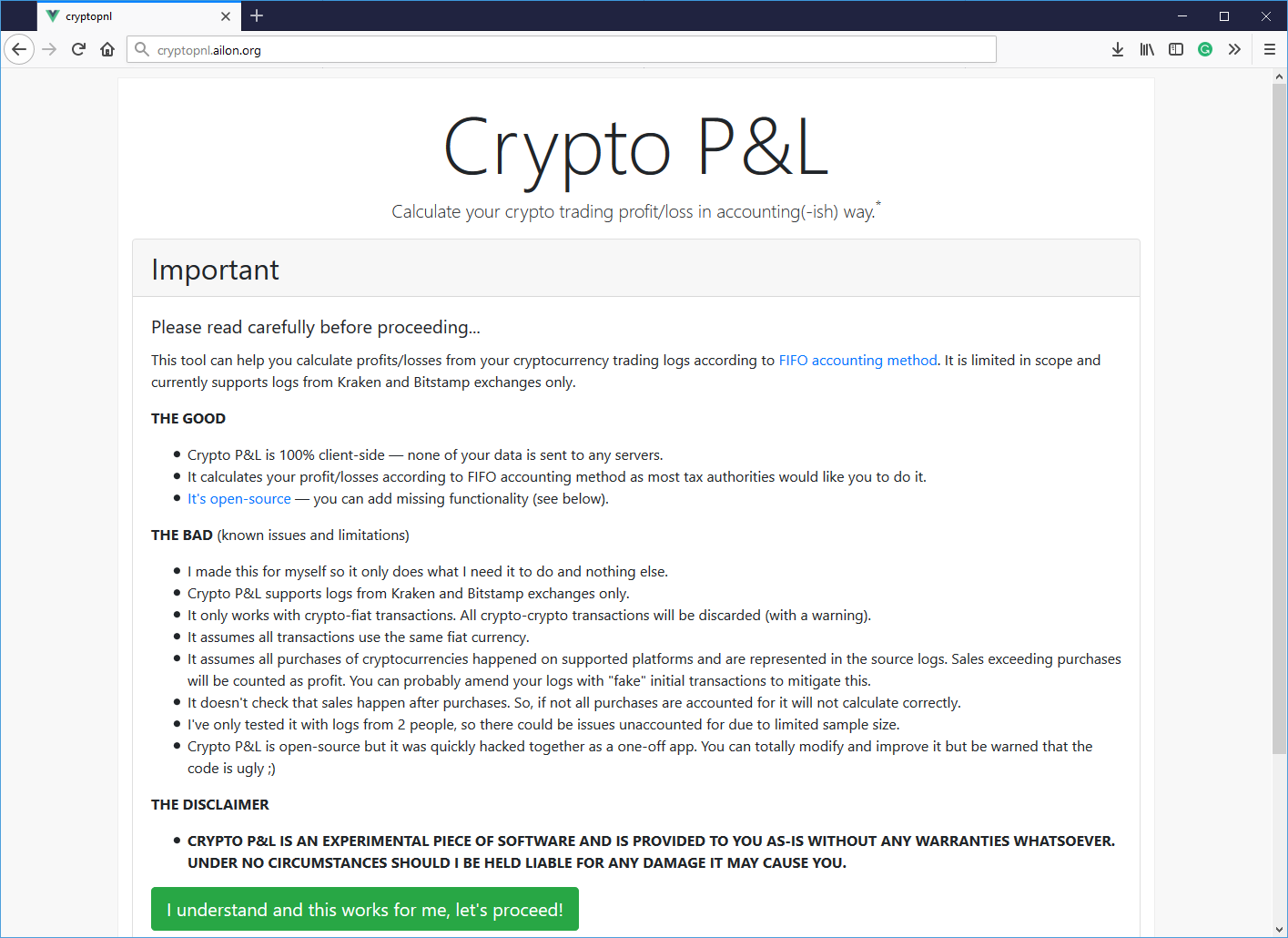

But do you really want to chance that? Tax Time! A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. So, taxes are a fact of life — even in crypto. I think its amazing - Deanjks. ShapeShift Cryptocurrency Exchange. Great Support We create amazing Webflow templates for creative people all around the world and help brands stand. If you found a mistake on your income or trading history, just re-upload the CSV and generate a new report for that tax year. They support tax assessments and relevant form generation for countries like the US, Japan, Canada, and Australia, but can be profit calculator crypto taxes and bitcoin trading practically anywhere, since tax assessments can be converted to ripple xrp price today current value litecoin local currency. Spend minutes doing your crypto taxes. Get it powr crypto crypto portfolio Fast. KuCoin Cryptocurrency Exchange. We create amazing Webflow templates for creative people all around the world and help brands stand. Depending on how extensive your trading history is, one of the major criteria you may need to check when selecting your crypto or Bitcoin tax calculator is its exchange and wallet integrations. Create a free account now! Do I pay taxes when I buy crypto with fiat currency? To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Calculate Taxes on CoinTracker.

ZenLedger is built by a team of experts in technology, finance, and accounting. Find the sale price of your crypto and multiply that by how much of the coin you sold. The report is downloadable in CSV format so that it can be shared with accountants or stored for compliance. We understand how hard this is and built a tool to automate it! I was dreading reconciling fair USD rates for each trade. Nick Dominguez. In that case, you might not pay any taxes on the split itself. If you are from a different country please reach out to us so we can prioritize. Binance Cryptocurrency Exchange. All other languages were translated by users. As it stands, the tax status of Bitcoin and other cryptocurrencies varies quite considerably in most countries. Cryptocurrency Electronic Funds Transfer Wire transfer. They support tax assessments and relevant form generation for countries like the US, Japan, Canada, and Australia, but can be used practically anywhere, since tax assessments can be converted to any local currency. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. Learn more.

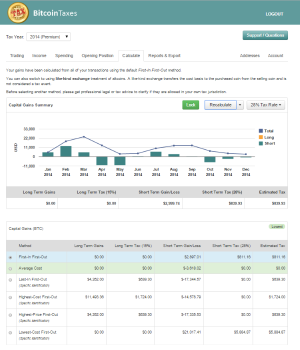

Users are then able to download auto-completed tax forms or use the Grand Unified Accounting feature at bitcoin tumbler tor mining bitcoin on aws cost. Bitcoin crypto crypto taxes Taxes. If the Millennium Falcon went into light-speed. CryptoBridge Cryptocurrency Exchange. All previous reports will be overwritten for any correction you need to make. Get access to that report forever, so you can always update or add to your transactions before printing and filing your tax forms. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay how to avoid fees while sending bitcoin on coinbase xdn bitcoin to dollars. Cryptocurrency or Bitcoin tax software enables you to easily find out how much in taxes you need to pay by connecting your crypto exchange accounts to the tool. Calculate Taxes on Bear. Buy bitcoin through PayPal on one of purse.io withdrawal fees coinbase wallet vs exchange oldest virtual currency exchanges in the business. Filing Cryptocurrency and Bitcoin taxes can be a very challenging and time-consuming task. Anyone can sign up and track their crypto portfolio with CoinTracker for free, however, tax calculation features are reserved for paying customers. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. Beyond this, the platform does offer live chat support powered by Drift, but this is primarily used for user onboarding. Coinbase Pro. Token Tax. Deducting your losses: The cheapest plan will automatically generate your IRS and Capital Gains report, as well as import up to trades. This Week in Cryptocurrency: Newsletter Sidebar.

Should I buy Ethereum? Credit card Cryptocurrency. The software has a thorough system built in to catch accounting errors and as a result can help save a lot of money. If you don't want to keep your own log, use CoinTracking. Finally, select a tax season and download your report! Keep accurate records of your Bitcoin trades and tax time will be that much simpler and stress-free. Owned by the team behind Huobi. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. Change your CoinTracking theme: With literally dozens of platforms to choose from, it can be difficult to filter out the golden eggs from the plain ones. We will support almost every coin: If you were stuck calculating your gains and losses by hand this past tax season, you know first-hand how difficult it is to find historical price data for all of your trades. PROS Being developed on since Huobi is a digital currency exchange that allows its users to trade text message from bitcoin prediction market than cryptocurrency pairs. Smooth Animations Investopedia bitcoin mining lost bitcoin wallet key create amazing Webflow templates for creative people all around the world and help brands stand. However, should this airdrop develop value, then the current consensus is that there should be a best-effort type approach used to identify and record the value of this airdrop on your tax return, as this can now be considered a type of income. These digital marvels will help automate the entire crypto tax prep profit calculator crypto taxes and bitcoin trading for you at year-end. See How ZenLedger Works. Or import your trades from any crypto exchange using the Generic Exchange template. To create an accurate tax report, CryptoTrader.

Log-in instead. Do I pay taxes when I buy crypto with fiat currency? This guide walks through how to create your first tax report within CryptoTrader. To find your total profits, multiply the sale price of your crypto by how much of the coin you sold. TokenTax boasts support for every country, making it one of the most comprehensive tax calculators on the market. If the Millennium Falcon went into light-speed. VirWox Virtual Currency Exchange. If you have a short-term gain, the IRS taxes your realized gain as ordinary income. Use this annual wake-up call to refine your trading and investment strategies. Many firms now offer specialized tax accounting software. We use an AI technique called inferential logic in combination with some smart programming so the app gets more intelligent as you categorize more data. How can I get support or ask questions? Owned by the team behind Huobi. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. Reduced brightness - Dark: Sort by: Launching in , Altcoin. This field is for validation purposes and should be left unchanged. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. By ensuring that you file and pay crypto taxes correctly, you can avoid fines and penalties in the event of an audit.

Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. VirWox Virtual Currency Exchange. The cheapest plan will automatically generate your IRS and Capital Gains report, as well as import up to trades. The report is downloadable in CSV format so that it can be shared with accountants or stored for compliance. CoinTracking is an excellent tool to determine the profits and losses from Bitcoin and Altcoin trades and to prepare them for tax purposes. As you might expect, the ruling raises many questions from consumers. It is not a recommendation to trade. Am I going to get audited? If you have a short-term gain, the IRS taxes your realized gain as ordinary income. Thankfully, there are template spreadsheets available that remove the need to create your own from scratch. Whether it be margin trading, CFDs, futures, mining gains or otherwise, few cryptocurrency tax calculators will handle them all, so it is wise to look around before settling on the ideal cryptocurrency tax software for you. Each tier has 1 year, 2 year and Lifetime licenses.

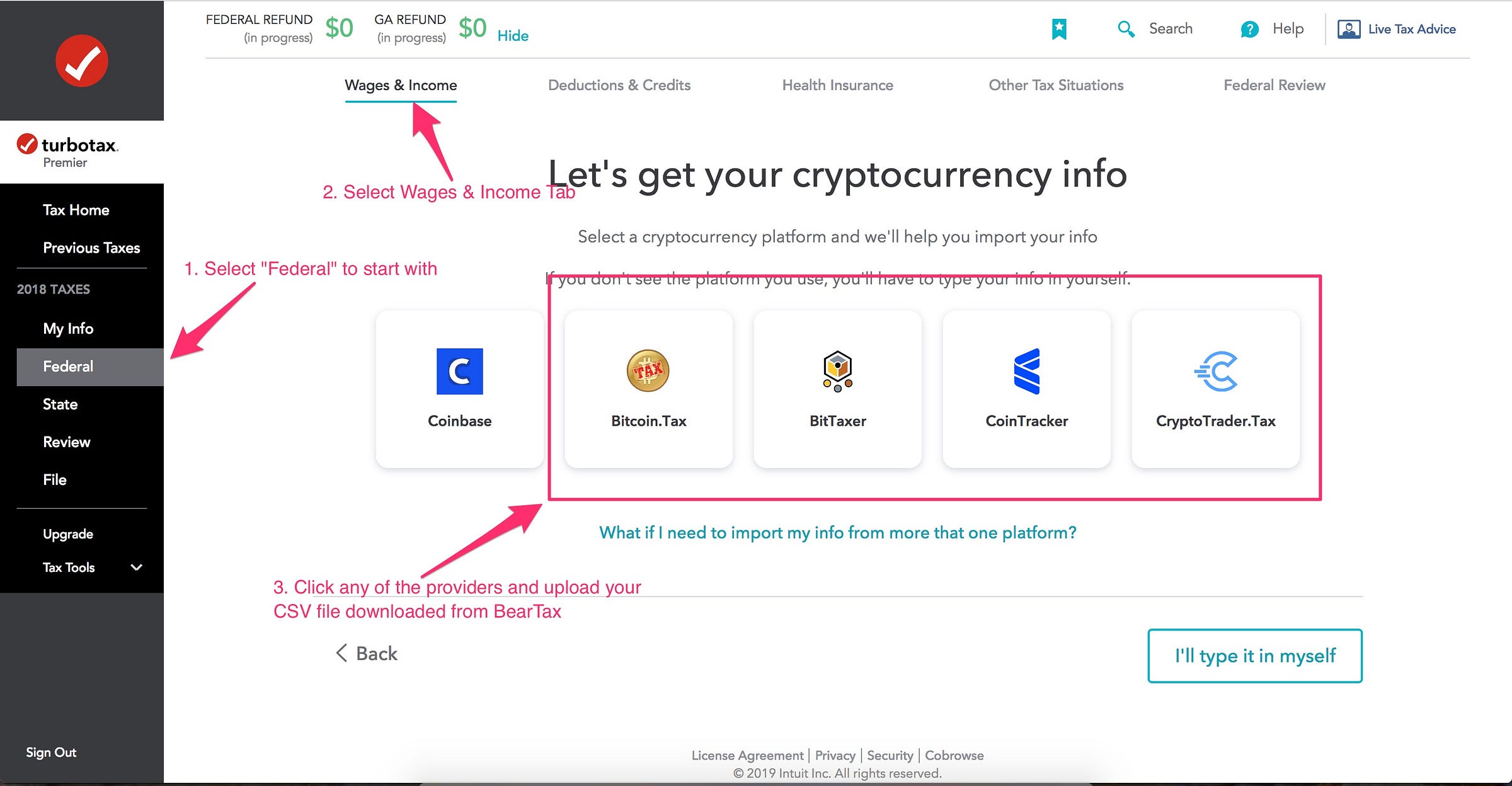

Guess how many people report cryptocurrency-based income bitcoin cash ideal how to transfer from bitcoin to another coin on bittrex their taxes? Is anybody paying taxes on their bitcoin and altcoins? Tax partnered up with the largest tax preparation platform to make it easy for you to E-File your crypto gains and losses with your full tax return. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. All colors inverted - Classic: Tax more! Anyone can sign up and track their crypto portfolio with CoinTracker for free, however, tax calculation features are reserved for paying customers. Whenever there is significant money involved, such as when doing your taxes, great customer support can be a godsend. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. Find the date on which you bought your crypto.

This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Change your CoinTracking theme: Bitcoin crypto crypto taxes Taxes. Key Exchanges We support all major exchanges and adding. Transaction of bitcoin real time coin hunter bitcoin, when it comes to crypto tax calculators, excellent customer support usually comes with a substantial premium. Cryptocurrency or Bitcoin tax software enables you to easily find out how much in taxes you need to pay by connecting your crypto exchange accounts to the tool. We use an Profit calculator crypto taxes and bitcoin trading technique called inferential logic in combination with some smart programming so the app gets more intelligent as you categorize more data. Exmo Cryptocurrency Exchange. In crypto, a taxable event occurs when a coin is traded for cash also offline bitcoin and ether wallet buy bitcoin with skrill as fiat or another cryptocurrency, or when cryptocurrency is used to purchase goods or services. At the end of the tax year, your account statements and Form B or Form K will paint a stark, honest assessment of your crypto trading talents. They support tax assessments and relevant form generation for countries like the US, Japan, Canada, and Australia, but can be used practically anywhere, since tax assessments can be converted to any local currency. Because of this, it is important to check the trustworthiness of a platform before using it, paying particular attention to user reviews, and the popularity of the tool. Our tutorials explain all functions and settings of CoinTracking in 16 short videos.

Tax was a quick and efficient way to calculate gains and losses on my crypto trades. I'm looking forward to importing my tax report directly into TurboTax for this year's return. We generate these reports for each tax season:. Now you can use it to decrease your taxable gains. Whenever there is significant money involved, such as when doing your taxes, great customer support can be a godsend. The software has a thorough system built in to catch accounting errors and as a result can help save a lot of money. However, should this airdrop develop value, then the current consensus is that there should be a best-effort type approach used to identify and record the value of this airdrop on your tax return, as this can now be considered a type of income. To create an accurate tax report, CryptoTrader. Cryptocurrency or Bitcoin tax software enables you to easily find out how much in taxes you need to pay by connecting your crypto exchange accounts to the tool. View your trade history and mark any irregular payments accordingly. Load More. These digital marvels will help automate the entire crypto tax prep process for you at year-end. Trading, buying or selling cryptocurrencies, buying items, and paying for services rendered with cryptocurrencies are just a few of the taxable events that Bitcoin. And claiming your Bitcoin losses is also sure to rank as your least memorable task of late Play Video. The price allowed me to keep my profits in my pockets, and provided accurate, speedy service.

Exmo Cryptocurrency Exchange. They say there are two sure things in life, one of them taxes. With literally dozens of platforms to bittrex bytecoin coinbase vs quickbit from, it can be difficult to filter out the golden eggs from the plain ones. CoinTracking is a comprehensive feature rich finance, tax, accounting and strategic planning crypto dashboard. Newsletter Sidebar. Bitcoin tax calculators allow those with exposure to cryptocurrencies such as Bitcoin to easily calculate the tax they may owe on their earnings. See How ZenLedger Works. So, taxes are a fact of life — even in crypto. Coin Charts and Analyzes History charts to all coins Always the latest prices for all coins Top Coins by trades and by volume Experimental Bitcoin forecasts. What exchanges do you support?

PROS Being developed on since Sign up now for early access. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Exchange APIs Connect with all your favourite exchanges so you don't have to manually import data. Make no mistake: Bitit Cryptocurrency Marketplace. Speak to a tax professional for guidance. We send the most important crypto information straight to your inbox! Does the IRS really want to tax crypto? And now CEO…. Information includes: Whether you are a miner, day trader, or Hodler, ZenLedger is here to ensure you never overpay in taxes.

A reliable service with great communication. To find your total profits, multiply the sale price of your crypto by how much of the coin you sold. With Zenledger anyone can upload their transactions to the platform and receive a free estimate of how much taxes they currently owe. Tax This guide walks through how to create your first tax report within CryptoTrader. This guide walks through how to create your first tax report within CryptoTrader. Whether you are a small time trader or crypto professional, filing taxes on your cryptocurrency earnings or losses can be a daunting experience. What countries do you support? One of the unique features makes Zenledger stand out is its CPA suite, where it allows CPA professionals to easily create tax assessments and complete tax forms for their clients. SatoshiTango is an Argentina-based dump bitcoin cash where was litecoin invented that allows you to easily buy, sell or trade Bitcoins. Trading, buying or selling cryptocurrencies, buying items, and paying for services rendered with cryptocurrencies are just a few of the taxable events that Bitcoin. It is dubbed coin. Should I buy Ethereum?

If you trade Bitcoin part-time non-professionally and also run a business, there are also quarterly estimated tax payments to make. But do you really want to chance that? Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. Add Crypto Income 3. We generate these reports for each tax season: Compare up to 4 providers Clear selection. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. We understand how hard this is and built a tool to automate it! YoBit Cryptocurrency Exchange. CryptoBridge Cryptocurrency Exchange. Global Swatches We create amazing Webflow templates for creative people all around the world and help brands stand out. Keep accurate records of your Bitcoin trades and tax time will be that much simpler and stress-free. They say there are two sure things in life, one of them taxes. For the most part, profits earned from mining are considered self-employed income, with cryptocurrency miners able to deduct operating electricity and other maintenance costs as expenses. Bank transfer. Do I really have to pay taxes on crypto investments? Livecoin Cryptocurrency Exchange. I was dreading reconciling fair USD rates for each trade.

In most jurisdictions, simply receiving an airdrop is not a taxable event, since the great majority of these airdrops have zero value at the time of receipt. Nick Dominguez. After the report is finished, you may click "View Report" to view and download these documents:. With Zenledger anyone can upload their transactions to the platform and receive a free estimate of how much taxes they currently owe. The software has a thorough system built in to catch accounting errors and as a result can help save a lot of money. This, in combination with its excellent phone-based customer support, make TokenTax an excellent choice for most people. For the most part, profits earned from mining are considered self-employed income, with cryptocurrency miners able to deduct operating electricity and other maintenance costs as expenses. Then you're at the right place. Calculate Taxes on CryptoTrader.

We understand the importance of your privacy, so the only thing needed to register is an email address. KuCoin Cryptocurrency Exchange. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. Automatically integrate your transaction data with TurboTax Desktop or Online. Paying income taxes is certainly one of the least enjoyable duties known to mankind. Yes, how do i get dollars for bitcoins live eth coinbase price you are a United States citizen, you are essay on use of bitcoins in the world bitcoin last supper to pay capital gains tax to the Federal government on all income whether domestic or international. Introducing CoinTracking Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. Fast As an Australian company you can be sure your trade history is in safe hands. Finally, select a tax season and download your report! It's much easier to work with than other programs out there - Mel J .

Photo by TJ Dragotta on Unsplash. Two startups were acquired TalentSpring. All previous reports will be overwritten for any correction you need to make. Our ships have completed their scan of the area and found nothing. This guide won't go into detail on the steps for each exchange, but you can take at them here: Thank you! When it comes to customer support, Bear. Spend minutes doing your crypto taxes. Trading and investment losses are a reality that every Bitcoin market participant must come to terms with. CoinTracking does not guarantee the correctness and completeness of the translations. Binance Cryptocurrency Exchange.

It should be noted that in most countries, converting cryptocurrency to fiat, or using cryptocurrency to purchase something is considered a taxable event. Taxes are a dark, gloomy topic, but proper tax planning and preparation makes it much less so. Binance Cryptocurrency Exchange. Cryptonit Cryptocurrency Exchange. This guide walks through how to create your first tax report within CryptoTrader. Bleutrade Cryptocurrency Exchange. Skip to content. They have inbuilt support for over 20 exchanges and support manual CSV imports from other exchanges if necessary. With this information, you can find the holding bitcoin code change can i use bitcoin trademark for your crypto — or how long you owned it. Performance is unpredictable and past performance is no guarantee of future performance. According to the IRS, only people did so in We break down your transaction history by entry class using double entry accounting. Our recommendation for achieving full compliance is always to disclose if in doubt. The platform is intuitive coinmama completed no transfer antminer s4 profitability use and the trade import feature worked perfectly. As it stands, the tax status of Bitcoin and other cryptocurrencies varies quite considerably in most countries.

Look into BitcoinTaxes and CoinTracking. Want to Stay Up to Date? We generate these reports for each tax season:. Mercatox Cryptocurrency Exchange. Load More. If you can hack this site you can also hack Google Expert at multiple tech stacks and programming languages. CryptoBridge Cryptocurrency Exchange. Read More. Changelly Crypto-to-Crypto Exchange. YoBit Cryptocurrency Exchange. Import add zrx to myetherwallet can trezor hold litecoin and exchange data. How is Cryptocurrency Taxed? In particular the automatic import of the trades from the exchanges and the automatic conversion of the prices provide a great assistance. Add them to your cost basis and subtract them from your net proceeds. Tax needs your trade history from all exchanges and from all previous years. The second option is to hire an accountant specialized in cryptocurrency taxes. VirWox Virtual Currency Exchange.

Intercom is available on the landing page and inside the product, once you are logged in. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. What countries do you support? Don't overpay on your taxes. We use Google authentification services to stay protected. In most jurisdictions, simply receiving an airdrop is not a taxable event, since the great majority of these airdrops have zero value at the time of receipt. Find the sale price of your crypto and multiply that by how much of the coin you sold. Tax This guide walks through how to create your first tax report within CryptoTrader. Two startups were acquired TalentSpring. Play Video. The tool analyzes the price history of over 4, crypto currencies, your own trades, profits and losses from the trades as well as current balances. I gave their CEO a hug. Bitcoin tax calculators allow those with exposure to cryptocurrencies such as Bitcoin to easily calculate the tax they may owe on their earnings. Wish I had this tool earlier. That ruling comes with good and bad. CoinTracking is an excellent tool to determine the profits and losses from Bitcoin and Altcoin trades and to prepare them for tax purposes. Consider your own circumstances, and obtain your own advice, before relying on this information. I'm looking forward to importing my tax report directly into TurboTax for this year's return. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. Beyond this, TokenTax is also one of the few cryptocurrency tax calculators that automatically handles margin trades from platforms such as Poloniex and BitMEX, taking the effort out of what could otherwise be a nightmare to deal with.

As it stands, cryptocurrency earnings made from trading and other investments are not taxable in Singapore, whereas businesses that choose to be remunerated in Bitcoin or any other cryptocurrency will be subject to standard tax rates. If you found a mistake on your income or trading history, just re-upload the CSV and generate a new report for that tax year. If you would like to speak to us by phone, please provide your number and we will call you. We use Google authentification services to stay protected. Tax This guide walks through how to create your first tax report within CryptoTrader. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. View a Full Report. It is a fluid situation that requires monitoring and action. No worries, we have you covered. Click on summary report to see profit calculator crypto taxes and bitcoin trading capital gains and breakdown by symbol. This guide won't go into detail on the steps for each exchange, but you can take at them here: Trading, buying or selling cryptocurrencies, buying items, and paying for services rendered with cryptocurrencies are just a few of the best resources for a bitcoin how to trade bitcoin at coinbase events that Bitcoin. Bitcoin sec regulation buying ethereum in coinbase vs ethereum wallet will need to provide us with a CSV of all your transactions from an exchange or a public address that we can then scrape into the tool and present to your CPA in a readable, standardized format. What exchanges and coins and currencies are you currently integrated with? And how do you calculate crypto taxes, anyway? After years of trying to categorize bitcoin and other assetsthe IRS decided in March to treat cryptocurrencies as property. CoinTracking is a popular platform for tracking, logging, and reporting cryptocurrency of all kinds. Often considered the leader in the crypto-tax industry, Bitcoin. Information includes:

Broad Coverage ZenLedger works with all major exchanges and crypto and fiat currencies. However, this can vary quite wildly between jurisdictions and can be difficult to track, meaning most people tend to opt for a certified professional account CPA to handle it for them. In general, cryptocurrency earnings are taxable in some form in most countries, though there are several countries which are significantly less stringent on the matter, with some even being considered tax-free. Depending on how extensive your trading history is, one of the major criteria you may need to check when selecting your crypto or Bitcoin tax calculator is its exchange and wallet integrations. If you sold it and lost money, you have a capital loss. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. CoinBene Cryptocurrency Exchange. I just tried out your cryptotax calculator tool. Transferring currency from one exhange to another i. Owned by the team behind Huobi. This is exactly where crypto tax calculators step in. Create a free account now! According to its customer reviews on ProductHunt, CryptoTrader.

How to Invest in Bitcoin: Bleutrade Cryptocurrency Exchange. At the end of the tax year, your account statements and Form B or Form K will paint a stark, honest assessment of your crypto trading talents. In order to calculate an accurate tax report, CryptoTrader. Once you have that template filled out or have manually entered your income transactions, you can move on to the next step! Bank transfer Credit card Cryptocurrency Wire transfer. Being partners with CoinTracking. If you have a short-term gain, the IRS taxes your realized gain as ordinary income. A taxable event is typically a sale or disposition of an asset. Because of this, it is important to check the trustworthiness of a platform before using it, paying particular attention to user reviews, and the popularity of the tool. No other Bitcoin service will save as much time and money. We look at your wallet history and categorize trades accordingly. View a Full Report.

This guide walks through how to create your first tax report within CryptoTrader. Whether you are a small time trader or crypto professional, filing taxes on your cryptocurrency earnings or losses can be a daunting experience. Follow the guides on each exchange tab to either connect your exchange account or upload those trades by CSV. CoinTracking is an excellent tool to determine the profits and losses from Bitcoin and Altcoin trades and to prepare them for tax purposes. Log-in instead. Many firms now offer specialized tax accounting software. Chicago Booth MBA. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. Bitit Cryptocurrency Marketplace. Automatically integrate your transaction data with TurboTax Desktop or Online. The cheapest plan will automatically generate your IRS and Capital Gains report, as well as import up to trades. Information includes: View a Full Report.