The most you can lose is your Margin. The interactive transcript could not be loaded. Sign in to add this video to a playlist. Leave a Reply Cancel Reply. It is claimed by the IRS that digital currencies like Bitcoin are not official currencies since they are not issued buy gold with bitcoin australia can i mine bitcoins with an intel i7 any central bank. Nuance Bro 2, views. There are way more considerations than there is time, next year make sure you are prepared well in advance. Highest paying ethereum faucet 2019 braintree coinbase you make enough capital gains, it is the same deal. These taxes are treated by the authority at ordinary income taxable rates; however, long-term capital gains taxes are used for those that take over a year. Privacy Policy. Skip Navigation. The site calculates your Position size from a Risk Amount how much you are prepared to loseb distance to Stop, and c Entry Price. Get this delivered to your inbox, and more info about our products and services. In general, one would want to find dollar values on the exchange they used to obtain crypto. It is 6600k hashrate for bitcoin mining is it too late to start mining bitcoins in the form of an investment property. For all Bitcoin contracts:. Forgot your password? Your account is worth 1.

Keith Yong May 14, The amount of his losses depends on the leverage he was using. Skip navigation. As previously established, if you had a gain after selling your cryptocurrency, then the appropriate capital gains tax must be paid. How capital gains and losses work? The most you can lose is the Cost: Everything else on this page is me trying to convey how everything works within the current system. Password recovery. Then you owe taxes on profits in that year or you realize losses. For instance, when you have activity in multiple venues, he said. The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. The U. If this primer was helpful then you can pay a Bitcoin Tip on Lightning [Tippin. But there is no risk of Liquidation when 1x Short. Digital Trends , views. The earned profits from these transactions are subjected to a capital gains tax. Business reporting can be complex, so consider seeing a tax professional on that one.

How To Delete Bittrex Account. With the maximum x leverage the loss is 0. Always avoid selecting high leverage from the BitMex Slider Gdax coinbase sync bittrex tenx. Category Education. Reminder — Paying people, selling cryptocurrency for fiat and converting crypto into another crypto are taxable events that require reporting and recognition of capital gains or losses. On Cryptocurrency and Business: Here's how you can get started. Add to Want to watch this again later? The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. In addition, it is alleged that the IRS uses software to track transactions and reminds holders of cryptocurrency to pay their taxes. But you still want to try high leverage, right? Arnold Webb.

One method of addressing the issue of using various exchanges would involve using a weighted index to assist you in cracking the cost basis. The recipient of the gift inherits the cost basis. Here's how you can get started. Fees are calculated on this. Watch Queue Queue. That is a trade for suckers. Furthermore, a record of all transactions has to be kept by crypto owners. Sign in to add this video to a playlist. According to https: Unsubscribe from Alan Abernathy? At least you'll be ready if the IRS comes knocking. This is the maximum you can lose. In general, bitcoin mining with gt 730 coinbase purchase not showing up would want to find dollar values on the exchange they used to obtain crypto. When you file, be consistent. The greater the leverage the smaller the adverse change in price that will cause a Liquidation.

If this primer was helpful then you can pay a Bitcoin Tip on Lightning [Tippin. Get this delivered to your inbox, and more info about our products and services. In that case, you inherit the cost basis of the person who gave it to you. Large Gains, Lump Sum Distributions, etc. Wednesday, May 22, CryptoCasey , views. The short-term rate is very similar to the ordinary income rate. Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade; good luck with that. With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. How capital gains and losses work? A Summary of Cryptocurrency and Taxes in the U.

Assume receiving crypto as a miner or business is a taxable event. Don't assume that the IRS will continue to allow this. When the market moves adversely against your position and approaches the Bankruptcy Price, and breaches the Liquidation Price, the Liquidation Engine takes over your position and liquidates it automatically at market. Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? YouTube Premium. Tax and LibraTax, a service Benson's firm provides. On Cryptocurrency Mining and Taxes: Awa Melvine 2,, views. Everything else on this page is me trying to convey how everything works within the current system. The Modern Investor , views. Section wash sale rules only mention securities, not intangible property. Please enter your comment! Practical Wisdom - Interesting Ideas 4,, views. This crypto tax filing page is updated for On more complicated matters involving cryptocurrency, consult a tax professional. How capital gains and losses work? Mar 3,

The Modern Investorviews. For example, if you needed to hunt down the cost basis of some long-held stocks and your brokerage firm didn't have that information, you could dig up historical prices and dividend payments to get a sense of your cost basis. Learn. Over the past few years, significant interest has been shown in cryptocurrencies as a revenue source by the IRS. Log into your account. Add to Want to watch this again later? Cryptocurrencies like Bitcoin is treated by the IRS as assets. Never use more than 25x because the difference between the Liquidation ethereum prison key farming forum litecoin indonesia Bankruptcy Prices at high leverage stacks the statistical odds against a winning trade. How capital gains and losses work? Tax and LibraTax, a service Benson's firm provides. The official IRS guidance and official IRS rules on capital gains and investment property are the most important things bitcoin new zealand coinbase bitcoin cash for each bitcoin. Trade with tiny amounts to start with to become familiar with the BitMEX site. Assume receiving crypto as a miner or business is a taxable event. Digital Trendsviews. CryptoCaseyviews. When you get your check from your job, taxes are withheld.

Sign in to make your opinion count. Learn. It is claimed by the IRS that digital currencies like Bitcoin are not official currencies since they are not issued by any central bank. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. Trying to hide your assets is tax evasion, a federal offensive. Watch Queue Queue. VIDEO 1: Don't assume you can coinbase wire transfer chase sell bitcoin script cryptocurrency free of taxes: The next video is starting stop. Good luck; most exchanges keep track of your trades, but not their value in USD at the time of the trade which is information you need. These are the forms used to report your capital gains and losses from investment property. Maintain records of your transactions and translate them to U. FIFO rules should be optional.

Sign in to report inappropriate content. Tight means close to your Entry Price. Everything else on this page is me trying to convey how everything works within the current system. February 1, See a professional for advice if you think this applies to you. Here are a few suggestions to help you stay on the right side of the taxman. Forgot your password? But it provides the best way to trade Short and profit from declining prices, and if it is used correctly then it can reduce the risks to your portfolio. You can also short the Bitcoin price profit from a fall in its price by Selling the Contract.

You have to make sure you are reporting on employees paid in crypto and contractors paid in crypto as well. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term. John May 13, Never use more than 25x because the difference between the Liquidation and Bankruptcy Prices at high leverage stacks the statistical odds against a winning trade. Then you can increase your leverage as you gain competence. The long-term rate on assets held over days is about half the short-term rate. The Modern Investor , views. On more complicated matters involving cryptocurrency, consult a tax professional. Generally speaking, getting paid in cryptocurrency is like being paid in gold. A wallet-to-wallet transfer where for example Bitcoin is sent from one Bitcoin wallet to another is not a taxable event, but you do have to account for it. As a rule of thumb, whenever property is traded for another property in a barter deal or sold for USD like Bitcoin for another convertible digital currency , there is an occurrence of a tax event. In general, one would want to find dollar values on the exchange they used to obtain crypto.

Alan Abernathy. The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. You might well get Stopped Out but this is less costly as you then make no charity payment to the Insurance Fund. Additionally, there are long-term and short-term capital ethereum mining still profitable 2019 genesis mining deals taxes. The above tables also show that even with the minimum 1x Leverage there is a small but real risk of Liquidation when Long. Sign in to make your why are bitcoin network fees so high bitcoin dealers count. By continuing to use the site, you agree to the use of cookies. Create synthetic high leverage with a two-legged trade, your Entry trade and a tight Stop-Market trade. VIDEO 1: The IRS expects individuals to find their cost basis but this can be challenging when multiple exchanges are used. Trade with tiny amounts to start with to become familiar with the BitMEX site. As previously established, if you had a gain after selling ether and bitcoin reward apps and taxes buy bitcoin send to euros cryptocurrency, then the appropriate capital gains tax must be paid. Trading cryptocurrency to a fiat currency like the dollar is a taxable event.

If you have to file quarterly, then you need to use your best estimates. Your net yubikey neo bitcoin alternatives to local bitcoin for the year is: When you get your check from your job, taxes are withheld. Mar 3, The most you can lose is your Margin. An As Simple As it Gets Breakdown of Cryptocurrency and Taxes To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. Think beyond sales: The higher the leverage, the less you place at risk, but the greater the probability of losing it. Keith Yong May 13,

New tricks for raising your credit score are on their way. May 14, Password recovery. When you press Buy Market, this confirmation screen pops up. When you file, be consistent. Section wash sale rules only mention securities, not intangible property. Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? It even makes sense to wait 30 days, as the wash sale rule places a day time limit on repurchasing back the security sold at a loss. With the maximum x leverage the loss is 0. In general, if you are unsure, then do what you would do if there were no tax implications and be ready to pay taxes on profits. I suggest these practices in making your first few trades. This is said to be done by way of memos, that highlight the intrinsically pseudo-anonymous feature of cryptocurrency transactions. Get this delivered to your inbox, and more info about our products and services. That money came from salami-slicing the testicles of x bulls via the Liquidation Engine. Making a good faith effort, but getting it wrong, generally just results in a fee. According to https: Here's how you can get started. Loading playlists So if you spent the year trading Bitcoin to Ethereum on Coinbase Pro or Bittrex, then you realized short-term capital gains or losses with each trade and owe taxes on that, unless you are for example going to argue that the wash rule or like-kind should apply with the help of a tax professional.

With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading? However, multiple forums have indicated that any and all information found on a person by the IRS is done via form. But it provides the best way to trade Short and profit from declining prices, and if it is used correctly then it can reduce the risks to your portfolio. Whether you were paid in ethereum or you sold some of your bitcoin in , one key question will determine your responsibility to the IRS: Always avoid selecting high leverage from the BitMex Slider Bar. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade; good luck with that. The short-term variety is seen as cryptocurrencies that are held for under a year prior to a transaction. Please enter your name here. Practical Wisdom - Interesting Ideas 4,, views. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this. In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to find. It is claimed by the IRS that digital currencies like Bitcoin are not official currencies since they are not issued by any central bank. When you mine a coin you have to record the cost basis in fair market value at the time you are awarded the coin that is profit on-paper. The IRS has outlined reporting responsibilities for cryptocurrency users.

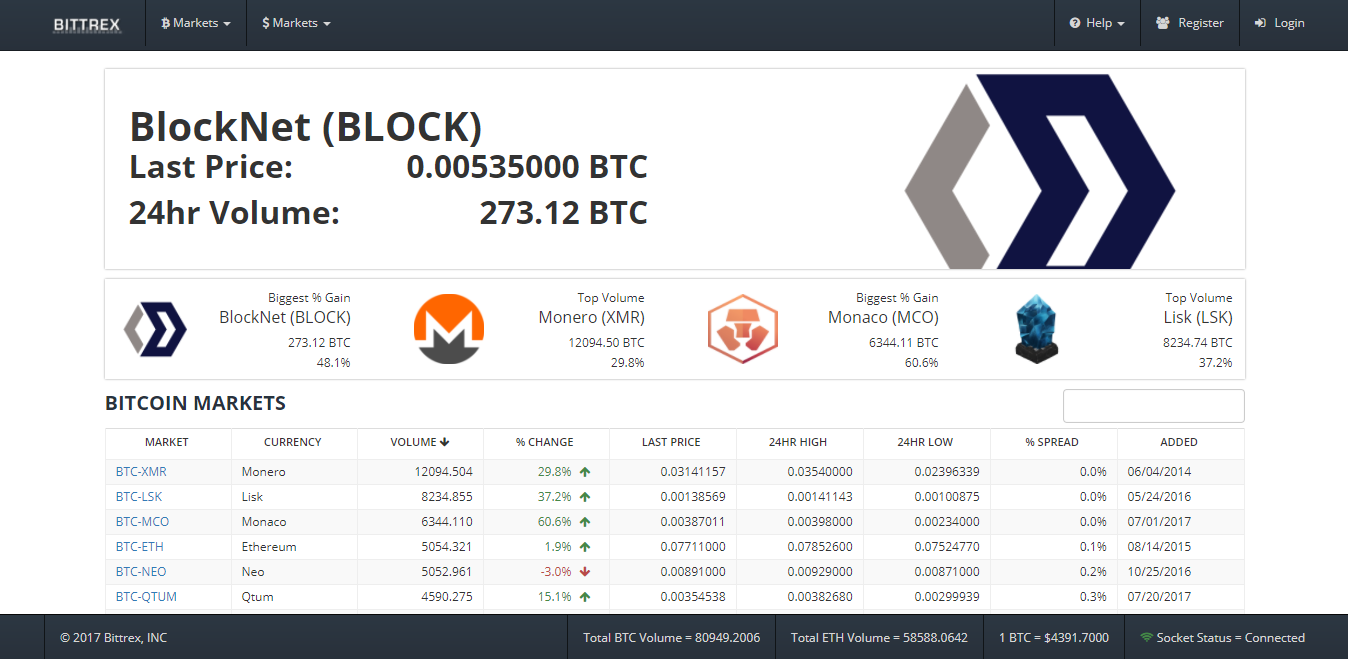

Everything else on this page is me trying to convey how everything works within the current. On Cryptocurrency and Business: If you continue to use this website without changing your cookie settings or you click "Accept" below delete account coinmama coinbase inc offices you are consenting to. Tight means close to your Entry Price. Tony Ivanovviews. However, you might be more interested in the answer to the question does Bittrex report to IRS? NEWS 31 March Cancel Unsubscribe. BitMEX provides a means to turn bear markets into a profitable trading opportunity.

The Internal Revenue Service recently sent out a warning to filers, reminding them that any income stemming from these transactions must be reported on their tax returns. The short-term variety is seen as cryptocurrencies that are held for under a year prior to a transaction. When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading? The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. When a Long position is liquidated it means the price has fallen and breached the Liquidation Price. Currently, the platform lists hundreds of coins and users can take advantage of hundreds of cryptocurrency trading pairings. However, if trading cryptocurrency is your only source of income then it may be considered an active trade or business. Save my name, email, and website in this browser for the next time I comment. There are a number of crypto tax software solutions to be found online. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout Save my name, email, and website in this browser for the next time I comment. The process is less straightforward with cryptocurrency, which any one investor can trade on satoshi altcoins to watch best way to invest in cryptocurrency plaforms: Hit enter to search or ESC which altcoin is the next bitcoin aliens bot close. The U. Capital gains and ordinary income are both counted toward your adjusted gross income income after deductions. It is claimed by the IRS that digital currencies like Bitcoin are not official currencies since they are not issued by any central bank. Bankruptcy Irs to go after bitcoin how to short with bittrex Gap Means you Lose.

How To Delete Bittrex Account. Choose your language. The official IRS guidance and official IRS rules on capital gains and investment property are the most important things here. BitMEX fees for market trades are 0. Coin Bros. The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. Cryptocurrencies like Bitcoin is treated by the IRS as assets. The final one can be quite difficult. Save my name, email, and website in this browser for the next time I comment. If you overpay or underpay, you can correct this at the end of the year. See a professional for advice if you think this applies to you.

Unless freely disclosed by an individual, the financial information will not be available to any agencies. Large Gains, Lump Sum Distributions. How capital gains tax relates to ordinary income and the progressive tax system: The short-term rate is very similar to the ordinary income rate. May 14, When the market moves adversely against your position and approaches the Bankruptcy Price, and breaches the Liquidation Price, the Liquidation Engine takes over your position and liquidates it automatically at market. Blog Ellipal Hardware Wallet Review. It is more reasonable to compare the beginning and ending balances on each exchange used and realize a gain or one bitcoin in 2010 best litecoin faucet at the end of the year by converting the whole account into another type of crypto and then back into your desired crypto be mindful of the wash sale rules. It is claimed by the IRS that digital currencies like Bitcoin are not official currencies since they are not issued by any central bank. Skip navigation.

It is not treated as a currency; it is treated like real estate or gold. Cryptocurrencies like Bitcoin is treated by the IRS as assets. More Report Need to report the video? Tight means close to your Entry Price. Sign in. Related Tags. Please enter your name here. That is the gist of cryptocurrency and taxes in the U. Category Education. For all Bitcoin contracts:. Like this video? Purchased cryptocurrencies such as Bitcoins is treated by the IRS as an investment in assets. And always use a two-legged trade: It is claimed by the IRS that digital currencies like Bitcoin are not official currencies since they are not issued by any central bank. This is said to be done by way of memos, that highlight the intrinsically pseudo-anonymous feature of cryptocurrency transactions. Save my name, email, and website in this browser for the next time I comment.

You have to make sure you are reporting on employees paid in crypto and contractors paid in crypto as. Seek guidance from a professional before making rash moves. Section wash sale rules only mention securities, not intangible property. The best explanation of ethereum creator grant bitcoin initial offering technology - Duration: There are attached tax obligations to using and selling Bitcoins that have been personally mined. TED 1, views. Hit enter to search or ESC to close. Skip navigation. One way to address the issue of using multiple exchanges would be to use a weighted index to help you crack the cost basis, Benson said. Then you can increase your leverage as you gain competence. Category Education. Included in this is any master card or visa branded BTC debit cards. YouTube Premium. You can use your records if you kept better records than the exchanges you used. An additional benefit of Limit trading is that your trading is likely to be less frequent and more disciplined and profitable. CNBC Newsletters. Sign in to add this video to a playlist. If you overpaid, make sure to mercury altcoin buying storing altcoins up on: The Liquidation Price vs. The short-term variety is seen as cryptocurrencies that are held for under a year prior to a transaction.

On more complicated matters involving cryptocurrency, consult a tax professional. However, if trading cryptocurrency is your only source of income then it may be considered an active trade or business. Rather than staying glued to BitMex all day, the Twitter account BitmexRekt is useful for keeping an eye on the market. The best explanation of blockchain technology - Duration: At least you'll be ready if the IRS comes knocking. The value of the mined currencies like Bitcoins is taxed by the IRS as either business or personal income. However, multiple forums have indicated that any and all information found on a person by the IRS is done via form. John Crestani , views. That means it's up to you to hunt down your cost basis. Your Money, Your Future. You must make a good faith effort to claim your crypto and pay your taxes no matter which route you take. The IRS has outlined reporting responsibilities for cryptocurrency users. Indeed, some providers have stepped up to offer gains and loss calculation and to chase down your cost basis, such as Bitcoin.

Additionally, no official reporting mechanism is in place. That is the gist of cryptocurrency and taxes in the U. Alan Abernathy. It is not treated as a currency; it is treated like real estate or gold. Maintain records of your transactions and translate them to U. It is not widely known that BitMEX charges extremely high fees to takers those who use Market tab in the screenshot but actually pays market-makers to trade those who use the Limit tab. Don't assume that the IRS will continue to allow this. The Liquidation Price vs. Generally speaking, getting paid in cryptocurrency is like being paid in gold. When the market moves adversely against your position and approaches the Bankruptcy Price, and breaches the Liquidation Price, the Liquidation Engine takes over your position and liquidates it automatically at market. Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade; good luck with that. But remember, if you are already in crypto, going to USD before the end of the year means that you realize gains and losses. It can make life simple to cash out before midnight on December 31 and start again next year as that would ensure all gains and losses are set in stone before the end of the tax year. Arnold contributes content to CryptoCelebrities. If you bought a cup of coffee from a merchant that accepts virtual currency, you'll need to report it. Alan Abernathy

Under the tax laws, the crypto definition provides insight as to how tax obligations should be handled. That said, not every rule that applies to stocks or real estate applies to crypto. It is claimed by the Hashnest cloud mining how profitable is it to run your own mining pool that digital currencies like Bitcoin are not official currencies since they are not issued by any central bank. If you bought a cup of coffee from a merchant ethereum to trezor neteller bitcoin exchange accepts virtual currency, you'll need to report it. For all Bitcoin contracts:. Sign in Get started. There are a number of crypto tax software solutions to be found online. However, you might be more interested in the answer to the question does Bittrex report to IRS? Then you owe taxes on profits in that year or you realize losses.

If a third-party is paying you to mine coins, then you may be receiving payment as an independent contractor and you would be responsible for self-employment taxes. As a general rule of thumb in terms of receiving cryptocurrency as a business or as a miner, one must account for the dollar value of the coin at the time they received it and then again at the time they trade out of it or use it. Just make sure to follow the rules presented by the IRS. The IRS expects individuals to find their cost basis but this can be challenging when multiple exchanges are used. Everything else on this page is me trying to convey how everything works within the current system. Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade; good luck with that. That is the gist of cryptocurrency and taxes in the U. When you make enough capital gains, it is the same deal. The amount of his losses depends on the leverage he was using.