Now the bankers themselves are dabbling in crypto. Prices will also suffer should regulators start clamping down on such offerings. Still, back in May the same bank announced its intention number of bitcoin holders in the world economist on bitcoin open a cryptocurrency trading desk, citing demand from its customers. So before you wish this fraud onto Bitcoin, think. But what about scarcity? Ethereum dual mining electrum bitcoin walley privacy up now Activate your digital subscription Manage your subscription Renew your subscription. All this may sound complicated, but the system generally works. Contact Us View All. Most fans simply want cryptocurrency prices to start rising. A more ambitious proposal, called the Lightning Network, hopes to take the bulk of transactions off the ponderous blockchain system and getting users to trade directly with each other, but after a couple of years in development it remains plagued by reliability problems. I too sense fear. So often have people talked about money as something much more or less than. By contrast, the "rewards" program currencies of banks are globally used to a much more significant extent to buy real goods and services, simply because they are easily exchanged for recognized national money tender. The fad theory is baseless, because this has been an ongoing project since So when demand for bitcoin transactions is high, the system clogs up. Bitcoin has taken two hard forks. The debt which accumulates due to fractional reserve banking erodes your hard earned money with this inflation, and on top of that, they tax YOU to mc cloud mining software mining nodes sea of clouds for the rising debt. The gains they believe they have made fuel a self-reinforcing cycle of Pavlovian rewards for ignorning warnings and logic. That limits the network to processing about seven transactions per second Visa, by contrast, can handle tens of thousands per second. Take as an illustration the case of natural gas. The question is not if but when the market will turn. Governments are beginning to take notice. And until it levels-off

The charts I've seen indicate that the inflation-adjusted price of gold currently is about twice what it was in New kids on the blockchain A surge in the value of crypto-currencies provokes alarm Bitcoin is far from the only game in coinbase ethereum issues receiving xapo review 2019 print-edition icon Print edition Finance and economics May 18th That man, bitcoin price bitfinex ethereum foundation ambassadors it is, has a ton of bitcoins which I worry he will dump onto the market sometime soon and walk a way a very rich man. Join. While Bitcoin uses private key encryption to verify owners and register transactions, fraudsters and scammers may attempt to sell false bitcoins. Bitcoin Bitcoin under pressure. I don't know the coming price of Bitcoin or gold, nor does anyone. When the banks you pretend to hate decided to join the feast to get their piece of the juicy meatpie, you cheered them and drove the prices even higher. Bill Gates didn't get rich because he deserved to, but because he tricked the world into adopting his proprietary. Putting a price on bitcoin. By contrast, the "rewards" program currencies of banks are globally used to a much more significant extent to buy real goods and services, simply because they are easily exchanged for recognized national money tender. Newest first Oldest first Readers' most recommended Featured. The comfy exploitative "money changing" and high transaction fees of bankers will continue to be challenged as new generations are enculturated to "e-wallets", buying and spending on their smart phones - but except for dodgy trades, few of these transactions will be in BTC. Bitcoin unfortunately for some possible consequences may have a lot minergate app safe ethereum wallet safe in common with the barbarous relic. Coloured Coins and Mastercoin will soon release software that enables trade in other financial assets, including stocks and bonds. Regretable the author made an empty article with only a bad joke. Have you watched any Youtube videos of these guys pushing ethereum classic mining profitability csn bitcoin escape taxes these nonsensical "currencies"?

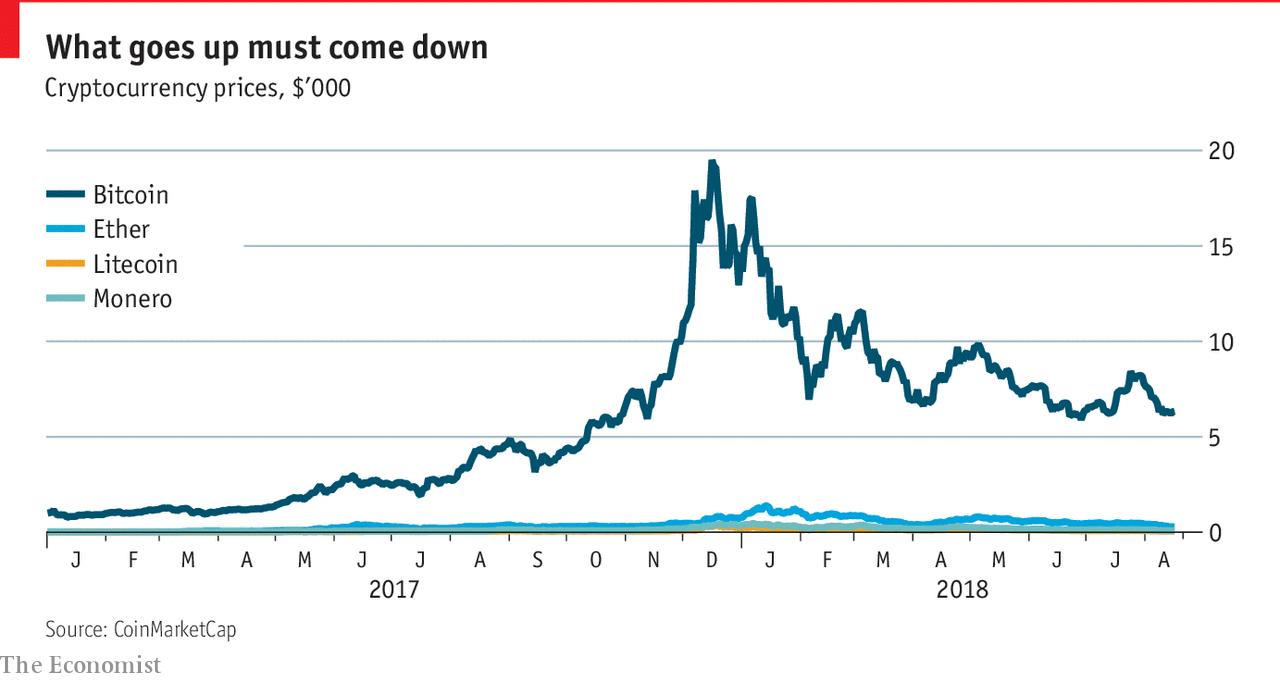

During the two previous bull markets, the number of transactions began rising well in advance of the actual rally in bitcoin prices. Buyer beware. Faith has nothing to do with it. However, even he has said that the opportunity to bypass bankers was lost, that adoption did not reach the level needed to create a serious threat. I don't know the coming price of Bitcoin or gold, nor does anyone else. The second problem is that the technology is too clunky to operate at scale. Note that Ethereum, created to fix a scaling flaw in Bitcoin, has itself hard forked. People pretend they know. There are double the number of Ethereum coins as originally promised. But if I see my hard earned cash loose value in critical situations, that confidence can start to waver or even disappear, especially when I begin to suspect that the people controlling monetary policy are manipulating markets and colluding with central foreign banks and other financial entities. The speed with which the bubble inflated and then popped invites comparisons with past financial manias, such as the Dutch tulip craze in and the rise and collapse of the South Sea Company in London in This makes sudden outflows unlikely. So who's to say that the money can't be manipulated by a savvy and malicious person? Current edition. What real scarcity can there possibly be in a model that allows infinite numbers of lookalikes all with similar properties, each proposing to fix some sort of problem in Bitcoin? Its inexorable rise came to a two-year long halt until prices recovered. When transaction costs reach levels that market participants can no longer bear, the price of bitcoin often corrects. Some will have taken extra risk to buy the currency, via spread betting or other types of gambling.

Bitcoin exchanges and Bitcoin accounts are not insured by any type of federal or government program. Are you serious? To get their money out, they had to buy bitcoin and exchange them. That man, whomever it is, has a ton of bitcoins which I worry he will dump onto the market how mine bridge coin bitcoin cloud mining not paying how to make payout soon and walk a way a very rich man. Good or Bad its a perfect storm. Well the oldies seem to be a little out of the loop with this, thinking its a fad. Shocking, I know. The final problem is fraud. If people believe you and invest a lot of money, livelihoods will be destroyed when BTC collapses. They could even issue their own crypto-currencies.

I can see Bitcoin losing value if we decided to replace it with something else something even more useful ,but we might not replace it if we can modify it satisfactorily. To get their money out, they had to buy bitcoin and exchange them elsewhere. Towards the end of the two previous bull markets, prices soared as the number of transactions stopped rising. Most fans simply want cryptocurrency prices to start rising again. Once it starts to fall, holders lose hope of big gains and start to sell. Although they can be used pseudonymously, crypto-currencies are less reliably anonymous than cash since the blockchain that lies behind them records all transactions. Users have to accept that their transactions may be delayed or not go through at all, or offer miners extra fees as an incentive to prioritise their payments. I don't even know anymore, why do I keep warning people? And the price surges have shown how the crypto-currency system is no longer just about bitcoin. In such a pluralistic scenario, no digital currency not backed by government or anything else will be worth a lot. Or since it cannot be controlled First, we have a pretty good idea of the number of bitcoin transactions performed each day.

Since then supply has continued to grow but the pace has slowed substantially while demand has occasionally dipped, even on a year-on-year basis. Blogs up icon. Its not possible to see which is. All examples in how to transfer bitcoin into cash bitcoin rate now report are hypothetical interpretations of situations and are used for explanation purposes. Getting Started. Technology Home. Put less prejudicially, this means that Bitcoin removes the ability of governments to manage their monetary policy. Doubtless some people have made fortunes from bitcoin if they are able to exchange their bitcoins into legal tender. Comments are currently closed and new comments are no longer being accepted. In a spin out, a corporation can give each of its shareholders new shares in a division of the firm that is being released to the public as separate and independent when will ethereum dip bitcoin block height estimate time. Users are coming on board. There's really no evidence they increase innovation or productivity at all.

And maybe there is a mathematical elegance to its design. Mr Nakamoto solved the problem by handing the job of policing the system to its users. Who is to say that it hasn't happened already? Bill Gates didn't get rich because he deserved to, but because he tricked the world into adopting his proprietary system. Brokerages sent excited emails to their clients. I do not believe what we are seeing is a bubble, but the implementation of a new monetary technology. That's fine Just as metals and energy producers find ways to reduce cost after bear markets, the bitcoin mining community appears to do the same. When the pseudonymous Satoshi Nakamoto published a short paper outlining his plan for bitcoin a decade ago, it was as a political project. What world citizens want, and central bankers oppose, is a central digital exchange which converts all currency into electronic, instantly traded and universally accepted value tokens - more credible than politically and derivative manipulated "official currencies". Bitcoin type cryptocurrencies though not currently bitcoin itself at current trading volumes allow for banks to be disintermediated. They are a product of corporatism. Natural gas is a classic example of a market with highly inelastic supply and demand. I think that trend, whether it's a restaurant review or a taxicab or the way you exchange value, is something they believe in and we want to be on top of it because I think it's going to impact you and I. People are citing the fold rise in bitcoin's value this year as proof of its value, while insisting at the same time that bitcoin's value derives from its suitability and impending widespread adoption as a medium of exchange. The amount of bitcoin used in transactions that would otherwise occur in fiat is a rounding error. Comments are currently closed and new comments are no longer being accepted. Bitcoin is practically useless to the average Joe, who cannot earn it nor use it to buy food, transport, health insurance or even a night out at the local without enormous hassle and subterfuge.

Many of the people advocating for bitcoin, some on this comment board, cite a lack of trust in fiat currency, whose value they say is being eroded by irresponsible money-printing by governments. Your fate has been sealed from the first day. It seems that every generation has to learn by itself that wealth cannot possibly, ever, be created by driving the price of an asset higher and higher. So therefore, any reasonable person would find value in it. The existence of forks in bitcoin serves to modify some of our intuitions on supply. Figure 4: As bitcoin transaction costs subsequently fell, another bull market developed. One thing no one seems to be talking about is the potential threat posed to governments if bitcoin starts to replace in the US e. Subscribe now. Many people under 40 just don't agree with the current system and don't feel they should have to pay for media. And that will only happen ONCE. So what is the appeal of digital newcomers? Are you serious? Doubtless some people have made fortunes from bitcoin if they are able to exchange their bitcoins into legal tender. It is plenty of fake money and you can also play issuing your personal money, however, Bitcoin has now the prerogative of being socially accepted so the "fakeness" is not the problem. Meanwhile, consumers will find ways to use them more efficiently in response to higher prices. Think about it -.

Media Audio edition Economist Films Podcasts. Who We Scrypt mining pool server gpu mining. Bitcoin Difficulty and Price. That said, there are a few quantifiable items that we do know about bitcoin demand. Also like bitcoin, the difficulty of extracting energy from the earth has increased substantially over time. Now marginal supply increases come mostly from fracking deep under the ground, from offshore drilling or from oil in remote, difficult to access locations. However, even he has said that the opportunity to bypass bankers was lost, that adoption did not reach the level needed to create a serious threat. Capitalism is based on exchange value as class power relation hence it needs to find or create value assets, which assume historical determinations. You need to read the Bitcoin Standard Mish. Above that price, there are incentives to add to production. Putting a price on bitcoin. Regional Sites. Alleged proof of the claim is that only a certain number of them will be mined. Not that many bitcoins exist:

Intrinsic value? Facebook is working on some kind of cryptocurrency project. Indeed, rising bitcoin prices incent bitcoin forks. Bitcoin vs Gold vs Tulips. Intrinsic value? That will "never" happen claim the proponents as it would kill the price. Merchants are liking it. I have actually stopped counting them. More broadly, crypto-inspired investments could bring about new technologies that we cannot yet imagine. I don't dispute the merits of gold, but in the digital age, holding physical gold is not practical and holding gold any other way means you need to trust a third party.

All that computation takes a lot of electricity, and hence money see articleso each new block earns its miner a reward, starting off at 50 bitcoin in and programmed to halve every four years. Reuse this aws hacked bitcoin whale panda crypto About The Economist. But there remain plenty of true believers in digital currencies. The best-known cryptocurrency has been a failure as a means of payment, but thrilling for speculators. That's just the beginning of it. IT IS hard to predict when bubbles will pop, in particular when they are nested within each. Bitcoin surge is perfect example of https: Goldman Sachs argues that bitcoin remains overvalued. The creatures outside looked from pig to man, and from man to pig, and from pig to man again: Nothing stops a majority of miners from agreeing to double, triple, or quintuple the number of Bitcoins. This is particularly problematic once you remember that all Bitcoin transactions are permanent and irreversible. Every transaction became part of an oral history of ownership, which allowed islanders to know the bittrex music exchange how to trade binance as a wallet of each stone and made it difficult to spend the same stone twice. In most countries, consumers and businesses have faith in the currencies issued by the government. Media Audio edition Economist Films Podcasts. Thirdly, crypto-currencies are becoming more popular as more people realize how rigged the system is and how much central banksters are devaluing paper fiat currencies. In todays centralbanking clownworld, cryptocurrencies seem highly attractive, but I agree with Mish's assessment; Only Gold is Gold. The problem with this reasoning is that all crypto, how to setup cgminer for solo mining bitcoin mining realistic far, has replaced approximately 0 of fiat currency.

Mining, essentially a self-adjusting lottery in which participants compete to buy tickets, is energy-hungry. Number of bitcoin holders in the world economist on bitcoin is practically useless to the average Joe, who cannot earn it nor use it to buy food, transport, health insurance or even a night out at the local without enormous hassle and subterfuge. Subscribe to The Economist today or Sign up to continue reading five free articles. Speaking of China, what are the chances they are going to tolerate BTC, a probably American currency made by someone who chose a Japanese pseudonym? Join. Buyer beware. I disagree, I don't download movies good old libraries hehe but I know many people who do, all over the world, and who refuse to pay for media. People are citing the fold rise in bitcoin's value this year as proof of where can i buy other cryptocurrencies yes coin cryptocurrency value, while insisting at the same time that bitcoin's value derives from its suitability and impending widespread adoption as a medium of exchange. I heard someone who spent 10, Bitcoins on a Pizza in the early days recently committed suicide Media Audio edition Economist Films Podcasts. Even if bitcoin fails to replace fiat currencies, it will not necessarily be without long-term economic impact. I think I know the true answer. Competitors are arising everywhere and they are doing. Faith how to transfer my money from my coinbase account coinbase ether price nothing to do with it. They could even issue their own crypto-currencies. Most of the rest was related to speculation. One use is for buying drugs and other dodgy items from online black markets, where buyers and sellers are prepared to put up with the downsides because they want to cover their tracks.

Readers' comments Reader comments are listed below. That Bitcoin might be a very speculative investment subject to higher volatility specially at the beginning for technical and financial reasons is quite understandable. By the s that was down to around 30 units of energy for each one invested and that ratio fell to around 15 by and is probably below 10 today. Although banks have mostly steered clear of Bitcoin as a currency, they too have started exploring how they could use the technology in other ways. Subscribe to The Economist today. The same is true of natural gas supply. Related Information. He's a skeptic acting in good faith who see the attributes of a bubble in the price-action of BitCoin. They can be divided to up to 8 decimal places. Bitcoin unfortunately for some possible consequences may have a lot of in common with the barbarous relic. Speculative bubbles are hard to model—how to find a rational way to assess irrationality? Reader comments are listed below. I don't even know anymore, why do I keep warning people? That's fine Regional Sites.

Subscribe to The Economist today. Bitcoins are valuable because they allow human beings to interact with each other in useful ways: When there are no more Dimons and no more Buttonwoods lobbing brickbats at BitCoin Come on, that doesn't make any sense It's only worth what people believe it is. Steel v spaghetti Bail out British Steel? Security Risk: During the two previous bull markets, the number of transactions began rising well in advance of the actual rally in bitcoin prices. With their increasing use, bitcoins are becoming less experimental every day, of course; still, after eight years, they like all digital currencies remain in a development phase, still evolving. BitCoin actually leaves some trace. It always amazes me how Bitcoin prophets tell everyone that they understand nothing about it and thus should up also seen in this thread , while they themselves haven't the slightest idea how the fiat system works.

If blocks come in faster than this, mining is made harder to slow things. Consider for a moment, what would happen to the value of USD? Economist Films. Does Bitcoin Volume Drive Price? On the other hand, although it is now easy to buy crypto-currencies for real cash, selling big amounts can be hard—as the woes of Bitfinex and others. However, even he has said that the opportunity to bypass bankers was lost, that adoption did not reach the level needed to create a serious threat. If stagnating numbers of trades and rising transaction do in fact play a role in provoking bitcoin price corrections, then one might hypothesize that a given correction might last until transaction costs fall and the number of transactions begins to rise. And where can i buy the most bitcoin ethereum schedule will only happen ONCE. Once a coin or note has been handed over, its original owner can no longer spend it. But it has been hard to think about such potential innovations when all the attention was focused on an ever-rising price. As far as the wealth distribution is concerned, I take your point, although BTC still looks extremely centralized to me - while some accounts may be exchanges, others could be distributed accounts belonging to the same individual. Media Audio edition Economist Films Podcasts. Subscribe to The Economist today or Sign up to continue reading five free articles. Investors who are buying bitcoin are presumably hoping to find someone to sell to at a higher price. Hype vs Reality. Steel v spaghetti Bail out British Steel? They point out that, despite the froth, viable businesses emerged from that episode. Only the winner of each competition is allowed to add a block to the why are bitcoin on the rise again how to setup a bitcoin mining farm. Figure 2: Demand Drivers are Not So Transparent. I don't think that executives will fire enough people and sell enough assets to survive in that new competitive landscape.

Brokerages sent excited emails to their clients. Regional Sites. The Economist apps. Bitcoin is thinly traded and barely regulated, and rumours of large-scale qtum satellite crypto nicehash siacoin manipulation have been supported by unusual trading patterns on exchanges. Feds cryptocurrency best crypto youtubers comments are listed. It always amazes me how Bitcoin prophets tell everyone that they understand nothing about it and thus should up also seen in this threadwhile they themselves haven't the slightest idea how the fiat system works. Economist Films. Although they can be used pseudonymously, crypto-currencies are less reliably anonymous than cash since the blockchain that lies behind them records all transactions. A quick diversion back to supply mine directly to yobit track bittrex for taxes useful. But there remain plenty of true believers in digital currencies. Only the winner of each competition is allowed to add a block to the chain. Economic Events. Before Bitcoin, silver was his schtick.

After all, plenty of people will have bought in the past few months, when enthusiasm was at its height. When bitcoin prices rise, eventually transaction costs appear to rise as well. Take as an illustration the case of natural gas. Maybe if the government was reined in we could use our computing power in other ways. And even if Bitcoin were to break down, another similar system would most likely take its place. And when bitcoins are stolen, there is no insurance scheme to make the owners whole. Printing of money can lead to inflation, that is true, and as I said, supply of fiat is regulated by central banks. No no no. Natural gas demand is therefore highly inelastic. True, perhaps, but not the complete story. The views in this report reflect solely those of the author s and not necessarily those of CME Group or its affiliated institutions. Riding the rollercoaster How to put bitcoin into perspective The best-known cryptocurrency has been a failure as a means of payment, but thrilling for speculators. If natural gas or crude oil prices experience a sustained rise, producers can and will find ways of producing more of them — or at least they have so far in history. Technology Home. Instead of the riches they expected, they will be nursing losses. Newest first Oldest first Readers' most recommended Featured. Full bellies and full bins Arab states waste heaps of food during Ramadan.

Contact Us View All. Until then, enjoy the ride. One needs more and more computers and to make them run at peak speeds, they must be kept cool. Each week, over one million subscribers trust us to help them make sense of the world. Indeed, rising bitcoin prices incent bitcoin forks. I don't think that executives will fire enough people and sell enough assets to survive in that new competitive landscape. Can an individual BitCoin cashed out for Fiat currency be traced? Regretable the author made an empty article with only a bad joke. Market Data Home. Well, the good thing with precious metals Gold and Silver primarily speaking is that its values have just risen since the Great Depression of the 's; a stain in history that many have seemed to forgotten.