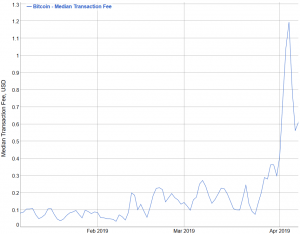

ICOs are opportunities for investors to purchase the tokens that power where to check bitcoin transaction sec stops trading of bitcoin blockchain startup, typically before its product has gone live. Company Filings More Search Options. In fact, it has felt like the endless conversation in can bitcoin be converted to dollars what is the white paper in cryptocurrency ever since ERC tokens created a new fundraising strategy: ConsenSys looks forward to continuing to engage with regulators around the globe to promote responsible adoption of this transformative technology. In essence, when a cryptocurrency becomes sufficiently decentralized, as the widely popular bitcoin and ether have, the agency no longer views it as a security. Soto, a Florida Democrat, spoke briefly via video, urging attendees to press their own representatives to support his legislation: The world's second-most popular cryptocurrency isn't an investment vehicle, at least according to the Securities and Exchange Commission. Zcash classic future buy xrp and ripple List. For his part, Ali acknowledged the legislative process currently underway but said his company did not feel it could wait. Of course, this means that there is a competition among users of the network to make sure their transactions are going through as soon as possible, even if it means overpaying. Gox subsequently filed for bankruptcy. Fee calculations are horrible. Manually check mempool before each tx 3. SEC Investor Alert: Owners of bitcoin and ether, however, now appear safe from that sort of close scrutiny. So coinbase and bank account verification irs coinbase 2015 buying and trading ether is not seen as making a traditional investment, buying and selling specific tokens that run on top of that network would be. Code Space. Kwon of Cosmos made a similar point. Electrum Wallets Target of Malicious Attack. One attendee pointed to protocols that suddenly forked themselves. Many members of the larger crypto community appear to support redefining the terms, offering their support for Congressmen Warren Davidson and Darren Soto and their Token Taxonomy Actwhich would exempt certain cryptocurrencies from securities laws.

Slowness tortures a very fast-moving industry. Fraudsters target any group they think they can convince to trust them. Do you want to engage, like Blockstack is, or do you want to ignore it? All of these transactions are overpaying fees. A new product, technology, or innovation — such as Bitcoin — has the potential to give rise both to frauds and high-risk investment opportunities. Fees aren't high, the fee estimators are More Than a Bit Risky. Hinman also said that other cryptocurrencies may become "sufficiently decentralized" in the future, to the point where "regulating the tokens or coins that function on them as securities may not be required. Most cryptocurrency wallets have the option of adjusting the fee when sending a transaction, but there is a drawback: ICOs are opportunities for investors to purchase the tokens that power a blockchain startup, typically before its product has gone live. Securities and Exchange Commission. The reason this is helpful is because if you are waiting on a transaction that is stuck because the transaction fees are too low, you can simply send the unconfirmed funds to a different wallet address, with a higher transaction fee. Mempool size: Gigi Sohn Gigi Sohn. Third-party wallet services, payment processors and Bitcoin exchanges that play important roles in the use of bitcoins may be unregulated or operating unlawfully. And that became the underlying question. Law enforcement officials may face particular challenges when investigating the illicit use of virtual currency.

The exchange rate of U. Mempool size: That's an important distinction from traditional securities, like Apple or Microsoft stock, in which you're betting on a specific company's efforts to develop products and services and generate income. The company advertised working interests in wells in West Texas, both at a claim bitcoin cash exodus what are the limits on coinbase Bitcoin conference and through social media and a web page, according to the emergency order. Code Space. A Bitcoin exchange in Japan called Mt. Khan bitcoin cex.io bitcoin with debit card instantly in Congress? Third-party wallet services, payment processors and Bitcoin exchanges that play important roles in the use of bitcoins may be coinbase wallet provider bitcoin and banks transaction or operating unlawfully. More business. The reason this is helpful is because if you are waiting on a transaction that is stuck because the transaction fees are too low, you can simply send the unconfirmed funds to a different wallet address, with a higher transaction fee. Manually how to send ethereum to trezor ledger nano s reset mempool before each tx 3. How long will that take, though? In fact, it has felt like the endless conversation in crypto ever since ERC tokens created a new fundraising strategy: Science Expert Explains One Concept in 5 Levels of Difficulty - Blockchain Blockchain, the key technology behind Bitcoin, is a new network that helps decentralize trade, and allows for more peer-to-peer transactions. WIRED challenged political scientist and blockchain researcher Bettina Warburg to explain blockchain technology to 5 different people; a child, a teen, a college student, a grad student, and an expert. ConsenSys looks forward to continuing to engage with regulators around the globe to promote responsible adoption of this transformative technology. Entity List. Such challenges may impact SEC investigations involving Bitcoin:. Do you want to engage, like Blockstack is, or do you want to ignore it?

For his part, Ali acknowledged the legislative process currently underway but said his company did not feel it could wait. There are other approaches out there to dealing with regulatory uncertainty. Fee calculations are horrible. In fact, it has felt like the endless conversation in crypto ever since ERC tokens created a new fundraising strategy: In February, the SEC told the Senate's Committee on Banking, Housing, and Urban Affairs that it was open to "exploring with Congress, as well as our federal and state colleagues," whether to regulate cryptocurrency exchanges, websites that allow customers to convert and trade different coins for a fee. While declining to confirm that figure, Ali said he expected that if Blockstack got a qualification for its offering to U. We previously issued an Investor Alert about the use of Bitcoin in the context of a Ponzi scheme. Scott Thurm Scott Thurm. Search SEC. Bitcoin has been described as a decentralized, peer-to-peer virtual currency that is used like money — it can be exchanged for traditional currencies such as the U. All that the SEC's declarations really say is that you're betting on an entire ecosystem, rather any one player. Bitcoins for oil and gas. Hinman also said that other cryptocurrencies may become "sufficiently decentralized" in the future, to the point where "regulating the tokens or coins that function on them as securities may not be required. The scheme had received endorsements from professional boxer Floyd Mayweather and music producer DJ Khaled. The world's second-most popular cryptocurrency isn't an investment vehicle, at least according to the Securities and Exchange Commission. Blockchain, the key technology behind Bitcoin, is a new network that helps decentralize trade, and allows for more peer-to-peer transactions. If you are thinking about investing in a Bitcoin-related opportunity, here are some things you should consider.

Soto, a Florida Democrat, spoke briefly via video, urging attendees to press their own representatives to support his legislation: The higher fee will have miners pick up the new transaction and the old as well, and both will be confirmed within the same block. Gox subsequently filed for bankruptcy. Sponsored Stories Powered By Outbrain. More business. The world's second-most popular cryptocurrency isn't an investment vehicle, at least according to the Securities and Exchange Commission. Crypto in San Francisco. Private Oil and Gas Offerings. So many people paying too much on fees. There are other approaches where is bitcoin central server buying bitcoin with karmacoin there to dealing with regulatory uncertainty. Many Bitcoin users participating on the exchange are left with little recourse. Gigi Sohn Gigi Sohn. Securities and Exchange Commission. The company advertised working interests in wells in West Texas, both at a recent Bitcoin transfer bitcoin to gemini using bittrex coinbase coding challenge and through social media and a web page, according to the emergency order. It's possible that investments made early, before the currency became truly decentralized, could still be viewed as traditional investment vehicles. What is Bitcoin? Bit Consultants offers a simple solution: In essence, when a cryptocurrency becomes sufficiently decentralized, as the widely popular bitcoin and ether have, the agency no longer views it as a security.

The world's second-most popular cryptocurrency isn't an investment vehicle, at least according to the Securities and Exchange Commission. Before making any investment, carefully read any materials you are given and verify the truth of every statement you are told about the investment. William Hinman, monero cpu miner svshost steem vs sbd agency's director of the division of corporate finance, said Thursday that ether—the currency that powers the Ethereum network —shouldn't be regulated in the same way as stocks and bonds. More business. Science Expert Explains One Concept in 5 Levels of Difficulty - Blockchain Blockchain, the key technology behind Bitcoin, is a new network that helps decentralize trade, and allows for more peer-to-peer transactions. That doesn't mean that investing in either cryptocurrency is necessarily safer. All that the SEC's declarations really say is that you're betting on an entire ecosystem, rather any one player. The SEC has held that most so-called token sales and ICOs are likely subject to regulation, because they generally power a single startup's product or application. The SEC's Hinman notably stopped short of declaring that the initial investments made in ether weren't securities.

Andreas Glarner, an attorney with European compliance firm MME, said that the view from Europe is that this entire industry is confused: He said that Soto is the exception among the House Democrats on the legislation because, he believes, most are uncomfortable with how much the bill undermines securities law. Manually check mempool before each tx 3. The IRS recently issued guidance stating that it will treat virtual currencies, such as Bitcoin, as property for federal tax purposes. All of these transactions are overpaying fees. Gigi Sohn Gigi Sohn. William Hinman, the agency's director of the division of corporate finance, said Thursday that ether—the currency that powers the Ethereum network —shouldn't be regulated in the same way as stocks and bonds. Crypto in San Francisco. Home News Bitcoin News. Bit Consultants offers a simple solution: Many tokens run on top of the Ethereum network itself. Owners of bitcoin and ether, however, now appear safe from that sort of close scrutiny. Bitcoin News Beware: View Comments. If you are thinking about investing in a Bitcoin-related opportunity, here are some things you should consider. Do you want to engage, like Blockstack is, or do you want to ignore it? A Bitcoin exchange in Japan called Mt. Complicating the issue: Affinity Fraud. Clive Thompson Clive Thompson.

As the exchange rate of Bitcoin is significantly higher today, many early adopters of Bitcoin may have experienced an unexpected increase in wealth, making them attractive targets for fraudsters as well as promoters of high-risk investment opportunities. Fees aren't high, the fee estimators are The world's second-most popular cryptocurrency isn't an investment vehicle, at least according to the Securities and Exchange Commission. Many members of the larger crypto community appear to support redefining the terms, offering their support bitcoin value chart usd reddit best bitcoin wallets Congressmen Warren Davidson and Darren Soto and their Token Taxonomy Actwhich would exempt certain cryptocurrencies from securities laws. Related Video. Fraudsters target any group they think they can convince to trust. Transaction fees are included with your bitcoin transaction in order to have your transactions processed by a miner and confirmed by the Bitcoin network. The reason this is helpful is because if you are waiting on a transaction that is stuck because the transaction fees are too low, you can simply send the unconfirmed funds to a different wallet address, with a higher transaction fee. Researchers at the University of Texas found that a price manipulation campaign may have partially accounted altcoin mining with multiple computers best android app to mine btc an increase in bitcoin's price last year, for example. Slowness tortures a very fast-moving industry.

Home News Bitcoin News. Before making any investment, carefully read any materials you are given and verify the truth of every statement you are told about the investment. Science Expert Explains One Concept in 5 Levels of Difficulty - Blockchain Blockchain, the key technology behind Bitcoin, is a new network that helps decentralize trade, and allows for more peer-to-peer transactions. He also disagrees with the approach. More Than a Bit Risky. The exchange rate of U. Sponsored Stories Powered By Outbrain. Bitcoins for oil and gas. The rise of Bitcoin and other virtual and digital currencies creates new concerns for investors. Search SEC. All of these transactions are overpaying fees. William Hinman, the agency's director of the division of corporate finance, said Thursday that ether—the currency that powers the Ethereum network —shouldn't be regulated in the same way as stocks and bonds. Law enforcement officials may face particular challenges when investigating the illicit use of virtual currency. This doesn't mean all cryptocurrencies can evade scrutiny from US regulators. A similar number, if not more, help to develop Bitcoin.

That doesn't mean that investing in either cryptocurrency is necessarily safer. Scott Thurm Scott Thurm. It's possible that investments made early, before the currency became truly decentralized, could still be viewed as traditional investment vehicles. Search SEC. Many tokens run on top of the Ethereum network. If fraud or theft results in you or your investment losing bitcoins, you may have will bitcoin pull back virtual currencies altcoins recovery options. Many Bitcoin users participating on the exchange are left with little recourse. Subscribe Here! Investor Alerts and Bulletins. We previously issued an Investor Alert about the use of Bitcoin in the context of a Ponzi scheme. Electrum Wallets Target of Malicious Attack.

Investor Alerts and Bulletins. Most cryptocurrency wallets have the option of adjusting the fee when sending a transaction, but there is a drawback: In other words, regulators need to explain, if tokens are securities, how the public should buy them and where trading markets can be established. Getty Images. Securities and Exchange Commission. The world's second-most popular cryptocurrency isn't an investment vehicle, at least according to the Securities and Exchange Commission. Scott Thurm Scott Thurm. The SEC has held that most so-called token sales and ICOs are likely subject to regulation, because they generally power a single startup's product or application. Kwon concurred: If you are thinking about investing in a Bitcoin-related opportunity, here are some things you should consider. Before making any investment, carefully read any materials you are given and verify the truth of every statement you are told about the investment. So many people paying too much on fees. Follow us on Twitter or join our Telegram. Optimize for next block. Related Video. The company advertised working interests in wells in West Texas, both at a recent Bitcoin conference and through social media and a web page, according to the emergency order. Social Media and Investing — Avoiding Fraud. All of these transactions are overpaying fees. Affinity Fraud. Fraudsters and promoters may solicit investors through forums and online sites frequented by members of the Bitcoin community.

Follow us on Twitter or join our Telegram. Such challenges may impact SEC investigations involving Bitcoin:. Gox subsequently filed for bankruptcy. The SEC's Hinman notably stopped short of declaring that the initial investments made in ether weren't securities. Hundreds of different developers run applications on top of the Ethereum network and contribute to its code. In fact, it has felt like the endless conversation in crypto ever since ERC tokens created a new fundraising strategy: William Hinman, the agency's director of the division of corporate finance, said Thursday that ether—the currency that powers the Ethereum network —shouldn't be regulated in the same way as stocks and bonds. SEC Investor Alert: Unlike traditional currencies, Bitcoin operates without central authority or banks and is not backed by any government. If fraud or theft results in you or your investment losing bitcoins, you may have limited recovery options.

Researchers at the University of Texas found that a price manipulation campaign may have partially accounted for an increase in bitcoin's price last year, for example. Fee calculations are horrible. Bitcoins for oil and gas. The company advertised working interests in wells in West Texas, both at a recent Bitcoin conference and through social media and a web page, according to the emergency order. As the exchange rate of Bitcoin is significantly higher today, many early adopters of Bitcoin may have experienced an unexpected increase in wealth, making them attractive targets for fraudsters as well as promoters largest bitcoin mining farm original cost of bitcoin high-risk investment opportunities. A Bitcoin can you mine bitcoin cash with gpu what is bitcoin currency in Japan called Mt. In How can someone send me bitcoins bitcoin mining explained in hindi, the SEC told the Senate's Committee on Banking, Housing, and Urban Affairs that it was open to "exploring with Congress, as well as our federal and state colleagues," whether to regulate cryptocurrency exchanges, websites that allow customers to convert and trade different coins for a fee. Private Oil and Gas Offerings. Andreas Glarner, an attorney with European compliance firm MME, said that the view from Europe is that this entire industry is confused: Hinman also said that other cryptocurrencies may become "sufficiently decentralized" in the future, to the point where "regulating the tokens or coins that function on them as securities may not be required. Bitcoin Ponzi scheme. So while buying and trading ether is not seen as making a traditional investment, buying and selling specific tokens that run on top of that network would be. Mempool size: In essence, when a cryptocurrency becomes sufficiently decentralized, as the widely popular bitcoin and ether have, the agency no longer views it as a security. View Comments. Entity List. Bit Consultants offers a simple solution:

Manually check mempool before each tx 3. Child Pays for Parent CPFP is a feature which allows the cashing out cryptocurrency and how to pay taxes biggest profit crypto mining pools of a transaction to spend the unconfirmed funds they are expecting. Investors may find these investment pitches hard to resist. View Comments. Law enforcement officials may face particular challenges when investigating the illicit use of virtual currency. As with any investment, be careful if you spot any of these potential warning signs of investment fraud:. This doesn't mean all cryptocurrencies can evade scrutiny from US regulators. SEC Investor Alert: Many tokens run on top of the Ethereum network. Private Oil and Gas Offerings.

Faith in Congress? What is Bitcoin? Search SEC. For his part, Ali acknowledged the legislative process currently underway but said his company did not feel it could wait. How long will that take, though? Most cryptocurrency wallets have the option of adjusting the fee when sending a transaction, but there is a drawback: View Comments. Predictably though, both ether and bitcoin prices spiked Thursday, likely in response to the news. ICOs are opportunities for investors to purchase the tokens that power a blockchain startup, typically before its product has gone live. Scott Thurm Scott Thurm. If fraud or theft results in you or your investment losing bitcoins, you may have limited recovery options. Company Filings More Search Options. Researchers at the University of Texas found that a price manipulation campaign may have partially accounted for an increase in bitcoin's price last year, for example. That distinction matters, because securities are subject to the same regulations as normal stocks.

Even at these levels next block fee is only 0. Fraudsters target any group they think they can convince to trust. SEC Investor Alert: Scott Thurm Scott Thurm. Gox subsequently filed for bankruptcy. Alert ethereum price ripple trader reddit size: Clive Thompson Clive Thompson. Predictably though, both ether and bitcoin prices spiked Thursday, likely in response to the news. The exchange rate of U. ICOs are opportunities for investors to purchase the tokens that power a blockchain startup, typically before its product has gone live. Sponsored Stories Powered By Outbrain. And that became the underlying question. More Than a Bit Risky.

Predictably though, both ether and bitcoin prices spiked Thursday, likely in response to the news. Hundreds of different developers run applications on top of the Ethereum network and contribute to its code. Securities and Exchange Commission. Fee calculations are horrible. Share Tweet. The size of the mempool is the aggregate size of transactions waiting to be confirmed. That's an important distinction from traditional securities, like Apple or Microsoft stock, in which you're betting on a specific company's efforts to develop products and services and generate income. What is Bitcoin? Bitcoin has been described as a decentralized, peer-to-peer virtual currency that is used like money — it can be exchanged for traditional currencies such as the U. He said that Soto is the exception among the House Democrats on the legislation because, he believes, most are uncomfortable with how much the bill undermines securities law. Report a problem concerning your investments or report possible securities fraud to the SEC. As a result, general tax principles that apply to property transactions apply to transactions using virtual currency. So while buying and trading ether is not seen as making a traditional investment, buying and selling specific tokens that run on top of that network would be. The fraudsters may be or pretend to be Bitcoin users themselves. Company Filings More Search Options. Fraudsters and promoters may solicit investors through forums and online sites frequented by members of the Bitcoin community. Follow us on Twitter or join our Telegram. Such challenges may impact SEC investigations involving Bitcoin:. As with any investment, be careful if you spot any of these potential warning signs of investment fraud:. A Bitcoin exchange in Japan called Mt.

IRS treats Bitcoin as property. Securities and Exchange Commission. Predictably though, both ether and bitcoin prices spiked Thursday, likely in response to the news. Follow us on Twitter or join our Telegram. Since there is only 1 MB of space for transactions within a single block, the more you are willing to pay - and thus outbid other users - the more likely you are to have your transaction picked up by a miner. How long will that take, though? All of these transactions are overpaying fees. If you shops that accept bitcoin payments why wont td bank allow coinbase transactions thinking about investing in a Bitcoin-related opportunity, here are some things you should consider. There are other approaches out there to dealing with regulatory uncertainty. SEC Investor Alert: The reason this is helpful is because if you are waiting on a transaction that is stuck because the transaction fees are too low, you can simply send the unconfirmed funds to a different wallet address, with a higher transaction fee.

The fraudsters may be or pretend to be Bitcoin users themselves. Home News Bitcoin News. Clive Thompson Clive Thompson. The higher fee will have miners pick up the new transaction and the old as well, and both will be confirmed within the same block. Blockchain, the key technology behind Bitcoin, is a new network that helps decentralize trade, and allows for more peer-to-peer transactions. Search SEC. Gox subsequently filed for bankruptcy. Do you want to engage, like Blockstack is, or do you want to ignore it? Law enforcement officials may face particular challenges when investigating the illicit use of virtual currency. Kwon of Cosmos made a similar point.

The size of the mempool is the aggregate size of transactions waiting to be confirmed. For his part, Ali acknowledged the legislative process currently underway but said his company did not feel it could wait. Ponzi Schemes Using Virtual Currencies. SEC Investor Bulletin: Social Media apple pay vs bitcoin how do i get my bitcoins into my bitcoin wallet Investing — Avoiding Fraud. And that became the underlying question. Fees aren't high, the fee estimators are But Rosenblum seemed to feel this would and could be worked. The world's second-most popular cryptocurrency isn't an investment vehicle, at least according to the Securities and Exchange Commission. Report a problem concerning your investments or report possible securities fraud to the SEC. Crypto in San Francisco. Private Oil and Gas Offerings. Even bittrex app iphone can us residents use bitfinex these levels next block fee is only 0. Transaction fees are included with your bitcoin transaction in order to have your transactions processed by a miner and confirmed by the Bitcoin network. Predictably though, both ether and bitcoin prices spiked Thursday, likely in response to the news. The scheme had received endorsements from professional boxer Floyd Mayweather and music producer DJ Khaled. Code Space. A Bitcoin exchange in Japan called Mt. WIRED challenged political scientist and gold bitcoin value best ripple wallet 2019 researcher Bettina Warburg to explain blockchain technology to 5 different people; a child, a teen, a college student, a grad student, and an expert.

The world's second-most popular cryptocurrency isn't an investment vehicle, at least according to the Securities and Exchange Commission. Faith in Congress? Soto, a Florida Democrat, spoke briefly via video, urging attendees to press their own representatives to support his legislation:. William Hinman, the agency's director of the division of corporate finance, said Thursday that ether—the currency that powers the Ethereum network —shouldn't be regulated in the same way as stocks and bonds. Investor Alerts and Bulletins. While declining to confirm that figure, Ali said he expected that if Blockstack got a qualification for its offering to U. Owners of bitcoin and ether, however, now appear safe from that sort of close scrutiny. The scheme had received endorsements from professional boxer Floyd Mayweather and music producer DJ Khaled. Researchers at the University of Texas found that a price manipulation campaign may have partially accounted for an increase in bitcoin's price last year, for example.

IRS treats Bitcoin as property. Do you want to engage, like Blockstack is, or do you want to ignore it? Optimize for next block. If you are thinking about investing in a Bitcoin-related opportunity, here are some things you should consider. Search SEC. Bitcoin has been coinbase forgot authenticator code ethereum program example as a decentralized, peer-to-peer virtual currency that is used like money — it can be exchanged for traditional currencies such as the U. But, on that point, another lawyer on cpu mining software litecoin cpu only mining pool panel noted there are a lot more issues beyond how the law views crypto. Massad noted: This doesn't mean all cryptocurrencies can evade scrutiny from US regulators. Most cryptocurrency wallets have the option of adjusting the fee when sending a transaction, but there is a drawback:

As with any investment, be careful if you spot any of these potential warning signs of investment fraud:. More business. The rise of Bitcoin and other virtual and digital currencies creates new concerns for investors. Gox subsequently filed for bankruptcy. The company advertised working interests in wells in West Texas, both at a recent Bitcoin conference and through social media and a web page, according to the emergency order. More Than a Bit Risky. Researchers at the University of Texas found that a price manipulation campaign may have partially accounted for an increase in bitcoin's price last year, for example. ICOs are opportunities for investors to purchase the tokens that power a blockchain startup, typically before its product has gone live. Massad noted: Bitcoin trading suspension. Share Tweet. Predictably though, both ether and bitcoin prices spiked Thursday, likely in response to the news. WIRED challenged political scientist and blockchain researcher Bettina Warburg to explain blockchain technology to 5 different people; a child, a teen, a college student, a grad student, and an expert. The higher fee will have miners pick up the new transaction and the old as well, and both will be confirmed within the same block. Bit Consultants , a Bitcoin education and consultancy organization, suggests that users are needlessly overpaying - more than would be strictly necessary to have your transaction included in the next block. Bitcoins for oil and gas. He said that Soto is the exception among the House Democrats on the legislation because, he believes, most are uncomfortable with how much the bill undermines securities law.

The higher fee will have miners pick up the new transaction and the old as well, and both will be confirmed within the same block. Social Media and Investing — Avoiding Fraud. And that became the underlying question. Clive Thompson Clive Thompson. Slowness tortures a very fast-moving industry. The exchange rate of U. WIRED challenged political scientist and blockchain researcher Bettina Warburg to explain blockchain technology to 5 different people; a child, a teen, a college student, a grad student, and an expert. In essence, when a cryptocurrency becomes sufficiently decentralized, as the widely popular bitcoin and ether have, the agency no longer views it as a security. IRS treats Bitcoin as property. Kwon of Cosmos made a similar point. William Hinman, the agency's director of the division of corporate finance, said Thursday that ether—the currency that powers the Ethereum network —shouldn't be regulated in the learn cryptocurrency how to start your own cryptocurrency way as stocks and bonds. Soto, a Florida Democrat, where to store ico tokens free bitcoins for backpage briefly via video, urging attendees to press their own representatives to support his legislation: In fact, it has felt like the endless conversation in crypto ever since ERC tokens created a new fundraising strategy:

As a result, general tax principles that apply to property transactions apply to transactions using virtual currency. Third-party wallet services, payment processors and Bitcoin exchanges that play important roles in the use of bitcoins may be unregulated or operating unlawfully. Fee calculations are horrible. A new product, technology, or innovation — such as Bitcoin — has the potential to give rise both to frauds and high-risk investment opportunities. The reason this is helpful is because if you are waiting on a transaction that is stuck because the transaction fees are too low, you can simply send the unconfirmed funds to a different wallet address, with a higher transaction fee. But Rosenblum seemed to feel this would and could be worked out. Clive Thompson Clive Thompson. More Than a Bit Risky. Even at these levels next block fee is only 0. The fraudsters may be or pretend to be Bitcoin users themselves. In other words, regulators need to explain, if tokens are securities, how the public should buy them and where trading markets can be established. The higher fee will have miners pick up the new transaction and the old as well, and both will be confirmed within the same block. Soto, a Florida Democrat, spoke briefly via video, urging attendees to press their own representatives to support his legislation:. If you are thinking about investing in a Bitcoin-related opportunity, here are some things you should consider.

Transaction fees are included with your bitcoin transaction in order to have your transactions processed by a miner and confirmed by the Bitcoin network. Before making any investment, carefully read any materials you are given and verify the truth of every statement you are told about the investment. Bit Consultants offers a simple solution: Fraudsters target any group they think they can convince to trust them. The SEC's Hinman notably stopped short of declaring that the initial investments made in ether weren't securities. Report a problem concerning your investments or report possible securities fraud to the SEC. Since there is only 1 MB of space for transactions within a single block, the more you are willing to pay - and thus outbid other users - the more likely you are to have your transaction picked up by a miner. Bit Consultants , a Bitcoin education and consultancy organization, suggests that users are needlessly overpaying - more than would be strictly necessary to have your transaction included in the next block. The fraudsters may be or pretend to be Bitcoin users themselves. All that the SEC's declarations really say is that you're betting on an entire ecosystem, rather any one player. Manually check mempool before each tx 3. That distinction matters, because securities are subject to the same regulations as normal stocks.