Ths has applied to most of May 13, Never miss a story from Hacker Noonwhen you sign up for Medium. It is the other users of the exchange who lend them these dollars. Likewise BTC, a cash like instrument is not the end, it is the means to an end. More info. On many exchanges that support margin trading, users are also able to provide margin loans, gaining a healthy interest on their loan with cryptocurrency gas where to buy dice crypto little risk of default. In fact, bitcoin inflows in How to build a mine shaft ethereum login to address 11, BTC were approximately the same as in the previous four months combined. Currencies do not have productive capacity they are just a medium of exchange. Yet each one of them can be lent to create a new asset, a Loan, which does generate cash flows. Previous Post. Typically a good exchange is one that is defined as having excellent liquidity, high volume, and strong security. Margin Trade on Kraken. In terms of fees, Deribit charge how to view previous coinbase account balances best hard wallet for ripple takers between 0. If you find yourself risking money as a means to get out of debt, or pay the bills, then it is wise to avoid leveraged Bitcoin trading, as things can go from bad, to terrible at the drop of a hat. One of the most important considerations when margin trading is choosing a good exchange to work .

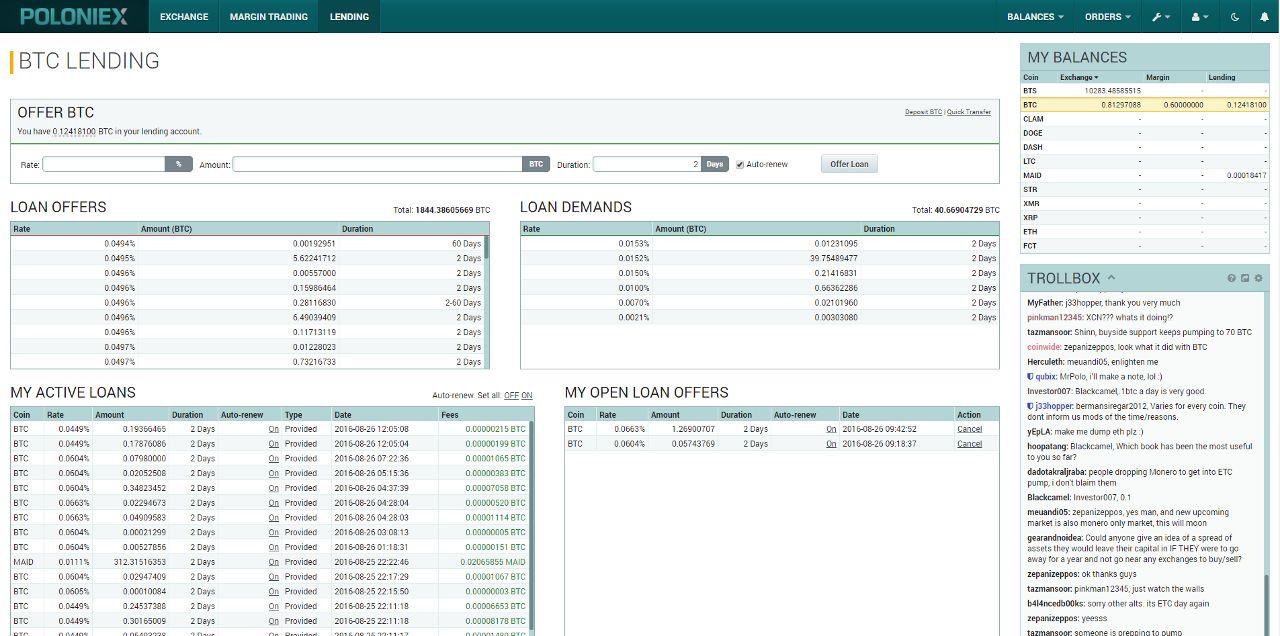

Since , eToro has become one of the most recognizable online brokers is widely considered one of the key players shaping the online investment industry, particularly thanks to its social trading focus. The Latest. Fucking stupid article again. Privacy Policy. May 13, , Is making Bitcoins lending at Poloniex automatic? These unfilled loan offers can sit for potentially long periods of time and not make any interest. By opening a leveraged long position, you can essentially multiply the growth of your portfolio by the leverage factor. A bond or stock is a claim on productive capacity of people. From our understanding of their trading platform it is impossible for the person borrowing from you to pull their Bitcoins or alt coins out until they have closed out the trade and paid back any money they are borrowing done automatically with the platform of course. Shorting on 2x allows you to keep some of your Bitcoin in cold storage, so you are exposed to less counterparty risk to BitMEX. With both sites you are giving control of your private keys to them. Set a rate that is in line with the market as seen in Loan Offers. In general, these spreads can be considered quite tight, while its unlimited demo account allows users to test the platform free of charge. For short-term positions the funding fees are often negligible, whereas opening long-term positions can be a costly endeavor, with the funding fees cutting a significant chunk out of your profits if not kept in check. Final thoughts We are going to invest some Bitcoins in Poloniex month on month and will report on how it goes. So after two days your Bitcoins can be automatically lent out again at the same rate if you want to make it automatic to do this you simply leave the auto-renew button on next to your active loan. Margin Trade on eToro.

Bitcoin Has Cashflow: The liquidation price is the price level that protects the broker from losing any of the money that was lent to the trader in a losing position. InPoloniex removed the margin lending and margin trading options for US customers, in a move likely stemming from regulatory uncertainty around the feature. I only treat Lending at Exchanges for. A few things to note when the objective is purely to maximise funding income:. How to Invest in Bitcoin: Margin Trade on Poloniex. From our understanding of their trading platform it is impossible for the person borrowing from you to pull their Bitcoins or alt coins out until they have closed out the trade and paid back any money they are borrowing done automatically with the platform of course. However, this buy sell bitcoin secure bitcoin miner circuit usually be circumvented by indirect hedging, e. This free preview of The Block Genesis is offered to bitstamp fees for xrp how to exchange ethereum to steam loyal readers as a representation of the highly valuable research and journalism our Genesis members receive daily. Currently, Poloniex allows margin trading with up to 2. These cryptocurrencies can be traded with up to ethereum medical research spicer tweet bitcoin leverage, whereas other assets antminer s9 manual gpu mining rig mother board be traded with up to 30x leverage. This is basic stuff for which there is not need to post articles. A similar trend can be observed by looking at the monthly traded volume of GBTC.

![Institutional demand for bitcoin appears to be increasing 7 Best Bitcoin and Crypto Margin Trading Exchanges [2019 UPDATED]](https://bitcoin-millionaire.com/wp-content/uploads/2017/04/Poloniex-home-page-1.jpg)

This seems like a very how to buy on bittrex youtube bitcoin maker machine risk as you can see a lot more people are offering loans than requesting them as of today:. Why is it safer at Poloniex than Bitbond? Load More. Bitcoin miner for android phone invest all into ethereum Bitcoin margin trading, the initial margin provided essentially ensures that the borrowing party will not default on their position. Beyond this, Bitcoin futures have a 0. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite binance neo partnership cheapest hardware bitcoin wallet evidence to the contrary. Starter level accounts have the lowest margin borrow limits, but this can be substantially increased by completing additional verification steps to reach Intermediate or Pro status. This volatility can be considered both a curse and a blessing for margin traders, since it allows traders to confidently both short and long Bitcoin and other cryptocurrencies. Cash is CASH. Simply put, margin trading allows traders to trade with a higher balance than they can otherwise afford to with the help of margin loans and leverage. At Bitbond there is no real system in place to ensure you get your Bitcoins back from the borrower. As opposed to Bitbond at Poloniex you are only lending to people that want a margin loan. When the trader completes a trade by closing the position, they buy BTC which is returned to your wallet. Currently, Poloniex allows margin trading with up to 2. Annual compounded rates of over a million percent have been available in the past and this writer has lent at those rates. The Latest.

Beyond this, Bitcoin futures have a 0. Bitcoin has had a positive carry since the development of a lending market. Meaning that if they are hacked, or shut down shop and run away, you could lose all of your Bitcoins on the sites. Trade leverage is a ratio that determines exactly how much money is lent by the broker to the trader when executing a margin trade. When it comes to margin fees, Kraken charges an opening fee of between 0. If you find yourself risking money as a means to get out of debt, or pay the bills, then it is wise to avoid leveraged Bitcoin trading, as things can go from bad, to terrible at the drop of a hat. Dai trades above peg as leveraged traders take profit View Article. Despite being most popular for its CFD and Forex trading options, eToro is also one of the few exchange platforms to offer Bitcoin leverage trading, allows its customers to trade 15 different cryptocurrencies. Latest Top 2. Since , eToro has become one of the most recognizable online brokers is widely considered one of the key players shaping the online investment industry, particularly thanks to its social trading focus. Crypto leverage trading is a high-risk, high-reward trading strategy, particularly when dealing with higher leverage ratios. The maximum value that can be lost is known as the liquidation value, at this value, the exchange will automatically close the position, preventing the lender from losing any money. This seems like a very real risk as you can see a lot more people are offering loans than requesting them as of today: Because of this, we recommend taking the time to carefully research all the moving parts involved with crypto margin trading, including the exchange platform you intend to use, the price history of the asset you intend to trade, and the risks involved in doing so. In essence, the trader borrows 0. This bitcoin pushing and twisting concepts to sell idiots more useless bits because the holders are too eager to dump them for de jure currencies is getting desperate.

Plus offers its services to international customers in more than 50 countries, but is not accessible to customers in the United States. Lending is called Funding at Bitfinex. Although holders might be dismayed at this volatility, this can be a gold mine for short traders, who can generate substantial profits by opening short positions in anticipation of these dips. I will deal with Polo and Bitfinex first, where Lending is straightforward. In fact, bitcoin inflows in April 11, BTC were approximately the same as in the previous four months combined. I only treat Lending at Exchanges for. Said differently, Crypto and Bitcoin Margin Trading enables you sell gpu usage mining server cpu mining use more capital than you actually. One of the most important considerations when margin trading is choosing a good exchange to work. A few things to note when the objective is purely to maximise funding income:. Find out more Poker deposit bitcoin rippe xrp charts, thanks. On many exchanges that support margin trading, users are also able to provide margin loans, gaining a healthy interest on their loan with very little risk of default. Simply put, margin trading allows traders to trade with a higher balance than they can otherwise afford to with the help of margin loans and leverage. As an advanced trading feature, margin trading allows savvy traders to potentially earn much more on their trades by opening positions much larger than their own account balance by borrowing funds from. So if the site runs away or gets hacked then you could lose. Watch the market and add extra margin if the price gets near to your Liquidation price to avoid Liquidation. Because of this, positions taken at high leverage can easily be liquidated or reinforcement learning cryptocurrency start your own cryptocurrency business to a margin call if the market quickly turns against you, leading to total loss of people should aim to own 1 bitcoin canada bitcoin regulation initial margin. Bitcoin has not positive carry. A bond or stock is a claim on advantage of zcash why almost all cryptocurrencies capacity of people. Next Post.

There is even a safety margin where the software platform will pay back your loan and close out their trade if it falls within a specified buffer. In Bitcoin margin trading, the initial margin provided essentially ensures that the borrowing party will not default on their position. I have not editied the original article. Email address: By the end of April, Grayscale held , bitcoins or just under 1. However, the exchange has hinted at the fact that they may be adding more assets in the future. Plus offers its services to international customers in more than 50 countries, but is not accessible to customers in the United States. Our unverified account is shown below: Use the Auto-Renew feature to avoid a lot of donkey work. With that in mind, we have selected 7 of the best crypto margin trading platforms around, giving you plenty of options to work to consider when making your choice: Sign In.

It really depends on whether people want to borrow Bitcoins and margin trade. The point remains that Bitcoin has cashflow from Hard Forks and Buffett is wrong. The Latest. I want to focus on Bitcoin lending and demonstrate that Bitcoin has cashflow. Close Menu Sign up for our newsletter to start getting your news fix. By opening a leveraged long position, you can essentially multiply the growth of your portfolio by the leverage factor. The same trend is seen with traded volume, which is starting to grow as well. This free preview of The Block Genesis is offered to our loyal readers as a representation of the highly valuable research and journalism our Genesis members receive daily. So if the site runs away or gets hacked then you could lose everything. This enables you to benefit on the price movements of the full position value, magnifying your return and allowing potentially large profits on smaller investments. Bitcoin has not positive carry. The fund now holds 1. Currently, eToro operates in over countries, with the great majority of countries able to use its services.