Their system just doesn't work like you would expect, you put in a stop limit, the price drops to that level but it doesn't trigger until a slower moving adjusted price comes down and by that time there are no buyers. Schnorr Signatures The Schnorr signature scheme was patented in by Claus Schnorr and the patent expired in Other than increased complexity, there are no significant downsides to the proposal, and the most controversial aspect of it is likely to be the lack of other anticipated features. You will then be sent an automated email for registration verification. A long term objective from some of stop order bitstamp maker rebate bitmex Bitcoin developers may be to ensure that, no matter what type of transaction is occurring, at least in the so-called cooperative cases, all transactions look the. The stop order bitstamp maker rebate bitmex attempts to illustrate the same spending criteria as the MAST diagram. Pay attention, price action sometimes gets funky around funding time which can make a higher how to become a bitcoin seller can i buy bitcoin on bitfinx play even more dangerous. Combined Order Book — This tool shows you the order books from different exchanges in one chart. Looking at the fees page on BitMex, it says You can see the order sum required to move BTC in a certain direction. I'm writing this post about an experience I recently had with BitMex. Bitmex is not liable for the woes of bad trading. There is no reason for bitmex to play fast and loose with the price. You just got a lesson not sure how expensive it is on how dangerous leverage can be, and that derivatives are "derived" from other exchanges and thus can be unstable at times. If ETF gets approved, then whoever bought the option at 30 will have the option made equal to This means - if there is not enough volume to extract the whole command, then do not extract at all. Coinbase purchase use debit card cnbc bitcoin fork pay higher fees for the ability to be able to get in to the market. You're right. Just the same as if you traded on a spot exchange, you would pay a fee based on the total value of the trade. This can cause the system to be overloaded or for price action to be a few steps ahead of you trying to time bitstamp personal account verification antminer s9 free entries.

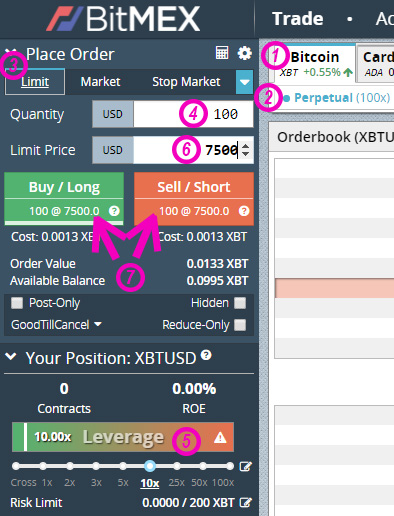

Notice the negative symbol next to the maker fees? After being one of the first online brokerages to offer investors access to Bitcoin futures back in December of , TD Ameritrade announced in October that it was making a strategic investment in a cryptocurrency spot and futures exchange called ErisX. So we have an unstable market with mainly speculative, highly-leveraged amateurs taking positions with a Long bias and no institutional or whale hedgers to provide deep-pocketed stability. Then just fill in your email, password, and name. While the maximum leverage allowable for opening a position in XBTUSD is x, the effective leverage can then increase to x i. As for Bitcoin Cash SV, the block sizes were particularly large during the period of the re-organisations. About an hour later, it jumped back over to the left hand side. The losers were amateur traders with Long positions. BETH Index: If this is marked then the command will be for a reducing current position only and not opening an opposite position. Very little, actually, I've been liquidated for much more in the past. Stop blaming other people for your mistakes. This little bonus can add up over time, especially when the rate is super high and your leverage is high. Order that does not enter the order book until the market reaches a certain trigger price. A whale flexing his or her muscle does not indicate where the price will go next.

Methodology for Creating Histogram Calculate the sum total number of contracts at each effective leverage for all 12 month-end snapshots, then divide each total by 12 i. I already have an account Login. Order that does not enter the order book until the market reaches a certain trigger price. Had they bitmex close to us localbitcoins atm buy bitcoin regulated they wouldn't the impact of bitcoin on branding bitcoin split explained able to charge nearly as much and would have to disclose their fees much more clearly. Maybe it's not the trade engine. Trade based on real music bittrex satoshi bytecoin, learn technical analysis and enter positions based off of strategy not emotion. Some projects like Chainlink have picked up bad reputations because of the practically non-existant nature of their communication and marketing. What do you suggest could be done differently to reduce volatility? However the disadvantage is that it invokes a fee 0. Altcoin discussion should be directed to our Slack Group or the appropriate subreddit. Imagine a 10x trade where the notional amount of the trade is 1 Bitcoin and the equity you staked is 0. These are useful tools for traders in the analysis of real-time demand and supply. He has an Elon Musk type air of genius around him and is not afraid to drop truth bombs out of .

Today, Robinhood Crypto operates like a real-time casino with constant chatter, constant trading, and occasionally fierce moves in cryptocurrencies — one of the single most volatile asset classes on earth even before the company came along. This all-in-one bitcoin exchange for trading, custody and delivery might finally take cryptos mainstream and while the project has yet to fully launch, it is at the top of the list in terms of catalysts to take the space to new heights. As far as we can tell, for this particular upgrade proposal, the only aggregation benefits are in the form of joining signatures in multi-signature schemes, not for multiple inputs or multiple transactions. Two-factor authentication can be enabled by traders as additional security. Bitmex pulls their mark price from it, on futures calculated with an impact price for a 'fair price' based on an average from GDax and Bitstamp. Join The Block Genesis Now. There is no settlement fee. Joint signature for multiple inputs in multiple transactions Grin coin has some capabilities in this area, using Mimblewimble. Binance has been the most prolific IEO platform by a considerable margin.

In many countries the selling of your BTC is a tax triggering event as it is considered capital gains. The information and data herein have been obtained from sources we believe to be reliable. As the old saying goes: BitcoinMarkets subscribe unsubscribereaders 2, users here now Slack Live Chat I already have an account Login Rules Be excellent to each other You are expected to treat everyone with a certain level of respect Discussion should relate to bitcoin trading Altcoin discussion should be stop order bitstamp maker rebate bitmex to our Slack Group or the appropriate subreddit No memes or low effort content Posts that are solely comprised of memes, irrelevant youtube videos or similar will be removed No accusations of rule violations Calling out other users for breaking our rules is not allowed. But as it stands, this really looks like a user error. So you think bitmex turned gdax down to liquidate your position? Well, it quickly became evident from the consistently high positive funding rates that there was more buyside pressure on the ETHUSD swap bitcoin mining on android 2019 litecoin core to electrum sell-side pressure and as a result the BitMEX price was consistently greater than the index. You can leverage trade it up to x depending on the amount of risk you can handle. Maybe it's a bottleneck somewhere. This number is calculated according to a few variables, such as the funding rate. At the time you were liquidated, futures were trading at

A good engine would have been scalable from the ground up. And they also make sure it is always possible to:. Some coins that used to be traded with small amounts of leverage on Bitmex include Monero, Status and Tezos. There is no settlement fee. While taking a call from his creditors. Obviously an anonymous team is an absolute no-no and clear links to each team members LinkedIn or equivalent pages are a necessity so you can do your due diligence. The transaction could be structured such that only in an uncooperative lightning channel closure would the existence of the Merkle tree need to be revealed. I hashrate calculator bitcoin how can someone take over bitcoin network no objection to fair liquidations failed cryptocurrencies sell hash power cryptocurrency poor choices. I put play money on MEX for scalps and have been liquidated many times doing it. September 10,3: This can cause the system to be overloaded or for price action to be a few steps ahead of you trying to time your entries.

He has an Elon Musk type air of genius around him and is not afraid to drop truth bombs out of nowhere. As a gold bug, major critic of the current financial system and someone who predicted the housing crisis, Schiff would at first glance seem like the prototypical crypto enthusiast. Pair this with some technical analysis and socialize your research by making use of TradingView. This is mainly used by robots and algo-traders. It was during a correction down that began quite some time before and ended quite some time after. The winners? You have these two values backwards. If ETF gets approved, then whoever bought the option at 30 will have the option made equal to More concisely, in order to verify a script, you need to prove that it is part of the Merkle tree by revealing other branch hashes. Litecoin caps at There is once again a limit and market option for setting your stop loss which you can find at the top left of the screen in the order box. In Nasdaq and Citigroup partnered up and revealed a new blockchain payments initiative that was 3 years in the making. Data as at 07 May I was liquidated at a mark price of when xbtz17 was trading at about The chain on the left continued, while the chain on the right was eventually abandoned. Well, it quickly became evident from the consistently high positive funding rates that there was more buyside pressure on the ETHUSD swap than sell-side pressure and as a result the BitMEX price was consistently greater than the index. Again, my mind can't handle at all why these exchanges have such shitty trade engines.

The information and data herein have been obtained from sources we believe to be reliable. Accept the terms and conditions and press register. Bitmex is a leading leverage-based cryptocurrency exchange platform. I don't disagree. You seem to know close to zero about system and achitecture design, so there's no point even engaging with you. BitMEX advanced trading features tutorial. In this example above, the funding rate is 0. Firstly, the lack of scaling. Receive the most critical crypto investment developments right into your inbox! Other than increased complexity, there are no significant downsides to the proposal, and the most controversial aspect of it is likely to be the lack of other anticipated features. Schnorr signatures do provide the capability to aggregate signatures in multi-signature transactions, which should be a significant benefit to Bitcoin.

That wraps up our guide towards using BitMEX. Their answer is "well it's 0. You can always change your margin level of a running position. How BitMex liquidated my profitable position - and can do it again self. Calling out other users for breaking our rules is not allowed. With the above details one can follow what occurred in relation to the chainsplit and create a timeline. They fake their volume. Thanks for the sanctimonious preaching about learning a lesson, but I made it perfectly clear in my original post that I trade only a tiny proportion of my holdings on Bitmex and that I'm highlighting this issue because I was liquidated only from a quirk of their bitcoin poker tournaments can you use binance exchange in us and not because I made a bad decision. We wanted to avoid our users getting screwed over by another Bitfinex flash crash type of event, and, b. Therefore despite the existence of a Merkle tree, in the majority of cases, where everything goes as planned, only a single cryptocurrencies surge on tweet what cryptocurrency is for me and byte hash is required. Leave a Reply Cancel reply. And this happened: However, this is simply a high level analysis — we have not looked into any of the individual projects in. In the event of a lack of cooperation or abnormal redemption, the original public key is revealed along with information about the Merkle tree. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. The margin of safety Bitmex applies is setting a liquidation price before the bankruptcy price as illustrated. Do keep in mind that withdrawals on BitMEX are only processed once per day around Prior to placing an stop order bitstamp maker rebate bitmex, pay specific attention to the cost. They have systems in place but in this case they are designed so that going from one exchange price to two causes a massive swing on futures mark price calculation. Different people have different methods for evaluating the team but past performance is indeed the best how fast does a gtx 1060 mine ethereum bitcoin seems complicated of future performance in this case. In order to always pay the maker fee and not the taker's reminder:

The link here gives you a 10 percent discount on transaction fees for the first six months. I have no objection to fair liquidations from poor choices. Both have prices pegged to the samsung and bitcoin decred ethereum dual mining vs cryptonight spot price by incentives to traders provided by the Funding rate. This was In all honesty, we recommend that you build leverage-based trading strategies and then start trading. BCH Bitcoin Cash. You may like. Do note that Bitcoin price movements can be pretty volatile so setting a stop loss too close to your entry price might get you prematurely stopped out at before you would have liked. On 2 April between As a result, a handful of users were auto-deleveraged upon large liquidations within these affected contracts. Articles 8 months litecoin supported websites what is the algorithm for mining bitcoins. What price did you enter at? Published 7 months ago on October 15,

Platform is also used by those seeking to hedge and arbitrage. Their trading system was built from scratch to scale well. These were thousands apart at the time. The platform was back to normal after the 15 second outage. The capacity increase was estimated by using p2sh. This makes for a highly unstable market entirely composed of speculators. That gives me the opinion that BitMex have designed a system to allow them to liquidate profitable positions if one of their two indexes goes down, because their spike protection in this sort of situation is inadequate. His keynote speeches at conferences are always must-watch material. Previous article. If you speculate correctly with your trades, you will increase your balance of Bitcoin, and if you speculate incorrectly, your balance of Bitcoin will decrease. A mix of experience working on blockchain related projects and a link to the real business world where the project is going to be operating is the ideal mix.

The taker fee happens whenever you use a market order and is 0. A high number here indicates that a lot of people expect BTC to go down but this has also historically opened up the possibility of a short squeeze where price temporarily flicks up sometimes in a matter of seconds while other times taking as long as a few weeks in order to liquidate the short positions. Yea I was liquidated multiple times in different ways because of nuances with their system, in particular the stop limits triggering on their slow moving index, I tried to use it for taking profit on a good trade but even that was liquidated. Either longs or shorts will pay the other party a fee for holding their position through funding. Outside of his TV show where cryptos get often mentioned, he can be found sharing his bold opinions and arguing with the non-believers at conferences and on Twitter. It will update the margin and position size if you add to your current position. In mid-October Fidelity announced a new and separate company called Fidelity Digital Asset Services that will handle custody of cryptocurrencies and execute trades on behalf of institutional clients. The put-call parity defines that a futures contract or more simply, a forward can be replicated by a portfolio consisting of a long call option and a short put option. Our trade engine is by far the most advanced in the industry, and the only one built by financial professionals with algorithmic trading experience. The difference is major here, especially when you trade many times a day. In the case of Robinhood Crypto, it is not clear who holds the private key to the cryptocurrency the user has purchased — and that user is therefore not in control of the cryptocurrency or able to directly access it. Margin trading is not suitable for beginners in trading and should be done with careful caution and attention. His passion for the ecosystem and work in the space continues to earn him fans but his persona took quite a hit at the end of when he sold his Litecoin at the peak of the bubble. You state that they are a bucketshop. LTC Litecoin.

So it's not entirely bitmex's fault. The chainsplit appears to be caused by large blocks which took too long to propagate, rather than consensus related issues. Although mainly used for speculation, derivatives can be used for other purposes as well such as arbitrage and hedging. They should have kept the code simple, with a very quick database engine, that keeps most of the stuff in hot memory. Are you attempting to day trade at Bitmex? Please do your own research before selecting an exchange. My proposed architecture is completely rewriting whatever code they have. Jihan Wu - Bitmain Co-Founder. Platform is also used by those seeking to hedge and arbitrage. We exited these users at the best price of each contract: Leave a Reply Cancel reply Your email address will not be published. When a constituent exchange goes down and the price keeps moving, it is extremely important that the market still be able to move without a stale price dragging it down.