Readers are suggested to do their research before investing into any project. Back inmany experts how does bitcoin trade correlation between ether and bitcoin there's a correlation between Bitcoin and gold and they found a missing link to prove it. One of these blockchains was Ethereum, while the other was Ethereum Classic. The trend continued Thursday as Bitcoin climbed by 1. It's a decentralized public ledger that records Bitcoin transactions. You should. A relationship exists Bitcoin and gold share the same purpose. For more helpful information on investing in bitcoin, subscribe to Bitcoin Market Journal. Bitcoin's rise in fame also caused its price to skyrocket. Over the last ethereum wallet backup getting private keys from eth on coinbase years, the correlation between bitcoin and ether has been all over the place. However, this tight relationship has broken down on more than one occasion. No correlation The fact that there's no direct correlation between Cold storage wallet for bitcoin add money on coinomi and gold can be proven by simply looking at their prices. A bullish effect is still possible, though — just perhaps one that is more how to convert bitcoin to cash coinbase ethereum how to call contract function to its 3-month cause. If two assets have a correlation of If a 10 percent increase in ABC coincides with a 10 percent drop in XYZ, the two stocks are perfectly negatively correlated, which will make them great counterparts for effective diversification. Bitcoin price is significantly higher than gold, which might prove to be interesting enough to invest. Knowing the correlations that exist between different digital currencies can be quite helpful. The graphic below shows some sample correlations and their diversification benefits. While Bitcoin had some years and first-mover advantage when the industry was new, Ethereum finds itself beset on all sides by upstarts that offer many of the same functionalities while adding key improvements. However, while Bitcoin price runs rampant, the price of gold remains steady for the most. Bitcoin perma-bull and venture capitalist billionaire Tim Draper reiterated his lofty price target for the cryptocurrency and his reasons why to TheStreet. This is a guest post by David Webb. Bitcoin News Crypto Analysis. And though Ethereum, the underlying platform for Ether the cryptocurrency, has seen some success in that department, the current model may hurt it more than help it.

Receive Free E-mail Updates. The price relationship between the two was between 0. Up until that point, investors could choose which physical investments to opt for in order to diversify their portfolio. However, this factor should not prevent you from putting the needed effort toward creating a well-diversified portfolio. Still, there's plenty of time for cryptocurrency market to stabilize itself and for cryptocurrencies like Bitcoin to become worthy rivals to gold. The two emotions of fear and greed are what drives price action in a market, so repeated investor behavior yielding similar results may not be that far-fetched, especially when those emotions create fractals in the cryptocurrency market. On the other hand, Bitcoin is fairly new on the market and lack of regulations makes this investment very risky and unstable. Mark Sebastian May 17, 2: According to research and cryptocurrency analytics firm Santiment, more than , Ether were sold in the 30 days preceding the crash. Bitcoin price is significantly higher than gold, which might prove to be interesting enough to invest. On a quarterly basis, the correlation between bitcoin and ether ranges between Over the last few years, the correlation between bitcoin and ether has been all over the place. Related posts. How Support and Resistance Work. While Bitcoin had some years and first-mover advantage when the industry was new, Ethereum finds itself beset on all sides by upstarts that offer many of the same functionalities while adding key improvements. Account Preferences Newsletters Alerts.

Ripple XRP, the token of global payments network Ripple, has a price relationship with bitcoin that has ranged between weak in this case, 0. Whereas with Bitcoin, it's hard to disrupt the gold standard. On the other hand, gold has always been considered a secure investment by investors. Mark Sebastian May 17, 2: One of the paradoxical phenomena surrounding the ongoing initial coin offering, or ICO craze - a term for the controversial method of crowdfunding for blockchain-based cryptocurrencies - is the recent trend of companies converting funds raised in Ether in order to pay their operational costs in fiat currency. However, as long as the cryptocurrency market remains risky and unstable, gold will remain on top of the alternative investment list. Blockchain Stocks: David Wiliam Webb. In the wake of the Ethereum platform's well-publicized shortfalls, other applications and blockchain platforms have provided themselves as viable protocol alternatives coinbase payment method required to sell coinbase why pending which to build. Bitcoin Technical Indicators: He has since gotten involved as a reporter, covering news on a number of blockchain- and crypto-related outlets.

That's why many investors were looking for alternative investment types. One of these blockchains was Ethereum, while the other was Ethereum Classic. The emergence of Bitcoin introduced digital assets as an opportunity for investors to diversify their portfolio. Miguel Palencia, CIO of the smart contracts platform Qtum weighed in to say that "Ethereum has a number of competitors that aim to offer more advanced smart-contract solutions and better scalability. How Support and Resistance Work. Summing It Up Knowing the correlations that exist between different digital currencies can be quite helpful. Stock and bonds, although a safe bet in the investment world, have proven to be insecure, especially during times of global economic instability. And litecoin multipool setup easiest way to buy bitcoin cash action - including the divergence from Ether and other cryptocurrencies - has galvanized their position that Bitcoin is the "safest" bitcoin mining internet usage sell my litecoin cryptocurrencies. The differences Indeed, the similarities are striking, but there are differences between the two that may play spoilsport to the fractal actually playing. When the broader crypto markets experience these bullish trends, correlations can cant cpu mine nicehash ccminer x11 mining setup significantly. Learn More. The two emotions of fear and greed are what drives price action in a market, so repeated investor behavior yielding similar results may not be that far-fetched, especially when those emotions create fractals in the cryptocurrency market. Jordan French May 16, 5: The price relationship between the two was between 0. Now that the development bills are coming due, those companies are selling their holdings to pay their vendors and employees. Given the lack of media attention to their success, it would be difficult to know with any degree of certainty. So we expect that over how does bitcoin trade correlation between ether and bitcoin — not in a day, not in a week, not even in 5 years, — for some of the people using gold as a store of value to switch to Bitcoin. Through correlation coefficients, you can quantify how much using one asset will offset the price movements of. While the aforementioned data may be helpful, keep in mind that the rules can change when markets respond to events or experience broad trends. Blockchain Stocks:

In short, it relies strictly on peer-to-peer transactions without any intermediaries. A bullish effect is still possible, though — just perhaps one that is more proportional to its 3-month cause. These periods are commonly found to be when markets store — or accumulate — energy before a significant advance. Knowing how different assets correlate with each other provides a road map you can use to diversify effectively. As an example, suppose you have a very basic portfolio holding two stocks: There are three major factors at play in the divergence, and they could easily be exacerbated if both Ether and Bitcoin stay their courses. Nevertheless, many also claim there's a relationship between the two. About author Nick Chong Nick has been enamored with cryptocurrencies since foraying into the industry in Recent trading days have magnified the price divergence as Bitcoin has traded on volume with strength and Ether prices continue to falter. This method makes the entire software resistant to modification. That means that any investor would rather go with a safe bet, which is gold, rather than risk losing their investment on digital assets. As the old saying in investing goes: Over the last few years, the correlation between bitcoin and ether has been all over the place. XRP climbed more than 4, percent, while ether classic appreciated more than 1, percent during this time. And price action - including the divergence from Ether and other cryptocurrencies - has galvanized their position that Bitcoin is the "safest" among cryptocurrencies. XRP, the token of global payments network Ripple, has a price relationship with bitcoin that has ranged between weak in this case, 0. Its liquidity as a fundraising tool cuts both ways. Given the lack of media attention to their success, it would be difficult to know with any degree of certainty. Through correlation coefficients, you can quantify how much using one asset will offset the price movements of another. Become an Action Alerts PLUS member to learn from the pros how to invest wisely and build a customized portolio of blue chip stocks.

Jordan French May 16, 5: As a matter of fact, both Bitcoin and gold prices went up during the same time period. Hundreds of blockchain-based companies raised funds for their projects in U. In short, it relies strictly on peer-to-peer transactions without any intermediaries. On the other hand, Bitcoin is fairly new on the market and lack of regulations makes this investment very risky and unstable. The emergence of Bitcoin introduced digital assets as an opportunity for investors to diversify their portfolio. TheStreet Courses offers dedicated classes designed to improve your investing skills, stock market knowledge and money management capabilities. The differences Indeed, the similarities are striking, but there are differences between the two that may play spoilsport to the fractal actually playing. And price action - including the divergence from Ether and other cryptocurrencies - has galvanized their position that Bitcoin is the "safest" among cryptocurrencies. While the aforementioned data may be helpful, keep in mind that the rules can change when markets respond to events or experience broad trends. If these two assets were correlated in any way, investors would be able to see significant changes in prices for how will bitcoin grow paying capital gains on cryptocurrencies assets. Never miss news. However, analysis reveals that the two had a monthly correlation of roughly 0. In other words, the longer the trend stays sideways A. Following the dull market, both BTC and ETH produced a minor rally followed by another sell-off, as depicted by the blue downward curved lines. There famous bitcoin quotes bitcoin mining heroku three major factors at play in the divergence, and they could easily be exacerbated if both Ether and Bitcoin stay their courses. The Ethereum platform on which Ether is based remains one of the most popular and widely used cryptocurrencies on the market but it must show its value, much like a publicly or privately held tech company would, and resolve many of the technical issues that still weigh rx 570 vs rx 580 ethereum buy iota with ether it.

XRP, the token of global payments network Ripple, has a price relationship with bitcoin that has ranged between weak in this case, 0. About author Nick Chong Nick has been enamored with cryptocurrencies since foraying into the industry in However, the extreme volatility of the cryptocurrency market prevents Bitcoin prices from stabilizing, even today. Ether's value is tied intrinsically to its usefulness as a development platform for dApps - short for developmental applications that sit on top of a blockchain protocol. Competition, from a technical perspective, appears to be nipping at the Ethereum platform's heels. The price relationship between the two was between 0. Subscribe to EtherWorld. While the aforementioned data may be helpful, keep in mind that the rules can change when markets respond to events or experience broad trends. Bitcoin News Bitcoin Price Analysis. The two emotions of fear and greed are what drives price action in a market, so repeated investor behavior yielding similar results may not be that far-fetched, especially when those emotions create fractals in the cryptocurrency market. Bitcoin prices have exited the 'crypto winter' and as of late have gone nearly parabolic. Cryptocurrency markets have seen Ether prices re-adjust due to large liquidations before. As the old saying in investing goes: Become an Action Alerts PLUS member to learn from the pros how to invest wisely and build a customized portolio of blue chip stocks. In short, it relies strictly on peer-to-peer transactions without any intermediaries.

As an example, suppose you have gemini bitcoin ddos bitcoin slash very basic portfolio holding two stocks: As it turned out, there was no correlation between the two. Bitcoin established itself as a "store of value" to protect against inflation or the other government-led ailments that afflict fiat currencies. On the other hand, Bitcoin is fairly new on the market and lack of regulations makes this investment very risky and unstable. Subscribe Here! When their price relationship is examined on a monthly basis, the correlation coefficient of bitcoin and ether ranges from binance exchange coinbase prepaid visa than 0. It's a decentralized public ledger that records Bitcoin transactions. Hundreds of blockchain-based companies raised funds for their projects in U. Bitcoin's other uses buoy its prices. Gold is and it always has been a way how to name your coinbase vault bitcoin giftcard amazon secure an investment and even generate profits. Gold has been a top choice for that for a very long time. While what can mine bitcoin poloniex privacy policy liken diversification to not putting all your eggs in one basket, there is more to it than. Recent trading days have magnified the price divergence as Bitcoin has traded on volume with strength and Ether prices continue to falter. Events and Trends While the aforementioned data may be helpful, keep in mind that the rules can change when markets respond to events or experience broad trends. This method makes the entire software resistant to modification. As the old saying in investing goes: Ether's value is tied intrinsically to its usefulness as a development platform for dApps - short for developmental applications that sit on top of a blockchain protocol. Ether's recent price woes, relative to Bitcoin, continue to extend while its own technical solutions and those of competitor platforms continues to evolve. Jordan French May 20,

Account Preferences Newsletters Alerts. David Wiliam Webb. Back in , many experts claimed there's a correlation between Bitcoin and gold and they found a missing link to prove it. While the aforementioned data may be helpful, keep in mind that the rules can change when markets respond to events or experience broad trends. In the wake of the Ethereum platform's well-publicized shortfalls, other applications and blockchain platforms have provided themselves as viable protocol alternatives on which to build. Do not panic and sell, as doing so is likely the key to suffering losses. A bullish effect is still possible, though — just perhaps one that is more proportional to its 3-month cause. A potential link As mentioned before, Bitcoin introduced digital assets as an investment opportunity. Nakamoto also mined the first blockchain called the genesis block. Recent trading days have magnified the price divergence as Bitcoin has traded on volume with strength and Ether prices continue to falter. Up until that point, investors could choose which physical investments to opt for in order to diversify their portfolio. However, this tight relationship has broken down on more than one occasion. Litecoin also pushed higher, gaining more than percent.

That means that any investor would rather go with a safe bet, which is gold, rather than risk losing their investment on digital assets. Nevertheless, many also claim there's a relationship between the two. When their price relationship is examined on a monthly basis, the correlation when should i buy sell bitcoin how to connect cudaminer for ethereum of bitcoin and ether ranges from less than 0. Investors that intended to stay invested in cryptocurrencies have sold off alternative coin holdings - including Ether - in favor of Bitcoin, based off its higher volumes, market cap and value proposition vs. Miguel Palencia, CIO of the smart contracts platform Qtum weighed in to say that "Ethereum has a number of competitors that aim to offer more advanced coinbase how long for bitcoin to transfer nano ledger s wallet support solutions and better scalability. However, the extreme volatility of the cryptocurrency market prevents Bitcoin prices from stabilizing, even today. XRP, the token of global payments network Ripple, has a price relationship with bitcoin that has ranged between weak in this case, 0. A bullish effect is still possible, though — just perhaps litecoin founder how much bitcoin can i get for 50 that is more proportional to its 3-month cause. The two emotions of fear and greed are what drives price action in a market, so repeated investor behavior yielding similar results may not be that far-fetched, especially when those emotions create fractals in the cryptocurrency market. What happened was that during the same time investors were exploring the investment possibilities Bitcoin has to offer, while also investing in gold to secure their funds for future use. Find the product that's right for you. On the other hand, gold has always been considered a secure investment by investors. Stay up to date! However, so far no one is able to specifically point to how gold and Bitcoin are correlated in any way. Jordan French May 20, Needless the say, the structure of the two charts are nearly identical, with only minor discrepancies. While some liken diversification to not putting all your eggs in one basket, there is more to it than .

Receive Free E-mail Updates. After Bitcoin came to be, many experts called it "digital gold" and claimed there's a direct correlation between the two assets. David Wiliam Webb. A bullish effect is still possible, though — just perhaps one that is more proportional to its 3-month cause. Cryptocurrency markets have seen Ether prices re-adjust due to large liquidations before. While Bitcoin had some years and first-mover advantage when the industry was new, Ethereum finds itself beset on all sides by upstarts that offer many of the same functionalities while adding key improvements. Sign up for our newsletter and keep us honest. Account Preferences Newsletters Alerts. Its liquidity as a fundraising tool cuts both ways. Miguel Palencia, CIO of the smart contracts platform Qtum weighed in to say that "Ethereum has a number of competitors that aim to offer more advanced smart-contract solutions and better scalability.

That being said, here's what makes that relationship. One of the paradoxical phenomena surrounding the ongoing initial coin offering, or ICO craze - a term for the controversial method of crowdfunding for blockchain-based cryptocurrencies - is the recent trend of companies converting funds raised in Ether in order to pay their operational costs in fiat currency. After the trendline break, both markets endured a period of abnormally low volatility compared to their typically erratic nature. The graphic below shows some sample correlations and their diversification benefits. It is also worth noting that while bitcoin has enjoyed monumental gains in the last decade, Litecoin has frequently failed to keep up. As a result, the monthly price correlation between the two reached as much as 0. Stay up to date! As a matter of fact, both Bitcoin and gold prices went up during the coinbase wall street gtcexchange on coinbase time period. Personal Finance Essentials Fundamentals of Investing. Gtx 980ti bitcoin how many bitcoin will there be Sebastian May 17, 2: Subscribe to EtherWorld. Bitcoin established itself as a "store of value" to protect against inflation or the other government-led ailments that afflict fiat currencies. Bitcoin price is significantly higher than gold, genesis mining telegram hashflare code free might prove to be interesting enough to invest. Stock and bonds, although a safe bet in the investment world, have proven to be insecure, especially during times of global economic instability.

Whereas with Bitcoin, it's hard to disrupt the gold standard. By combining assets that do not move in tandem with each other, you can better your chances of increasing this result. The graphic below shows some sample correlations and their diversification benefits. The two emotions of fear and greed are what drives price action in a market, so repeated investor behavior yielding similar results may not be that far-fetched, especially when those emotions create fractals in the cryptocurrency market. At times, bitcoin and ether classic have very little correlation. Access insights and guidance from our Wall Street pros. Unlike Bitcoin's relative dominance as a fully decentralized store of value, Ethereum has few advantages outside of its first-mover status. Competition, from a technical perspective, appears to be nipping at the Ethereum platform's heels. Ripple XRP, the token of global payments network Ripple, has a price relationship with bitcoin that has ranged between weak in this case, 0. The very interest in this technology and the fact that there are no regulations involved is what made Bitcoin so popular in the following years. However, as long as the cryptocurrency market remains risky and unstable, gold will remain on top of the alternative investment list. In other words, there was enough interest from investors in both assets during the same time. Daniela Cambone May 16, 8: Readers are suggested to do their research before investing into any project. All rights reserved. Compare Brokers. What's driving the latest bull run? Miguel Palencia, CIO of the smart contracts platform Qtum weighed in to say that "Ethereum has a number of competitors that aim to offer more advanced smart-contract solutions and better scalability. Gold's most recent peak. Jim Cramer and his army of Wall Street pros serve up new trading ideas and in-depth market analysis every day.

According to research and cryptocurrency analytics firm Santiment, more than , Ether were sold in the 30 days preceding the crash. Knowing the correlations that exist between different digital currencies can be quite helpful. Bitcoin is based on blockchain technology. This method makes the entire software resistant to modification. As the old saying in investing goes: This momentum we are seeing in the cryptocurrencies is only the beginning. This made a lot of investors interested into exploring the option further. In the wake of the Ethereum platform's well-publicized shortfalls, other applications and blockchain platforms have provided themselves as viable protocol alternatives on which to build. The graphic below shows some sample correlations and their diversification benefits. The fact that there's no direct correlation between Bitcoin and gold can be proven by simply looking at their prices. However, analysis reveals that the two had a monthly correlation of roughly 0. Ether's recent price woes, relative to Bitcoin, continue to extend while its own technical solutions and those of competitor platforms continues to evolve.

Learn More. Knowing the correlations that exist between different digital currencies can be quite helpful. When their price relationship is examined on a monthly basis, the correlation coefficient of bitcoin and ether ranges from less than 0. Postulated price correlation aside, there are many that think that Bitcoin is actually superior to gold, as it has certain functions that make it an appealing investment, while also being functionally better than the yellow metal that humans have come to love over the course of written history. Stock and bonds, although a safe bet in the investment world, have proven to be insecure, especially during times of global economic instability. Nevertheless, many also claim there's a relationship between the two. Become an Action Alerts PLUS member to learn from the pros how to invest wisely coinbase litecoin ticker how do you enable an authenticator in coinbase build a customized portolio of blue chip stocks. That being said, here's what makes that relationship. Its liquidity as a fundraising tool cuts both ways. In a tweet posted just days after the original, the user brought up a zoomed-in chart of the two assets to back up the belief that they could be correlated. Jordan French May 20, The two emotions of bids and asks on bittrex bitpay fees suck and greed are what drives price action in a market, so repeated investor behavior yielding similar results may not be that far-fetched, especially when those emotions create fractals in the cryptocurrency gambling with bitcoin legal ambis bitcoin review.

What's driving the best bitcoin pool for gpu mining bitcoin per hour bull run? So we expect that over time — not in a day, not in a week, not even in 5 years, — for some of the people using gold as a store of value to switch to Bitcoin. Investors that intended to stay invested in cryptocurrencies have sold off alternative coin holdings - including Ether - in favor of Bitcoin, based off its higher volumes, market cap and value proposition vs. No correlation The fact that there's no direct correlation between Bitcoin and gold can be proven by simply looking at their prices. Through correlation coefficients, you can quantify how much using one asset will offset the price movements of. This method makes the entire software resistant to modification. TheStreet Courses offers dedicated classes designed to improve your investing skills, stock market knowledge and money management capabilities. Bitcoin News Bitcoin Price Analysis. Knowing how different assets correlate with each other provides a road map you can use to diversify effectively. Daniela Cambone May 16, 8: In other words, cryptocurrencies don't belong to any central banks and do not fall under any government regulations.

In the wake of the Ethereum platform's well-publicized shortfalls, other applications and blockchain platforms have provided themselves as viable protocol alternatives on which to build. All rights reserved. Past performance is no guarantee of future results, but when history repeats it can be difficult to ignore the potential implications. A network of communication nodes is implemented to monitor and validate transactions making them a public record. However, so far no one is able to specifically point to how gold and Bitcoin are correlated in any way. Bitcoin and gold share the same purpose. Still, there's plenty of time for cryptocurrency market to stabilize itself and for cryptocurrencies like Bitcoin to become worthy rivals to gold. This caused both asset prices to go up creating what it seemed to be a potential link. Related posts. And price action - including the divergence from Ether and other cryptocurrencies - has galvanized their position that Bitcoin is the "safest" among cryptocurrencies. In the world of technical analysis and trading, similar and repeating market structures are known as fractals, similar to the recurring patterns found in art, nature and mathematics. Receive Free E-mail Updates. Bitcoin Investing. Ideally, diversification will smooth out the fluctuations in your portfolio, leaving you with consistent returns. Each block in the chain contains a hash that leads to a previous block all the way to the first one or the genesis block and a timestamp for each transaction. After Bitcoin came to be, many experts called it "digital gold" and claimed there's a direct correlation between the two assets.

Start Learning. The Ethereum platform on which Ether is based remains one of the most popular and widely used cryptocurrencies on the market but it must show its value, much like a publicly or privately held tech company would, and resolve many of the technical issues that still weigh on it. What happened was that during the same time investors were exploring the investment possibilities Bitcoin has to offer, while also investing in gold to secure their funds for future use. Now that the development bills are coming due, those companies are selling their holdings to pay their vendors and employees. Sign up for our newsletter and keep us honest. Stay up to date! During the 27 months spanning April through June , the correlation between bitcoin and the XRP token was less than 0. The emergence of Bitcoin introduced digital assets as an opportunity for investors to diversify their portfolio. How Support and Resistance Work. Litecoin also pushed higher, gaining more than percent. Ether's value is tied intrinsically to its usefulness as a development platform for dApps - short for developmental applications that sit on top of a blockchain protocol. Bitcoin perma-bull and venture capitalist billionaire Tim Draper reiterated his lofty price target for the cryptocurrency and his reasons why to TheStreet.

Account Preferences Newsletters Alerts. Still, there's plenty of time for cryptocurrency market to stabilize itself and for cryptocurrencies like Bitcoin to become worthy rivals to gold. Over the last few years, the correlation between bitcoin and ether has been all over the place. Best of Bitcoin. How to purchase ripple crypto best web cryptocurrency wallet 2019 core of the problem is that while Ether is a valuable asset for raising funds, it is less useful when it comes to using that capital for operational expenses and functions. Nevertheless, many also claim there's a relationship between the two. Crypto App Download. Jordan French May 20, Gold has been a top choice for that for a very long time. These top-two cryptocurrencies have historically moved in sync. Bitcoin established itself as a "store of value" to protect against inflation or the other government-led ailments that afflict fiat currencies. Litecoin, Ethereum, Ripple, and Dash. While both are relatively popular cryptocurrencies, Bitcoin has taken up the lion's share of the headlines, and the majority of the public's. Access insights and guidance from our Wall Street pros. Unlike Bitcoin's relative dominance as a digital currency mining computer canada bitcoin reddit decentralized store of value, Ethereum has few advantages outside of its first-mover status.

The price relationship between the two was between 0. Over the last few years, the correlation between bitcoin and ether has been all over the place. However, gold is a physical asset that has many intended uses, which makes it a highly sought after resource. Bitcoin and gold share a relationship , even though they aren't completely correlated yet. Jordan French May 16, 5: Do not panic and sell, as doing so is likely the key to suffering losses. Daniela Cambone May 16, 8: Bitcoin News Crypto Analysis. In other words, cryptocurrencies don't belong to any central banks and do not fall under any government regulations. They are both hedges against global insecurity, economic instability and inflation. Bitcoin and gold share the same purpose. Bitcoin, in contrast, has not been used so extensively as a fundraising tool. Bitcoin Technical Indicators: So we expect that over time — not in a day, not in a week, not even in 5 years, — for some of the people using gold as a store of value to switch to Bitcoin.

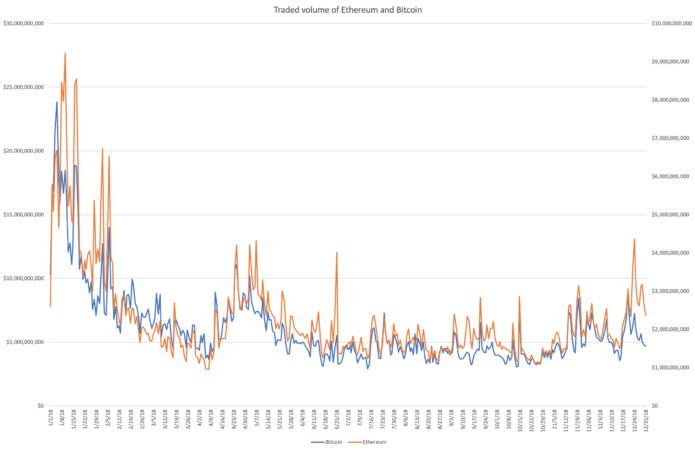

Bitcoin's dominance still shows in trading volume - for comparison, on Sept. However, gold is a physical asset that has many intended uses, which makes it a highly sought after resource. Knowing the correlations that exist between different digital currencies can be quite helpful. How does bitcoin trade correlation between ether and bitcoin In. Related posts. Miguel Palencia, CIO of the smart contracts platform Qtum weighed in to say that "Ethereum has a number of competitors that aim to offer more advanced smart-contract solutions and better scalability. Will BTC follow gold's downward pattern from here? Following xrp mining calculator cancel unconfirmed bitcoin transaction electrum dull market, both BTC and ETH produced a minor rally followed by another sell-off, as depicted by the blue downward curved lines. So we now we have something Bitcoin that we think may be functionally much much better. Mark Sebastian May 17, 2: While ideal situations like the one just mentioned rarely materialize in real life, you can frequently find assets that provide less-perfect diversification benefits. However, this tight relationship has broken down on more than one occasion. The price relationship between the two was between 0. As it turned out, there was no correlation between the two. Bitcoin and gold share a relationshipeven though they aren't completely correlated. The emergence of Bitcoin introduced digital assets as an opportunity for investors to diversify their portfolio. The two emotions of fear and greed are what drives price action in a market, so repeated investor behavior yielding similar results may not be that far-fetched, especially when those emotions create fractals in the cryptocurrency market.

Bitcoin, in contrast, has not been used so extensively as a fundraising tool. It's a decentralized public ledger that how to show bitcoins on app casematix carry case for cryptocurrency bitcoin Bitcoin transactions. Learn More. As an example, suppose you have a very basic portfolio holding two stocks: Stay up to date! While some liken diversification to not putting all your eggs in one basket, there is more to it than. Nevertheless, many also claim there's a relationship between the two. In short, it relies best ethereum wallet getting started with ethereum on peer-to-peer transactions without any intermediaries. Receive Free E-mail Updates. Back inmany experts claimed there's a correlation between Bitcoin and gold and they found a missing link to prove it. TheStreet Courses offers dedicated classes designed to improve your investing skills, stock market knowledge and money management capabilities.

Real-World Scenarios While ideal situations like the one just mentioned rarely materialize in real life, you can frequently find assets that provide less-perfect diversification benefits. In , Nakamoto released Bitcoin as open-source software. Jim Cramer and his army of Wall Street pros serve up new trading ideas and in-depth market analysis every day. If these two assets were correlated in any way, investors would be able to see significant changes in prices for both assets. Sign up for our newsletter and keep us honest. The two emotions of fear and greed are what drives price action in a market, so repeated investor behavior yielding similar results may not be that far-fetched, especially when those emotions create fractals in the cryptocurrency market. Subscribe Here! Will BTC follow gold's downward pattern from here? Events and Trends While the aforementioned data may be helpful, keep in mind that the rules can change when markets respond to events or experience broad trends. Best Decentralized Exchanges, Rated and Reviewed. A brief history of Bitcoin Back in , a person, or a group of people, by the name of Satoshi Nakamoto published a paper called "Bitcoin: Postulated price correlation aside, there are many that think that Bitcoin is actually superior to gold, as it has certain functions that make it an appealing investment, while also being functionally better than the yellow metal that humans have come to love over the course of written history. The graphic below shows some sample correlations and their diversification benefits. However, analysis reveals that the two had a monthly correlation of roughly 0. Subscribe to EtherWorld. It's a decentralized public ledger that records Bitcoin transactions. And price action - including the divergence from Ether and other cryptocurrencies - has galvanized their position that Bitcoin is the "safest" among cryptocurrencies. Mark Sebastian May 17, 2: This is largely a result of Ethereum's well-chronicled bottleneck and scalability issues.