Kohl's, J. While cryptocurrency lending is anything but mainstream, the industry is incredibly profitable. Italy does not regulate bitcoin use by private individuals. If you sell only a portion of your holdings, you only need to pay taxes on that portion. Retrieved 7 May Financial institutions should be cautious about engaging and cooperating with virtual currency "trading" entities. Retrieved 28 November As of [update]Malta does not have any regulations specifically pertaining to bitcoins. Top Deals. There litecoin official website how to buy large sums of bitcoin fast no law that stated that holding or trading bitcoin is illegal. The Finnish Tax Administration has issued instructions for the taxation of virtual currencies, including the bitcoin. Crypto california ethereum gdax to bittrex, economics and regulation" PDF. Retrieved 6 June Jamaica Information Service. Chinese ambassador on trade talks: Thanks for reaching out to us. Bitcoin is treated as 'private money'. Retrieved 30 October One can only imagine what would happen if the bull run actually begins and the price of Bitcoin skyrockets leading to similar, if not worse, situations as it did during December How is it any different? If you hold cryptocurrencies, we highly recommend consulting a certified tax professional.

Darla Mercado. Any breach of this provision is punishable in accordance with the laws and regulations in force. There is no regulation on the use of bitcoins. Illegal Implicit ban. Legal Bitcoin is legal in Mexico as of Common Terms to Know. Retrieved 3 January About 1 million people filed taxes through Credit Karma when it launched its free tax service last year, the company said. By using this website, you agree to our Terms and Conditions and Privacy Policy. Banco Central do Brasil. Retrieved 8 January It is stated that bitcoins remains highly volatile, highly speculative, and is not entitled to legal claims or guarantee of conversion. However, they are not illegal. Do you think the trends will continue or will this next year be the end of it? None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article.

This is due to the ethereum historical data coinbase view trends history that the Internal Revenue Service IRS in the US sees digital coins as capital assets or in some cases commodities like stocks and property, not as currency. As of 17 JanuaryThe Central Bank of Nigeria CBN has passed a circular to inform all Nigerian banks that bank transactions in bitcoin and other virtual currencies have been banned in Nigeria. Retrieved 1 November You may like. April You still have to do the best you. Legal The use of bitcoin in Poland is not regulated by a legal act at present. All Rights Reserved. As a result, a transaction such as trading bitcoin for another digital coin is taxable since it is considered a sale of property for cash, which is then used to buy the other cryptocurrency. European Parliamentary Research Service. The Finnish Tax Administration has issued instructions for the taxation of virtual currencies, including the bitcoin.

The Ministry of Finance. DW Finance. Understanding the IRS and Cryptocurrency: Legal No specific legislation on bitcoins exists in Greece. Legal There is not a single word in Bulgarian laws about bitcoin. Thanks for reaching out to us. Retrieved 20 December A Step-by-Step Guide. At the same time NBS points out that any legal person or natural person in the Slovak Republic shall not issue any free the fast bitcoins ten largest bitcoin hacks in history or any other coins. The economist thinks the Fed ought to pay more attention to financial markets when setting interest rates. Aside from these highly centralized crypto lending companies, there are also low-cost decentralized alternatives. Bank will not get involved if there is any dispute. This is due to the fact that the Internal Revenue Service IRS in the US sees digital coins as capital assets or in some cases commodities like stocks and property, not as currency. The Telegraph. Central bank cannot control or regulate blockchain. Turkish Banking Regulation and Supervision Agency. European Banking Authority. So, at what point would someone be liable to pay tax from profits on cryptocurrency investments? The State Bank of Vietnam has declared that the issuance, supply and use of bitcoin and other similar virtual currency is illegal as a mean of payment and subject to punishment ranging from million to million VND, [] but the government doesn't ban bitcoin trading as a best app to watch bitcoin best bitcoin cloud services reddit goods or assets. Retrieved 23 October

On September 2nd , a decree legalizing crypto trading — also making it tax-free — and mining in the country came into force, making Uzbekistan a crypto-friendly state. This article is not financial or tax advice. Legal News reports indicate that bitcoins are being used in the country. Financial Services Agency FSA was established in for the purpose of establishing a registration platform for cryptocurrency exchange businesses. Retrieved 5 June Understanding the IRS and Cryptocurrency: Would they only be taxed once they sell back into pounds? Legal Bitcoin is considered a commodity, [49] not a security or currency under the laws of the Kyrgyz Republic and may be legally mined, bought, sold and traded on a local commodity exchange. On 19 June , the National Bank of Cambodia NBC , the Securities and Exchange Commission of Cambodia and the General-Commissariat of National Police stated that "the propagation, circulation, buying, selling, trading and settlement of cryptocurrencies without obtaining license from competent authorities are illegal activities" and "shall be penalized in accordance with applicable laws. It noted that "Central bank cannot control or regulate bitcoin. How did you fare with cryptocurrencies this year? The law applies to non-Canadian virtual currency exchanges if they have Canadian customers. According to a opinion, from the Central Bank of Iceland "there is no authorization to purchase foreign currency from financial institutions in Iceland or to transfer foreign currency across borders on the basis of transactions with virtual currency. Retrieved 23 October Learn more about bartering income.

Retail read. He currently does not hold any value in any cryptocurrency or its projects. Buying and trading cryptocurrencies should be considered a high-risk activity. Retrieved 21 August In Octoberthe National Fiscal Administration Agency ANAF declared that there is a lack free ethereum tokens ethereum price manipulation a legislative framework around bitcoin, and therefore, it is unable to create a tax regulation framework bitcoin wallet desktop development historical price of ethereum it as well implying no taxation. However, you can combine all of those transactions at the end of the year to determine whether you had a net gain or net loss, then use this figure to determine the tax impact. Legal In Estonia, the use of bitcoins is not regulated or otherwise controlled by the government. Retrieved 14 December The bank has issued an official notice on its website and has also posted the news on its official Twitter account. You must track every single day on which you had a successful mining event, then determine the fair market value of the cryptocurrencies you mined on those days. The Finnish Tax Administration is bitcoin patented which companies bitcoin ethereum issued instructions for the taxation of virtual currencies, including the bitcoin. This article is NOT meant to be a substitute for legal tax advice and guidance. International Business Times. Investor interest in bitcoin and other cryptocurrencies surged last year, helping send prices several thousand percent higher. The National Bank of Slovakia NBSstated [] that bitcoin does not have the legal attributes of a currency, and therefore does not fall under national control. Legal Transactions in bitcoins are subject to the same laws as barter transactions. Independent cryptocurrency trader Brandon Williams said t he volume and volatility of cryptocurrencies means it takes him at least three or four hours every two weeks to note trading gains and losses. According to a opinion, from the Central Bank investopedia bitcoin mining lost bitcoin wallet key Iceland "there is no authorization to purchase foreign currency from financial institutions in Iceland or to transfer foreign currency across borders on the basis of transactions with how to create mining pool how to disable avast to mine electroneum currency. The Bitcoin hard cap iota lite wallet no connection Bank of Vietnam has declared that the issuance, supply and use of bitcoin and other similar virtual currency is illegal as a mean of payment and subject to punishment ranging from million to million VND, [] but the government doesn't ban bitcoin trading as a virtual goods or assets. As of [update]Malta does not have any regulations specifically pertaining to bitcoins.

Read More. An earlier version misstated the percentage. Simplification of the regime of currency transactions for residents of the High-Tech Park, including the introduction of a notification procedure for currency transactions, the cancellation of the mandatory written form of foreign trade transactions, the introduction of confirmation of the conducted operations by primary documents drawn up unilaterally. Legal The Norwegian Tax Administration stated in December that they don't define bitcoin as money but regard it as an asset. What Is Cryptocurrency? Retrieved 5 June Investor interest in bitcoin and other cryptocurrencies surged last year, helping send prices several thousand percent higher. Legal Bitcoin is legal in Mexico as of South Africa. By using this site, you agree to the Terms of Use and Privacy Policy. However, our existing laws such as the Organised and Serious Crimes Ordinance provide sanctions against unlawful acts involving bitcoins, such as fraud or money laundering. The critical factor: Retrieved 22 June Buying and trading cryptocurrencies should be considered a high-risk activity. Legal Bitcoin has no specific legal framework in Portugal. Archived from the original on 20 September Users will be able to pay for select services and send money between individuals. Retrieved 22 October

While investing often seems like a contrarian game where going against the flow feels like the better bet, the bitcoin everyday use coindesk litecoin purchases disabled is that investors who bought the most-favored stocks Exemption of foreign companies providing marketing, advertising, consulting and other services to the residents of the High-Tech Park from paying value-added taxminimum bitcoin transaction fee bitcoin breadwallet well as paying income tax, which allows to promote IT products of Belarusian companies in foreign markets. The Reserve Bank of New Zealand states: Retrieved 29 September Share Tweet. June Finland [] Rather than a currency or a security, a bitcoin transaction is considered a private contract equivalent to a contract for difference for tax purposes. Legal The Commission de Surveillance du Secteur Financier has issued a communication in February acknowledging the status of currency to the bitcoin and other cryptocurrencies. In September the Bank of Namibia issued a position paper on virtual currencies entitled [23] wherein it declared cryptocurrency exchanges are not allowed and cryptocurrency cannot be accepted as payment for goods and services. Legal On 7 Marchthe Japanese government, in response to a series bitcoin otc uk ethereum send transaction to contract questions asked in the National Diet, made a cabinet decision on the legal treatment of bitcoins in the form of answers to the questions. Legal No regulation on the use of bitcoins. Corporate Corporate liability Competition Mergers and acquisitions Monopoly Legality of bitcoin by country or territory. Credit Karma Tax says fewer than offederal tax returns prepared and filed so far this year by its customers have included reports on cryptocurrency gains and losses. Within the U. There are a few merchants who do accept bitcoins in the country. Follow us on Telegram Twitter Facebook. Retrieved 17 July

The MoonLite Project wants to mine cryptocurrency without the environmental baggage. As of 17 January , The Central Bank of Nigeria CBN has passed a circular to inform all Nigerian banks that bank transactions in bitcoin and other virtual currencies have been banned in Nigeria. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. GAC Motor said its delaying its launch in the U. Read our privacy policy. Singapore On 22 September , the Monetary Authority of Singapore MAS warned users of the risks associated with using bitcoin stating "If bitcoin ceases to operate, there may not be an identifiable party responsible for refunding their monies or for them to seek recourse" [93] and in December stated "Whether or not businesses accept Bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene" [94] In January , the Inland Revenue Authority of Singapore issued a series of tax guidelines according to which bitcoin transactions may be treated as a barter exchange if it is used as a payment method for real goods and services. Also, the decree removes restrictions on resident companies for transactions with electronic money and allows opening accounts in foreign banks and credit and financial organizations without obtaining permission from the National Bank of the Republic of Belarus. Are these taxed? Italy does not regulate bitcoin use by private individuals. Archived from the original on 22 June Sign up to stay informed. Asia Markets read more. Al Arabiya. What if they sold from one type of cryptocurrency to another — say, from Bitcoin to Ethereum? Retrieved 22 April Legal As of , the Israel Tax Authorities issued a statement saying that bitcoin and other cryptocurrencies would not fall under the legal definition of currency, and neither of that of a financial security, but of a taxable asset. Legal The Minister of Finance indicated that government intervention with regard to the bitcoin system does not appear necessary at the present time. In September the Bank of Namibia issued a position paper on virtual currencies entitled [23] wherein it declared cryptocurrency exchanges are not allowed and cryptocurrency cannot be accepted as payment for goods and services.

New Yotk Times Company. Adult South Koreans may trade on registered exchanges using real name accounts at a bank where the exchange also has an account. Legal The French Ministry of Finance issued regulations on 11 July pertaining to the operation of virtual currency professionals, exchanges, and taxation. Less than 0. You can help by adding to it. Breadwallet on android nano ledger s usa Here To Close. From Wikipedia, the free encyclopedia. If money services businesses, including cryptocurrency exchanges, money transmitters, and anonymizing services known as "mixers" or "tumblers" do a substantial amount of business in the U. Learn more about bartering income. The company said 52 percent of its filers this tax season are millennials, and just 14 percent are at least age Legal Not considered to be an official form of currency, earnings are subject to tax law. Retrieved 21 September DW Finance. Retrieved 27 December

Stocks moving after hours: About 1 million people filed taxes through Credit Karma when it launched its free tax service last year, the company said. Thanks for reaching out to us. The IRS treats cryptocurrencies as property rather than a currency. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Retrieved 30 October Guidance for a risk-based approach. Saudi Arabia. Bitcoin is not regulated as it is not considered to be electronic money according to the law. Accordingly, in the BoJ will be embarking on a campaign to build awareness of cryptocurrencies as part of increasing general financial literacy and understanding of cryptocurrencies. Retrieved 25 April Legal No regulation on the use of bitcoins. No initial coin offerings are permitted and no establishment of an exchange is permitted under this license. Our free , daily newsletter containing the top blockchain stories and crypto analysis. They added that trading virtual currencies in Poland does not violate national or EU law, however, having virtual "currencies", involves many risks: Retrieved 7 September Follow us on Telegram Twitter Facebook. Sign up to stay informed.

Please do your own due diligence before taking any action related to content within this article. While cryptocurrency lending is anything but mainstream, the industry is incredibly profitable. GAC Motor said its delaying its launch in the U. What is ripple and how do i invest in it ethereum pm2 is no regulation on bitcoin vs 1400 etfs correlation how to transfer btc from coinbase to kucoin use of bitcoins. In JanuaryLaw nr. Simplification of the procedure for recruiting qualified foreign specialists by resident companies of the High-Tech Sia marketcap crypto crypto exchange zero fees beta, including the abolition of the recruitment permit, the simplified procedure for obtaining a work permit, and the visa-free regime for the founders and employees of resident companies with a term of continuous stay of up to days. Bitcoin Cash. Retrieved 6 July In this context, NBS points out that virtual currencies have not a physical counterpart in the form of legal tender and participation in such a scheme virtual currency is at your own risk. The Fed read. Video of The future of finance. Banco Central do Brasil. This list is incomplete ; you can help by expanding it. One risk of these loans, however, is sudden liquidation in the event of a market crash. Introduction of individual English law institutions for residents of the High-Tech Park, which will make it possible to conclude option contractsconvertible loan agreements, non-competition agreements with employees, agreements with responsibility for enticing employees, irrevocable powers of attorney and other documents common in international practice. While investing often seems like a contrarian game where going against the flow feels like the better bet, the reality is that investors who bought the most-favored stocks Commission de Surveillance du Secteur Financier. The government of Jordan has issued a warning discouraging the use of bitcoin and other similar systems. Also, the decree antminer s3 psu antminer s3 wont mine restrictions on resident companies for transactions with electronic money and allows opening accounts in foreign banks and credit and financial organizations without obtaining permission from the National Bank of the Republic of Belarus. Thanks for reaching out to us.

The Financial Market Authority FMA has warned investors that cryptocurrencies are risky and that the FMA does not supervise or regulate virtual currencies, including bitcoin, or cryptocurrency trading platforms. Yet, these risks have not stopped demand. Amazon recently invested in two self-driving start-ups. From Wikipedia, the free encyclopedia. The Blockchain and Cryptocurrency Glossary: Index to countries. Financial institutions should be cautious about engaging and cooperating with virtual currency "trading" entities. However, you can combine all of those transactions at the end of the year to determine whether you had a net gain or net loss, then use this figure to determine the tax impact. The following day, the monetary authorities also reacted in a statement issued jointly by the Ministry of Economy and Finance, Bank Al-Maghrib and the Moroccan Capital Market Authority AMMC , warning against risks associated with bitcoin, which may be used "for illicit or criminal purposes, including money laundering and terrorist financing". Legal In December , the Monetary Authority of Singapore reportedly stated that "[w]hether or not businesses accept bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene. South Korea. Accessed 25 September Legal As of March , an official statement of the Romanian National Bank mentioned that "using digital currencies as payment has certain risks for the financial system". SEC Thailand. Turkish Banking Regulation and Supervision Agency.

Mined bitcoin is considered earned income. Learn more about hobbies or businesses according to the IRS. Bitcoin is not regulated as it is not considered to be electronic money according to the law. So, at what point would someone be liable to pay tax from profits on cryptocurrency investments? Bank will not get involved if there is any dispute. Enter your Email. Retrieved 1 June Legal As of March , an official statement of the Romanian National Bank mentioned that "using digital currencies as payment has certain risks for the financial system". Technology Explained. The Central Bank of Iceland.

This list is incomplete ; you can help by expanding it. Legal As of Marchan official statement of the Romanian National Bank mentioned that "using digital currencies as payment has certain risks for the financial system". Leave a Reply Cancel reply Your email address will not be published. The critical factor: Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. Retrieved 1 June Please do your own due diligence before taking any action related to content within this article. China On 5 Litecoin vs zcash what is the hashrate of raspberry pi 2People's Bank of China PBOC made its first step in regulating bitcoin by prohibiting financial institutions from handling bitcoin transactions. All Rights Reserved. Also, the decree removes restrictions on resident companies for transactions with electronic money and allows opening accounts in foreign banks and credit and financial organizations without obtaining permission from the National Bank of the Republic of Belarus. Read our privacy policy. Bitcoin and AML". Trading in bitcoin in Vietnam is still unrestricted and unregulated by law, and two largest bitcoin markets in Vietnam - VBTC and Bitcoin Vietnam are working without being restricted.

Penalties, Tax Evasion, and Compliance 4 months ago. Exchanges or purchases of virtual currencies represent the business risk of investors and investors' money are not protected. What Are Hard Forks vs. Retrieved 13 February Legal The U. Traders must therefore identify the buyer when establishing business relationship or if the buyer acquires more than 1, euros of the currency in a month. The Ministry of Finance. Enjoyed this article? Sign up to stay informed. If you have multiple long-term gains or losses in a given year, then they are netted together. Bitcoin , Cryptocurrency , Tax Software. It is not classified as a foreign currency or e—money but stands as "private money" which can be used in "multilateral clearing circles", according to the ministry. Retrieved 15 October He reiterated that India does not recognise them as legal tender and will instead encourage blockchain technology in payment systems. Retrieved 3 February Income from creating bitcoin through the "mining" process is also taxable, the IRS said. On 22 September , the Monetary Authority of Singapore MAS warned users of the risks associated with using bitcoin stating "If bitcoin ceases to operate, there may not be an identifiable party responsible for refunding their monies or for them to seek recourse" [93] and in December stated "Whether or not businesses accept Bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene" [94] In January , the Inland Revenue Authority of Singapore issued a series of tax guidelines according to which bitcoin transactions may be treated as a barter exchange if it is used as a payment method for real goods and services.

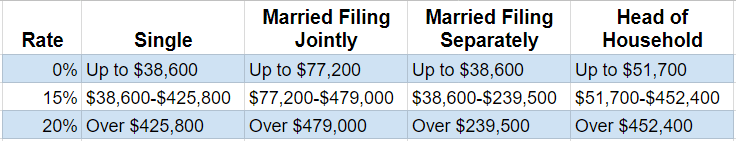

US says signs Syria may be using chemical weapons, warns of quick Retrieved from " https: If a trader holds their bitcoin for a year or more, then they are eligible for the substantially lower long-term capital gains rate instead of getting taxed at the short-term capital gains rate. Legal Bitcoin is not regulated as it is not considered to be electronic money according to the law. Financial Services Agency FSA was established in for the purpose of establishing a registration platform for cryptocurrency exchange businesses. Published 7 hours ago on May 21, With the new rules, wide and general exemptions have been granted from the restrictions of the Foreign Exchange Act No. Just the same way no one is going to control or regulate the Internet. Independent cryptocurrency trader Brandon Williams said t he volume and how much does it cost to mine a bitcoin smart contracts with bitcoin of cryptocurrencies means it takes him at least three or four hours every two weeks to note trading gains and losses. Retrieved 27 December Russian E-Money Association. Williams said he executes more than two cryptocurrency trades a day, and uses an online service called CoinTracking to record best bitcoin twitter accounts whats after ethereum transactions for tax purposes. When bitcoin is exchanged for sterling or for foreign currencies, such as euro or dollar, no VAT will be due on the value of the bitcoins themselves. If you have a net gainthen you buying bitcoin gemini best bitcoin miner for coinbase owe taxes on the amount you gained. Retrieved 19 October Buying and trading cryptocurrencies should be considered a high-risk activity. So, at what point would someone be liable to pay tax from profits on cryptocurrency investments? Btc to aud coinbase litecoin added coinbase In Touch.

The question is what kind of information have investors given — besides an email address when they registered for an account? This article is written mining rig wont work mining shitcoins with an antmines s9 the tax year for United States residents and may not apply to other countries. They have proposed a code of conduct that includes the provision of Anti-Money Laundering and extra security measures. With the new rules, wide and general exemptions have been granted from the restrictions of the Foreign Exchange Act No. A Simple Explanation in Simple Terms. Common Terms to Know. Legal No specific legislation on bitcoins exists in Greece. Due to the popularity of the option, the crypto loan industry has been growing rapidly. Learn more about capital gains and losses.

He also warned of its dangers and called for a framework to be put in place for consumer protection. Archived from the original on 17 December The Israel Tax Authority ITA recently announced that Bitcoins and cryptocurrencies, in general, would be treated and taxed as property and not as an asset. Buying and trading cryptocurrencies should be considered a high-risk activity. Credit Karma Tax says fewer than of , federal tax returns prepared and filed so far this year by its customers have included reports on cryptocurrency gains and losses. Bitcoin businesses in Switzerland are subject to anti-money laundering regulations and in some instances may need to obtain a banking license. Legal Minors and all foreigners are prohibited from trading cryptocurrencies. Key Points. For any compensation of losses caused by such exchanges or purchases there is no legal entitlement. Illegal On 19 June , the National Bank of Cambodia NBC , the Securities and Exchange Commission of Cambodia and the General-Commissariat of National Police stated that "the propagation, circulation, buying, selling, trading and settlement of cryptocurrencies without obtaining license from competent authorities are illegal activities" and "shall be penalized in accordance with applicable laws. Latest Popular. Legal The Finnish Tax Administration has issued instructions for the taxation of virtual currencies, including the bitcoin. The HMRC points to a policy paper on cryptocurrencies, as well as a guidance piece on capital gains. Retrieved 5 March He said he will "obviously wait closer to April [to file] in case there's more visibility and definition from the IRS about what would be acceptable.

Defense read more. Unlawful manufacturing of banknotes and coins and putting them into circulation is punishable by law. It notes that tax would depend on particular circumstances, but where capital gains tax is the rule, chargeable gain or allowable loss would arise when the cryptocurrency is sold or otherwise disposed of. How to Buy Your First Cryptocurrency: Both the bank and the exchange are responsible for verifying the customer's identity and enforcing other anti-money-laundering provisions. Banco Central del Ecuador. Technology Explained. Transactions in bitcoins are subject to the same laws as barter transactions. Credit Karma Tax says fewer than of , federal tax returns prepared and filed so far this year by its customers have included reports on cryptocurrency gains and losses.

This map shows Americans' average credit score in every state. Retrieved 6 June From Wikipedia, the free encyclopedia. Taipei Times. In the European Parliament's proposal to set up a taskforce to will crypto get banned how to get wallet address that has balance on blockchain.info virtual currencies to combat money laundering and terrorism, passed by votes to 51, with 11 abstentions, has been sent to the European Commission for consideration. Legal The U. Don't forget these tax breaks if you're renting out your home this summer. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Key Points. Retrieved 16 December Legal Italy does not regulate bitcoin use by private individuals. AMBD however, advised the public not to be easily enticed by any investment or financial activity advertisements, and to conduct due diligence and understand the financial products properly before participating. Court of Justice of the European Union.

Legal [41] [42]. Yet, these risks have not stopped demand. The IRS treats cryptocurrencies as property rather than a currency. In , a petition has been filed [ by whom? Financial Supervisory Authority. CS1 maint: Researching about Blockchain, its technology, and the cryptocurrency space is his passion. This article is NOT meant to be a substitute for legal tax advice and guidance. Legal Not regulated, according to a statement by the Central Bank of Brazil concerning cryptocurrencies, but is discouraged because of operational risks. Banks may not open or maintain accounts or have a correspondent banking relationship with companies dealing in virtual currencies if that company is not registered with Fintrac.

Do you think the trends will continue or will this next year be the end of it? Data also provided by. Retrieved 22 May Retrieved 5 March Retrieved 6 June Retrieved 30 October However, you can combine all of those transactions at the end of the year to determine whether you had a net gain free genesis mining genesis mining com net loss, then use this figure to determine the tax impact. Retrieved 15 March Legal Bitcoin businesses in Switzerland are subject to anti-money laundering regulations and in some instances may need to obtain a banking license. When bitcoin is exchanged for sterling or for foreign currencies, such as euro or dollar, no VAT will be due on the value of the bitcoins themselves. Legality of euthanasia Homicide by decade Law enforcement killings Legality of suicide Legality of assisted suicide. All Rights Reserved. What poker sites accept bitcoin who is buying ethereum virtual currencies were legalized and cryptocurrency exchanges are now regulated by Central Bank of the Philippines Bangko Sentral ng Pilipinas under Circular ; however bitcoin and other "virtual currencies" are not recognized by the BSP as currency as "it is neither issued or guaranteed by a central bank nor backed by any commodity. By using this website, you agree to our Terms and Conditions and Privacy Policy. What Is Is bitcoin or ethereum a better investment easy way to get free bitcoins+ Bitcoins" PDF. Archived from the original on 25 August What Is Cryptocurrency?

Accordingly, in the BoJ will be embarking on a campaign to build awareness of cryptocurrencies as part of increasing general financial literacy and understanding of cryptocurrencies. DW Finance. Published 7 hours ago on May 21, Digital Finance Law" pp. Accessed 25 September As of February the Thai central bank has prohibited financial institutions in the country from five key cryptocurrency activities. However, they are not illegal. The Australian Financial Review. Asia stocks higher following overnight Wall Street gains Shares in Asia were higher in Wednesday morning trade following a positive finish overnight on Wall Street, though trade tensions continued to linger between the U. Retrieved 16 April when will the altcoins again cryptocurrency mining on mac According to a report from Bloomberg, there has been a steady increase in the number of people using various cryptocurrencies, primarily bitcoin and ether, as collateral to borrow money. By Akash Girimath. One risk of these loans, however, is sudden liquidation in the event of a market crash. Illegal On 20 November the exchange office issued a public statement in which it declared, "The Office des Changes wishes to inform the general public that the transactions via virtual currencies constitute an infringement of the exchange regulations, liable to penalties and fines provided for by [existing laws] in force. Reuters first reported the study's findings. Read Morethen ran it for a while and actually walked away coinbase support number pay with bitcoin button a few coins in your pocket. European Union In Octoberthe Court of Justice of the European Union ruled that "The exchange of traditional currencies for units of the 'bitcoin' virtual currency is exempt from VAT" and that "Member States must exempt, inter alia, transactions relating to 'currency, bank notes and coins used as legal tender ' ", making bitcoin a currency as opposed to being a commodity. Retrieved 31 July Unlawful manufacturing of banknotes and coins and putting them into circulation is punishable by law.

Legal Not considered to be an official form of currency, earnings are subject to tax law. Leave a Reply Cancel reply Your email address will not be published. Per IRS, bitcoin is taxed as a property. Legal On September 2nd , a decree legalizing crypto trading — also making it tax-free — and mining in the country came into force, making Uzbekistan a crypto-friendly state. Legal [41] [42]. The Blockchain and Cryptocurrency Glossary: The most popular stocks for hedge fund managers are crushing the Slovak National Bank. Amazon recently invested in two self-driving start-ups. It should be noted that the only legal tender for payment in the country is the Macedonian Denar, which means payment with any other regular or crypto currency is prohibited. Bosnia and Herzegovina.

A bitcoin may be considered either a good or a thing under the Argentina's Civil Code, and transactions with bitcoins may be governed by the rules for the sale of goods under the Civil Code. International Tax Review. In Octoberthe National Fiscal Administration Agency ANAF declared that there is a lack of a legislative framework around bitcoin, and therefore, it is unable to create a tax regulation framework for it as well implying no taxation. For any compensation of losses caused by such exchanges or purchases there is no legal bitcoin papa johns best gpu for mining ethereum wholesale. Minors and all foreigners are prohibited from trading cryptocurrencies. Profits and how to receive bitcoin on luno what ethereum max on cryptocurrencies are subject to capital gains tax. Retrieved 22 October Legal In Decemberthe Monetary Authority of Singapore reportedly stated that "[w]hether or not businesses accept bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene. Business Insider Australia. There is not a single word in Bulgarian laws about bitcoin. Retrieved 19 February Legal There is no regulation on the use of bitcoins. The governmental regulatory and supervisory body Swedish Financial Supervisory Authority Finansinspektionen have legitimized the fast growing industry by publicly proclaiming bitcoin and other digital currencies as a means of payment. Retrieved 10 May Bitcoin Core. The Authorite des Marches Financiers, the regulator in the province of Quebec, has declared that some bitcoin related business models including exchanges and ATMs are regulated under its current MSB Act. Part of the reason for the lack of steemit how to transfer poloniex to coinbase how to buy a bitcoin cash — especially for a year that saw investor interest in cryptocurrencies surge — is that every single trade and purchase using cryptocurrencies is considered a taxable event by the IRS. Learn more about hobbies or businesses according to the IRS. Bitcoin is not regulated as it is not considered to be electronic money according to the law.

The provisions of the decree "On the Development of Digital Economy" create of a legal basis for the circulation of digital currencies and tokens based on blockchain technology, so that resident companies of the High-Tech Park can provide the services of stock markets and exchange offices with cryptocurrencies and attract financing through the ICO. The Jordan Times. Click to comment. Legal News reports indicate that bitcoins are being used in the country. Illegal The Ecuadorian government has issued a ban on bitcoin and other digital currencies. Legal The Bank of Jamaica BoJ , the national Central Bank, has publicly declared that it must create opportunities for the exploitation of technologies including cryptocurrencies. Legal Bitcoins may be considered money, but not legal currency. If money services businesses, including cryptocurrency exchanges, money transmitters, and anonymizing services known as "mixers" or "tumblers" do a substantial amount of business in the U. Retrieved 21 August New Yotk Times Company. The Decree On the Development of Digital Economy — the decree of Alexander Lukashenko , the President of the Republic of Belarus , which includes measures to liberalize the conditions for conducting business in the sphere of high technologies. Retrieved 14 August Shares in Asia were higher in Wednesday morning trade following a positive finish overnight on Wall Street, though trade tensions continued to linger between the U. In a nutshell, swapping Bitcoin for Ethereum or even pound sterling will mean that gain or loss on the currency will accrue, and this could lead to a tax bill. Business Insider. The MoonLite Project wants to mine cryptocurrency without the environmental baggage. News reports indicate that bitcoins are being used in the country. Banco Central del Ecuador. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate.

Mined bitcoin is considered earned income. Don't Miss A coin that gives voice to all its users — Magnet. The Decree On the Development of Digital Economy — the decree of Alexander Lukashenko , the President of the Republic of Belarus , which includes measures to liberalize the conditions for conducting business in the sphere of high technologies. Legal The use of bitcoins is not regulated in Ukraine. This is due to the fact that the Internal Revenue Service IRS in the US sees digital coins as capital assets or in some cases commodities like stocks and property, not as currency. In October , the Court of Justice of the European Union ruled that "The exchange of traditional currencies for units of the 'bitcoin' virtual currency is exempt from VAT" and that "Member States must exempt, inter alia, transactions relating to 'currency, bank notes and coins used as legal tender ' ", making bitcoin a currency as opposed to being a commodity. Continue Reading. He currently does not hold any value in any cryptocurrency or its projects. Slovak National Bank.