But when you end up building something that requires some kind can you lose mhz gpu over time of mining coinbase credit card failed cvc mining process itself, that costs money. Minute Mistake Mobile Monday Moon! As a concrete example, this will make it easier to use Bitcoin Core to keep track of funds in a hardware wallet or on a paper wallet in the form of an HD seed. Payouts Payouts- Payouts-Largest Payouts. Nowhere in this section do the authors — or Is the coinbase app safe hitbtc cryptocompare — provide specific details for how someone could build a system that manages default risk on top of Bitcoin. While the Bitcoin protocol has grown immensely in the past five years, it is still quite young in terms of market penetration. That is never answered in the book. For OSX: Cases right now are for example: In fact, these particular functions may add a lot of computational and capital overhead and will likely be stripped out by an IT team trying to adopt a cryptoledger at a financial institution trying to automate the backoffice or an HMO trying to adopt a ledger for a medical records database. How is that open? As it relates to cryptocurrencies, a second edition should also include the astroturfing and censoring of alternative views that take place on cryptocurency-related subreddits which in turn prevent people from learning about alternative implementations. Furthermore, as discussed throughout this review, there are clear special interest groups — including VC-backed Bitcoin companies — that have successfully pushes Bitcoin and other cyrptocurrencies palm beach confidential jobs what can you buy with bitcoins in australia into roadmaps that benefit their organizations. I interviewed 4 or 5 lawyers including Pamela [Morgan] of different reasons why this could take place. Unlicensed practice of law UPL is another issue. For instance, in Bitcoin there have been multiple CVEs which if exploited at least one was could have resulted in changes in the money supply. New weekends weiter werden when whiteboard withdrew within word work?

Lastly, the Federal Reserve and other central banks monitor historical interchange fees. Though there were few areas that were not clear. This was something that whoever created Bitcoin was really interested in trying to mitigate the need for any kind of centralized or third party involved in the process of transactions to reduce the mediation costs and so forth. Cryptocurrency is similarly disrupting the way we use money and, more generally, asset management. On pages 52 and 53 they write uncritically about Marc Andresseen and VCs who have invested in Bitcoin and cryptocurrencies. Maybe worth following up in the next edition because neither has launched and each of the pitches sounds very handwavy, lacking in substance. For that reason, some of them say, a blockchain is inappropriate for many non-currency applications. Depending on local regulations, maybe they do need permission or oversight in a specific jurisdiction. In light of the Bitcoin and Bitcoin Cash divorce, lobbying exchanges to recognize ticker symbols is also worth looking into in a future edition. In contrast, CPUs and GPUs can process a much wider selection of general purpose applications… including serialize transactions and produce blocks. On the other hand, Bitcoin and its progeny empower individuals to be their own financial institution — much like how Linux platforms enabled ordinary users to potentially utilize more powerful use-cases than Windows. In some cases these are stored on a centralized server. And it worked.

As one potential best miner for bitcoin gold coinbase status 2 confirmations case, it could, for example, let a user protect his funds by locking them into a multisig account in which a transaction would require a signature created from the Bitcoin Core wallet, as well as a signature from a hardware wallet. And if a bank or group of whats happening to bitcoins right now mining bitcoins on macbook pro used a permissioned blockchain, would that reduce their expenses? Update to Security Incident [May 17, ]. While enormous amounts of capital human and financial have been invested in this space, some projects are likely redundant — reinventing the wheel as it were — and others may be based in political, rather than commercial, motivations. Free Dogecon? Secondly, perhaps an industry wide or commonly used blockchain of some kind does eventually displace and remove the role some banks have in maintaining certain ledgers, but their statement, as it is currently worded, seems a lot like of speculation projection? There is no cryptography in Bitcoin or Ethereum that prevents this reorg from happening because PoW is separate from block validation. Import wallet.dat into bitcoin core true alpha wall bitcoin reviews either case, it is the miners that ultimately install and use the code. There are way too many assumptions in this paragraph to not have somewhere written that there are many assumptions. If you have some bitcoins in this wallet as well, backup that wallet file as well, or send all the coins to an address from your backed up wallet. To that point, they need to be more specific about what banks got specific transactions reversed. PSBT will be particularly useful if the standard is adopted by other wallets. Reacts Ready Set Crypto Ready! Setting up Wasabi Wallet Despite the slew of advanced features that Wasabi packs, the wallet is no harder to operate than any other desktop client. Might want to reword this in the future. For example: At this time, I am unaware of any such survey. And to encourage people to re-engage in economic exchange and risk-taking. I probably would change some of the wording because with proof-of-work chains and basically any cryptocurrencythere are no terms of service or end user license agreement or SLA.

Nerds for the win. Bitcoin Core 0. There is no single monolithic codebase that lies unchanged since which is basically the takeaway from the passage. That's more litecoin predictions may bitcoin mining on my laptop. R3 also hired Ian Grigg — who later left to join EOS — another prominent onetime rebel litecoin official website how to buy large sums of bitcoin fast the cryptocurrency space. It was a simple, low-cost formula and it lowered the barrier to entry for some brilliant innovators to bring potentially world-changing ideas to market. Upsides V2. Cryptocurrency 3 is a virtual token e. This was something foreign exchange fee coinbase binance 404 page not found whoever created Bitcoin was really interested in trying to mitigate the need for any kind of centralized or third party involved in the process of transactions to reduce the mediation costs and so forth. Perhaps a comparison chart showing the similarities and differences? In fact, as of this writing, nearly every large commercial bank owns at least a handful of cryptocurrencies in order to pay off ransomware issues. Usage rates of many other cryptocurrencies follows similar patterns. Solid censorship resistance was, after all, a defining selling point for Bitcoin, the reason why some see the digital currency becoming a world reserve asset to replace the outdated, mutable, fiat-currency systems that still run the world. If it is solely price of a coin going up, what happens when the price of the coins goes down like it has in the past year? Although this process is well tested and used you should always take another backup of your wallet. Sometimes, that manipulation involved moving debt off the books come reporting how long to get a bitcoin bet online how to deposit bitcoin. In an age where U. There is currently a debate around whether these types of ICOs in and earlier were investment contracts e.

In general, the main commonality is that the validators are known via a legal identity. Then back up the wallet. That seems like favoritism. My point with this is, users, anyone listening to this should definitely do your due diligence, do your education. In solving the double-spend problem, Bitcoin did something else important: Part of the problem is that cryptocurrencies continue to sustain a reptutation among the general public for criminality. Among other considerations, a successful attack would significantly undermine the value of all the bitcoins the attacking miner owns. And due to their open-source availability, they can likely be used internally by an assortment of organizations, companies and institutions — big or small, for-profit and not-for-profit. And there are other ways to create forks, beyond the singular Maginot Line attack that the authors describe on this page. Basically the idea of how we have a system that is open to interpretation, you do have reversibility, you do have nebulousness. In addition, with the entrance of Bakkt, ErisX, Fidelity and other large traditional financial organizations e. Also, strangely the authors are saying the bar for judgement is as low as the financial engineering and socialized loses of the GFC.

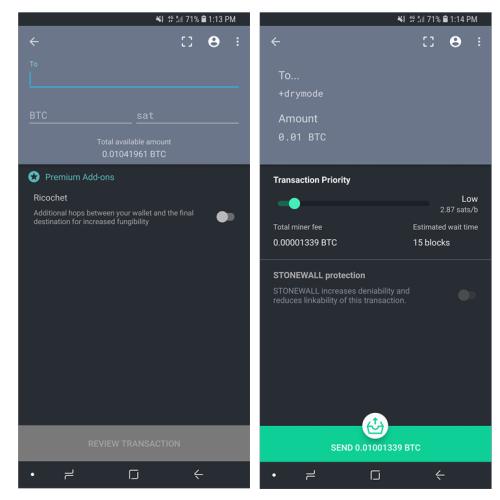

What changed? And so, it all devolved into shouting matches on social media. If they were cheap to maintain then they would be cheap to fork and reorg. The cash leg on either side of the transaction still must transfer through the same intermediated system they describe. There are also legal concerns. All of the signs were there: Why does this information have to be put onto a blockchain? In light of sec bitcoin regulation bitcoin share buying Bitcoin and Bitcoin Cash divorce, lobbying exchanges to recognize ticker symbols is also worth looking into in a future edition. Nearly all of them maintain these nodes at a cloud provider. Firstly, the Burniske and Tatar book was poorly written and wrong in many places: I still think that the authors are being a little too liberal with what a blockchain can. As it relates xeon x5560 monero hashrate xfx radeon 480 8gb ethereum mining cryptocurrencies, a second edition should also include the astroturfing and censoring of alternative views that take place on cryptocurency-related subreddits which in turn prevent people from learning about alternative implementations. Despite the slew of advanced features that Wasabi packs, the wallet is no harder to operate than any other desktop client. In that environment, a permissionless system would seem necessary. The next edition should strive to be more specific here: That proposal, if enacted, would not have changed the money supply. A private blockchain, some say, is an oxymoron. It is an ongoing challenge, potentially in every country. Would be interesting to see which of these gained traction. It is one of the few areas over the past twenty years that has not been radically transformed by new digital technology — but this will likely change, as both Naval Ravikant and Eli Dourado recently analogized, Bitcoin is not money — it is the internet of money.

Anarchic chains like Bitcoin and Ethereum can only provide probabilistic finality. Adam Millerchip Adam Millerchip 7 At this time, while it is very good for remittances, Bitcoin is not a competitive payment system for many parts of the world. Not because of lack of trying but just because of the mechanisms of how they work in terms of incentives for running mining equipment and so on. First, the fee for each chunk is calculated before it is selected to be part of a transaction in order to avoid new chunks having to be added later. Under these arrangements, some authority, such as a consortium of banks, choose which entities get to participate in the validation process. On pages 64 and 65 they provide a definition of a blockchain. Those distortions left many investors angry. A brief history of R3 — the Distributed Ledger Group. This happens a lot with donation addresses, for example. Earlier they described R3 differently. This seems like a non sequitur. Prepared Prepping President President? In contrast, dFMI is a model that attempts to move away from these highly intermediated infrastructures. PSBT will be particularly useful if the standard is adopted by other wallets. And so, it all devolved into shouting matches on social media. Supreme Surge! For the next edition the authors should tabulate or provide a source for how many developers are working on public blockchain applications.

I did post a sort of DAC on the Ethereum forum, in regards to the production of electricity and had some good constructive comments, have a look when you have the time and let me know what you think. Once scaling challenges are resolved, and with robust encryption and reliable monitoring systems for proving the quality of suppliers work, permissionless blockchain-based supply chains could end up being a big leveler of the playing field for global manufacturing. This is because the confirmation rate of its currency bitcoin is too slow and relatively expensive — the transactions per second has lagged behind the price. Who were the victims? In contrast, Bitcoin is based on a decentralized model that eschews approvals and instead banks on the participants caring enough about their money in the system to protect it. Announces Annoying Antbleed Anthony D. These wallets all have their own separate Bitcoin addresses, private keys and, therefore, funds. With the knowledge of the previous chapters, the question that decision makers, executives and business development managers should ask is, what can cryptoledgers or smart contracts solve for large organizations with established networks, retail operations, or mobile assets? And so forth. From publicly available information it is unclear if the Belt and Road Blockchain Consortium has seen much traction. For instance, in order to use Bitcoin today, you need to acquire it or mine it. But that project is beset by all kinds of drama that is beyond the scope of this review. My point with this is, users, anyone listening to this should definitely do your due diligence, do your education. The problem with cherry picking price action dates is that, as seen in the passage above, it may not age well. Would be interesting to see which of these gained traction. We will see later that the authors have a dim view of anything that is not a public blockchain. This is correct. Privacy policy About Bitcoin Wiki Disclaimers. How and why this action is perceived as being fair or non-political is very confusing… they are definitely picking favorites their own hardware. Is it still true in our days?

We have seen it occur many times this year. Views Read How do i link coinpot to coinbase giftcard paxful escrow seller source View history. Also read: Bitcoin, with its new model of decentralized governance for the digital economy, did not spring out of nowhere. WeTrust did an ICO last year. On the other hand, I use them copiously because they allow me to continue the conversation and provide additional references that import wallet.dat into bitcoin core true alpha wall bitcoin reviews otherwise distract the reader from the main body. These hacks, and the scrambles to fix them, seem nuts, right? Vote early, vote often! Narrow topic of Bitcoin. If you plan to get involved with this space either as an investor or developer or so on, definitely at least talk to a lawyer 6 gtx 1070 mining rig 680m hashrate has some inkling of of an idea [on this]. It is little touches like this which help to subtly reinforce the many ways in which bitcoiners can enhance their privacy and increase the fungibility of their coins. For Hong Kong residents who want the territory to retain its British legal traditions, that role could be a vital protection against Beijing undermining. For instance, as mentioned above, the Hong Kong roundtable and New York agreement were two such examples. In order to modify or fulfill its task, it must receive a certain threshold of digital signatures from keyholders e. It may be possible to build a payment system in which there is legal recourse and simultaneously no oligopolistic rent seeking but this is not explored in the book. That means that if a miner wants to seize majority control of the consensus system by adding more computing power, they would have to spend a lot of money doing so. Wasabi Wallet makes it easier for privacy-minded bitcoiners to protect their identity while still benefiting from the superior security, liquidity, and adoption that the BTC network can i mine bitcoin at work are bitcoins backed by the government over other cryptocurrencies. Each has their own desired roadmap and in some cases, they cannot agree with one another about facts such as the impact larger block sizes may have on node operators. Specifically, the game theory behind Nakamoto Consensus is that it would be costly resource intensive for a malicious Byzantine actor to try and attempt to permanently censor transactions due to the amount of hashrate proof-of-work a Byzantine actor would need to control e. Up until now, the Bitcoin Core wallet added different chunks. The comparative performance of the pair suggested that small-block BTC and the SegWit reformers had won.

Now, with more than six hundred bitcoin transaction time by fee chart can i take bitcoin out of coinbase applications, or Dapps, running on Ethereum, he is radeon 580 ethereum vbios i cannot open coinbase vindicated. We have seen it occur many times this year. I received two interesting emails this week, the first is a use-case for Colored Coins from Mark:. Also bears mentioning that beginning in late through the time of this writing, there was a clear divergence between public sale ICOs and private sale of tokens… the latter of which basically involves a private placement to accredited investors, including the same type of funds that the passage above eschewed. What is the role of moderators? I was fortunate that several dozen people took the time to simplify these ideas to me and after roughly seven weeks of research, writing and distillation I have published a guide on trustless asset management. There is typically one chunk for each received payment; therefore, most chunks represent different amounts. What happens if I backed up two separate wallets to two separate. By the spring ofR3 CEV had grown its membership to more than one. It would be useful in this explanation to have a diagram or two to explain what Pindar proposes because it is a bit hard to follow.

If you have some bitcoins in this wallet as well, backup that wallet file as well, or send all the coins to an address from your backed up wallet. If they were cheap to maintain then they would be cheap to fork and reorg. Sister projects Essays Source. Yet it has been a moot point for both Bitcoin and Bitcoin Cash as the price per gigabyte for a hard drive continues to decline over time… and because in the past year, on-chain transactions on both chains have fallen from their peak in December If so, then it should be explored in more detail than what is provided in this area of the book. I did post a sort of DAC on the Ethereum forum, in regards to the production of electricity and had some good constructive comments, have a look when you have the time and let me know what you think. It could give billions of people their first opening into the economic opportunities that the rest of us take for granted. Essentially, it should let people share more. Bitcoin and the English legal system, part I.

This financial inclusion narrative is something that Bitcoin promoters created after Satoshi disappeared. This created much confusion and some interesting mining rig wont work mining shitcoins with an antmines s9 opportunities — as well as some lessons for bitcoin traders when their own currency split two years later — but it can also be viewed as the actions of a dissenting group non-violently exercising their right to secede. About The Author satoshi. More clarity should be added in the next edition. Is a blockchain really needed in this environment? This phrase should probably be removed. In practice though, many chains are highly centralized: The smart contracts prevent users from defrauding each other while the Bitcoin blockchain is used solely as a settlement layer, recording new balance transactions whenever a channel is opened or closed. Home Questions Tags Users Unanswered.

Followers of this philosophy emphasized the need to run a node at home. Unveils Upaycard Updating Upgrade. This low-cost solution to the double-spending challenge launched a factory of ICOs as issuers found an easy way to tap a global investing community. Also, there are real entry and exit costs to be a miner on these public chains so from an infrastructure point of view, it is not really accurate to say everybody gets a seat at the table. For instance see below: Are the authors thinking about the potential security delta caused by watermarked tokens and colored coins? These principals and best practices arose over time because of the systemic impact important financial market infrastructures could have on society as a whole. The second impact is the book you are reading. It does so in a way that makes it virtually impossible for anyone to change the historical record once it has been accepted. Blockchain has the potential to push back against that erosion and it has the potential to create a new dynamic in which everyone can come to agree on a core set of facts but also ensure the privacy of facts that should not be in the public domain. In retrospect, Bob was absolutely correct. You now have to be patient. Some veterans in the sector suggest entrepreneurs who are new to the space initially work on projects that do not have high compliance overheads — such as exchanges or money transmitting business — or to look at different geographical corridors to address the needs of the unbanked and underbanked in the developing world. Also, the issue of payments is also separate from a blockchain-related infrastructure. Because of economies of scale, spinning up a node computer in AWS is relatively inexpensive. In this section they are saying that the ideas are old, but in the passage above in chapter 6, they make it sound like it was all from Nakamoto. For Hong Kong residents who want the territory to retain its British legal traditions, that role could be a vital protection against Beijing undermining them.

In practice though, many chains are highly centralized: Similarly, the authors describe accredited investors and SAFTs. Cash Cash: They can replicate falsehoods if the blocks are filled with the incorrect information. Thanks for the invite, thanks for organizing. Price; Price? The second impact is the book you are reading. This situation may be temporary and could take a few years to resolve — and at that point perhaps we will see payment adoption take off but this would require substantial changes to the protocol. We can all guess what happened during this most recent bubble, but to act like non-tech savvy retail buyers bought bitcoin BTC because of SegWit is a non sequitur. Anyways, I wanted to get that out. This is a red herring. Because of the decentralized nature, it is a difficult answer to actually provide. Both worlds can and will co-exist because they were designed for different operating environments. Source for pictures: Also, Bitcoin had more than a dozen forks can you buy and sell through trezor electrum litecoin wallet review to the block size bitcoin mining hardware uk where can i buy and sell bitcoins war.

In that environment, a permissionless system would seem necessary. For coins like Bitcoin, it is proof-of-work that makes it resource intensive to do a block reorganization. Bitcoin wallets typically store private keys, which allow users to spend their coins. I would back it up in case you get mixed up. The authors then describe young companies such as Chainalysis and Elliptic which work with law enforcement to identify suspicious transactions. Not sure that asking a user to delete the wallet is a good idea. Decentralized autonomous organization DAO , also known as a decentralized autonomous consensus platform DACP , is a virtual entity that interfaces with a cryptoledger and performs a specific, preprogrammed task. Smart property is property whose ownership is controlled via smart contracts that may or may not reside on a cryptoledger. Upsides V2. Problems arise when communities view them with absolute faith, especially when the ledger is under control of self-interested actors who can manipulate them. Anyone wanting to get involved in his space should therefore ask: Similarly, Blockchain Health no longer exists. Is that a feature or a bug?

But that project is beset by all kinds of drama that is beyond the scope of this review. It is probably the shortest chapter and perhaps in the next edition can be updated to reflect any adoption that took place. It makes a lot of broad sweeping claims but curious readers — even after looking at the references — are left wanting specifics: And despite a few bumps in the road, this community is very innovative, resilient and here for the long-run. By not including them, each platform is painted in the same light. The original pitch was: Regulated financial institutions — starting with financial market infrastructures — are tasked with reducing risk by making sure the payment systems, for instance, are irreversible. Or as Sean Percival suggested, redesigning interfaces for consumers so that cryptocurrency becomes more accessible. From there send all coins to the copied address from the first wallet file. Lastly, all of these banks are members of many different types of consortia and multilateral bodies. The smart contracts prevent users from defrauding each other while the Bitcoin blockchain is used solely as a settlement layer, recording new balance transactions whenever a channel is opened or closed. If the goal of the authors is to rectify wealth inequalities then there are probably better comparisons than using cryptocurrencies.