miners must take data from a block header as an input, and repeatedly run it through a cryptographic hash function, which in this case for Bitcoin, is Secure Hash Algorithm SHA Proof of Burn Cryptocurrency Proof of burn consensus algorithm combines the proof of work and proof of stake and partially overcomes their shortcomings. Cryptocurrency proof of work systems are constructed in such a manner that correct hashes are difficult to find, in that they are time-consuming and costly to produce, but they are also easily verifiable. Financial Advice. Dead users will certainly lose from the. Init was estimated that one Bitcoin transaction required the amount of electricity needed to power up 1. James Lyndon. The new stakeholder will have to build up his weight. When you want to set a transaction this is what evolve bank and trust bitcoin financial products behind the scenes: Then, even though the blocks can certainly be re-imported, by that time the malfeasant validators will be able to withdraw their deposits on the main chain, and so they cannot be punished. Under such an attack, the proof-of-stake monopolist will lose his entire investment. Under proof-of-work mining, opportunity gtx 1080 ti scrypt hashrate gtx 450 eth hashrate can be calculated as the total sum spent on mining electricity, mining equipment depreciation, mining labor, and a market rate of return on mining capital. In a benevolent monopoly, the currency txn continue as usual, but the monopolist earns all txn fees and coin generations. Virtual Currency. From a technical point of view, mining process is an operation of inverse hashing: How does the bitcoin market work proof of stake explained Proof-of-space Proof-of-stake Proof-of-work.

These are some goals proof-of-stake aims bitcoin sites list ethereum latest news today achieve: The PoS block miner reddit excel crypto buy coin on bittrex 0. This article has multiple issues. So, if the previous blocks are found in less than two weeks, then the network difficulty is increased. If these costs are not substantial, then it will be exceptionally easy to monopolize the mining network. One block every blocks a different number can be used instead is a signature block. See here and here for a more detailed analysis. Stake Signing Key - Private Key can delegate signing and sending authority to one other private key. Proof-of-authority Proof-of-space Proof-of-stake Proof-of-work. Going deeper, proof of work is a requirement to define an expensive computer calculation, also called mining, that needs to be performed in order to create a new group of trustless transactions the so-called block on a distributed ledger called blockchain. This page was last edited on 5 Mayat Hence, the recovery techniques described above will only be used in very extreme circumstances; in fact, advocates of proof of work also generally express willingness to use social coordination in similar circumstances by, for example, changing the proof of work algorithm. With bitcoin and a few other digital currencieseveryone has a copy of the ledger blockchainso no one has to trust in third parties, because anyone can directly verify the information written. Those how does the bitcoin market work proof of stake explained transactions are then stored publicly, which sustains immutability of the blockchain. How does validator selection work, and what is stake grinding? Here, we simply mining bitcoin with raspberry pi 3 ff 14 bitcoin the penalties explicit. Making replication, tempering, and meddling very difficult. In PoS, we are able to design the protocol in such a way that it has the precise properties that we want - in short, we can optimize the laws of physics in our favor. This site uses Akismet to reduce spam.

Now how do BFT-style proof of stake algorithms work? This changes the incentive structure thus: The new stakeholder will have to build up his weight. Views Read Edit View history. A third alternative is to include censorship detection in the fork choice rule. This means that the more Bitcoin or altcoin owned by a miner, the more mining power he or she has. This has its own flaws, including requiring nodes to be frequently online to get a secure view of the blockchain, and opening up medium-range validator collusion risks i. April 25, To solve this issue, Buterin created the Casper protocol, designing an algorithm that can use the set some circumstances under which a bad validator might lose their deposit. Invalid chain finalization: The biggest issue is that Proof-of-work is an energy consuming method and due to resources used to provide electricity just for Bitcoin mining. Load More Comments. The meta-argument for why this perhaps suspiciously multifactorial argument leans so heavily in favor of PoS is simple:

Since such a large purchase would dramatically increase bitcoin price, the entrepreneur would likely need to invest several times this amount. Namespaces Article Talk. The database only needs to incorporate public keys which control at least 1 coin. Top Posts RCast The computing power translates into a high amount of electricity and power needed for the proof of work. The process of creating and agreeing to new blocks is then done through a consensus algorithm that all current validators can participate in. Learn how and when to remove these template messages. In a PoS-based system, bets are the transactions that, according to the consensus rules, will reward their validator with a money prize together with each chain that the validator has bet on. This article wants to be a basic guide to understanding the problem above. The other is to use Jeff Coleman's universal hash time.