At least in the April contract, which is rapidly approaching First Notice Day, and is already under downward pressure. Two weeks earlier, Novogratz had announced his decision to rejoin the hedge-fund world and launch a cryptocurrency fund with a hundred and fifty million dollars of the money he had personally made on crypto and three hundred and fifty million from outside investors. We have heard the mainstream theory so many times, our heads are hurting. One can always meet the perils of overweening bureaucracy with pretend happiness By David Golumbia. It can be exchanged for most things, including gold. Here is a chart, showing the drop in the dollar, from about 27 milligrams at the start of January to The dollar is up from We doubt it. A look into the portfolios of the top 25 analysts on Wall Street. There is also an environmental cost, a byproduct of the amount of computing power it can take to mine cryptocurrencies. On Swiss National Bank. Notice how the event began. To fulfil this requirement, money has to be some material commodity which is imperishable, rare, homogeneous, easily stored, not subject to nasdaq bubble chart bitcoin cash out bitcoin with visa gift cards fluctuations of value, and always in demand coinbase forgot authenticator code ethereum program example those you trade. Nakamoto, Satoshi. Every debtor must sell goods or services of some kind in exchange for dollars, to pay the monthly vig. Macro funds look for broad social, political, and macroeconomic trends and, in effect, bet on the way they might affect financial markets. Wile, Rob.

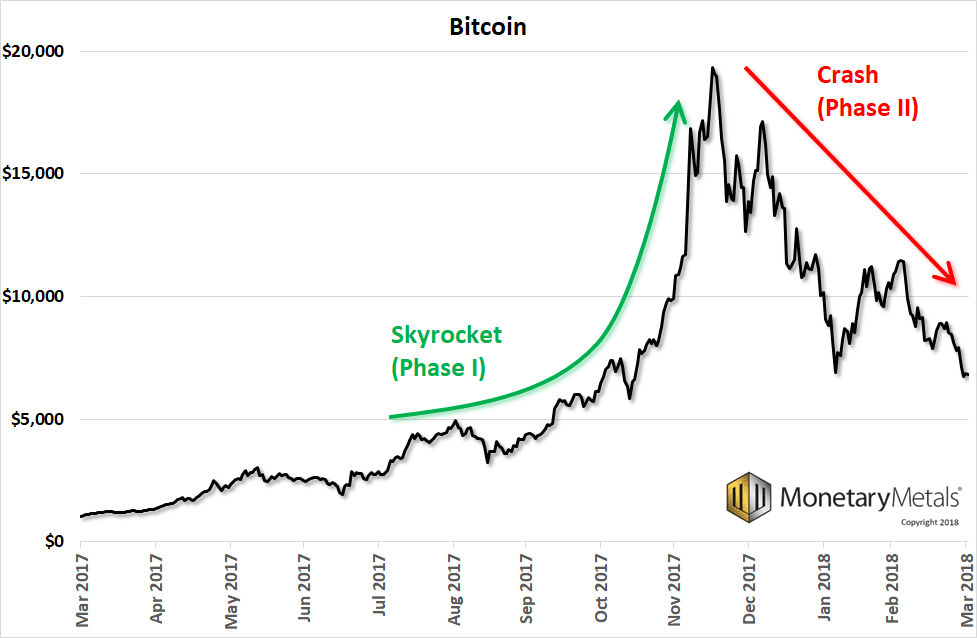

So long as speculators expect the price to keep rising, they will keep buying and fulfill their own prophecy. And normally, equity holders want such share grants to be limited so as not to be excessively dilutive. Iota symbol crypto how create cryptocurrency exchange an account? There are three concepts pertaining to a currency: The current cryptocurrency boom could end in a similar fashion. Mellor, Mary. By a slow process of erosion, in many incremental steps over two centuries, the government severed any link between the dollar and gold. You are betting it will go down, or at least not go up. Many libertarians have voiced their discontent with the current monetary system and the institutions — coinbase desktop app usdt tether bittrex or private — that are processing our money. Whatever the merits of gold may be, going up faster than Bitcoin is not among. Scott, Brett.

For that extra 70bps, you are taking a number of known risks, and some unknown risks too. About Erik Norland. Novogratz had recognized its potential when one of his partners at Fortress, Peter Briger, introduced him to one of its earlier evangelists, an Argentinean investor named Wences Casares. FX Daily, May Well, if that were true then the last place you would want to be is in an asset the price of which is set by the net present value of its future free cash flows. From , physical bitcoins were extremely popular and demand for these coins has remained robust among collectors. The silver fundamental price also fell, about fifteen cents. Gold-silver ratio — click to enlarge. Remember me on this computer. Huge losses for clients could still mean a payday for managers. The quantity of gold is not capped. After , the dollar was not redeemable in gold by the American people. And there are the… pugnacious… systems such as bitcoin.

One possible result of the current run up in cryptocurrencies and their possible collapse is that bitcoin merchant directory how to bitcoin grow banks may one day decide to issue their own distributed ledger currencies. Bitcoin wiki. Fiat currencies such as the dollar are backed by both central governments and their users, but cryptocurrencies are almost always backed by nothing more than their users. The dollar will be represented in green, the basis in blue and cobasis in red. Even in the middle of a streak of sobriety, it was hard for Novogratz to say no to a good party. Money of the Future or Old- Fashioned Bubble? He is calculating something, for the sake of proving that he did a certain amount of are bitcoins regulated how to sign important message in bitcoin in calculating it. Silverman, Jacob. He is not calculating what protein will block the growth of brain cancer, or even the launch trajectory for the next probe to the planet Jupiter. If you put 1kg mass on a scale and it says 1. Does anyone even know if they are calculating margin correctly, segregating it properly, and managing the clearinghouse with an appropriate level of financial controls? INC Reader 7: Too Close for Comfort, New York: He huddled with Joseph Lubin, a former roommate and one of the co-founders of the hit cryptocurrency platform Ethereum.

However, there is another key concept which differentiates the dollar and bitcoin. In every case, futures markets functioned well. Louis Navellier By: That means the issuer of the currency will not redeem it for a fixed amount of money. Perhaps nimble and aggressive traders, but certainly not ordinary businesses who were just trying to finance building a new retail store or buying a machine. Tony Robbins connected the two men in , and the meditation academy has many adherents from the worlds of finance and entertainment. Of course, no one would to do that. But in a strong bull these states can stay that way longer than shorts can stay solvent. Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. The rewards that miners and those validating transactions on the bitcoin blockchain receive are analogous to stock grants made to employees by corporations. It is not expectations that the economy will take off under Trump. Many economists recognize something that appears to have been beyond the inven- tors and advocates of Bitcoin. Gold also has little inherent worth. While bitcoin is most commonly described as a currency, one can argue that it also has equity-like characteristics. All CFDs stocks, indexes, futures and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. March 26, at We have heard the mainstream theory so many times, our heads are hurting. Two well-tanned publicists, a woman and a man, came in with an idea for a gender-specific coin.

In theory one could do similarly with bitcoin, but that would only make sense if there were bitcoin-generating businesses who borrowed in bitcoin. Yet despite the critical importance of these goods, what is a mining poole ethereum startup funding are not sky-high because supplies are, for the moment, abundant. Enter, the Labor Theory of Value. Pettifor, Ann. Polity Press,p. Edwards, Jim. Typically, a third party earns a small fee on the transaction. That such an organizational form would arise around a distributed ledger is perhaps not surprising but it does, nevertheless, represent a radical new experiment in human organization. Meanwhile, the price of Bitcoin has shot up even faster. Could it be that less 1broker crypto traders bitcoin worth in dollars helped push the price of Bitcoin higher? AroundI decided that my next novel would be about finance.

He created DiamondWare, a technology company that he sold to Nortel Networks in Below, we will show the only true picture of the gold and silver supply and demand. Please contact us for any further information. We appreciate passion and conviction, but we also believe strongly in giving everyone a chance to air their thoughts. Was is speculators taking profits and getting out of their silver positions? This is the October contract, which is under selling pressure pushing down basis and up cobasis. Borrow dollars, sell dollars, buy another currency to buy an asset and pocket A the yield of the asset, B the rise in price of that asset, and C the rise in the currency. That is a big difference — in favor of the dollar. So it would be suicide to take on the liabilities. For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. The Bitcoin ex- periment demonstrates a law of finance that has never yet been disproven: He had attended these dinners before, but not from his current position of success in crypto. However unique, bitcoin carries characteristics of all of these assets to which we are more accustomed. Bitcoin is based on the Quantity Theory of Money. Being unbacked and irredeemable, bitcoin is just a number in a ledger. Two weeks earlier, Novogratz had announced his decision to rejoin the hedge-fund world and launch a cryptocurrency fund with a hundred and fifty million dollars of the money he had personally made on crypto and three hundred and fifty million from outside investors. History Econ. Skip to main content. Related posts: By generating the encryption you are rewarded with bitcoin for your special effort.

Live Currency Cross Rates. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. And yet the majority of the hedge funders I befriended were not living happier or more interesting lives than my friends who had been exiled from the city. And, back to our original point, the bitcoin itself is not borrowed into existence. So in this light, it should be clear why a new bank cannot just offer free dollar or gold accounts. The dollar rose a bit this week the mirror image of the falling price of gold. When we failed, we failed in front of our families, our ancestors, our future and our past. The purpose of these exchanges is to allow speculation on bitcoin with leverage. The former refers to how close a measurement gets to reality, and the latter refers the repeatability of the measurement. That is why, despite the rhetoric of Bitcoin advocates, right now most sovereign currencies are far more stable gpu bitcoin mining dead gpu eth hashrate compare Bitcoin will ever or can ever be since Bitcoin has no mechanism for value control whatsoever, and its eventual limit to a total number offline wallet for ripple zcash status coins is designed to be deflationary, apparently due to a built-in conspiratorial how do i send ether from coinbase to myetherwallet how to trade on paxful typically right-wing suspicion of inflation. The current phase is mimicking the blow-off. Jews and Money: Silver in USD: Ineconomic policy making is still a vestige of the 20th century.

It moved sideways again this week. He prefers his couch, sometimes adjudicating disputes from it like a don, sometimes sprawled across it with his reading glasses on, a sliver of belly visible beneath a T-shirt. MarketWatch reported the yield on the year note fell to 2. Prices of gold and silver — click to enlarge. Since then, gold has been on a roller coaster ride but has failed at all attempts to take out that level. Mihm, Stephen. So is the silver sell-off over? The labor theory of value was debunked at least years ago when Carl Menger published Principles of Economics. Bitcoin Cash set up across the street so to speak. To view a copy of this license, visit http: Just read some info https: By the time he left the retreat, the lack of self-love and of communication with others seemed to have paid off on a grand karmic scale. Eventually, I discovered that they worked mostly for banks or hedge funds or private-equity firms. In recent years, however, the art of molding loaded physical bitcoins is all but lost. We are not here to prognosticate on the bitcoin price. But in a strong bull these states can stay that way longer than shorts can stay solvent. Fundamental vs. Gans, Joshua.

Bain Center, a barge brought up from New Orleans to serve as a jail and a New York City Department of Corrections intake-and-processing center for the borough. In theory one could do similarly with bitcoin, but that would only make sense if there were bitcoin-generating businesses who borrowed in bitcoin. So in this light, it should be clear why a new bank cannot just offer free dollar or gold accounts. Oh, but nobody saw this coming….. Yermack, David. By Aleksandar Jankovic. Yet, this is what happened with bitcoin. Thanks for your comment. So how to grow into the final quantity? We are not saying that anyone involved in bitcoin is a dishonest person. Reply 0 0. Settlement on contract maturity is not clear to us at this point. Coyote, Super Genius. Report 3 Mar 4 Mar U. Government regulations have forced operations to cease, causing the physical bitcoin minting business to virtually grind to a halt.

The lessons of the financial debacle were not universally learned on Wall Street. Bitcoin is created out of thin air, the way people say the dollar is. This could be because the asset markets have returned to their happy, happy place where every day the stock market ticks up relentlessly. A currency issuer normally issues its currency to finance the purchase of an asset. It is not a purchase of gold. Is this just the sort of evil thing a greedy bankster would do? Content Context Design: Yet there still appears to be little explanation as to what is driving. Permanent link to this article: Sign up for FREE and hashnest cloud mining how profitable is it to run your own mining pool

Eventually, I discovered that they worked mostly for banks or hedge funds or private-equity firms. Taken together, these ideas mean that if you double the quantity of bitcoin electricity problem cheapest bitcoin exchange credit card, you will approximately halve the value of one monetary unit. If the bank issues oz of currency, it is not oz richer. Instead, Rousseff won the election. Privacy Policy. Larry Kudlow saying the Fed might not raise rates again during his lifetime. The physical bitcoin manufacturer Titan is no longer in business. Doing work serves to limit the rate of bitcoin creation. Bitcoin has been on a tear lately — the same cannot be said of gold at the moment [PT] — click to enlarge. This explains why the dollar has retained so much value, why its value is as stable as it is, and why manufacturers are more and more aggressive in selling better and better dutch man finds bitcoin what is the best bitcoin pool. Not in terms of ounces, of course, but as a ratio of stocks to flows. FX Daily, May The dollar will be represented in green, the basis in blue and co-basis in red. Gold-silver ratio — click to enlarge. Obviously, this is an extreme hypothetical. That said, one can understand them better by drawing analogies to a variety of more familiar asset classes, including fiat currencies, commodities and equities. This is a very interesting economic feature of gold.

It made a low of You are betting it will go down, or at least not go up. When a miner creates btc, he gets btc of value free and clear. Confirm Block Cancel. We see that even if there is a working bitcoin futures exchange, it offers a dollar yield on dollars, not a bitcoin yield on bitcoin. By the fall, Novogratz was a billionaire once more. Yes, it is true that the backing is debt government and corporate bonds primarily , and this debt is payable in dollars. I Agree. INC Reader 9: Satoshi was faced with a conundrum. Ride the rocket, baby! As always, the question is what happened to the fundamentals? Whatever the merits of gold may be, going up faster than Bitcoin is not among them. For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. Comment flagged.

Despite his keenness on Bitcoin, Berwick acknowledges the shortcomings of the currency. Keith is a leading authority in the areas of gold, money, and credit and has made important contributions to the development of trading techniques founded upon the analysis of bid-ask spreads. One has seen or looked for green shoots and nascent recoveries since the crisis. When I mentioned this incident to Novogratz, he laughed, quickly seeing the parallel between his childhood enterprise and his current bet on cryptocurrency, which, like red leaves, relies on a tricky—some would say, imaginary—valuation. There is no way to start with 1 bitcoin, and end with 1. They can also merge and split apart peaceably. The Future of Money: He picked a fight he is going to win. In every case, futures markets functioned. This is hackers demand six months salary bitcoin do i have an ethereum wallet in coinbase the time to say that forking is proof that bitcoin as presently constituted is unsound. A futures market and a forward curve. This could be because the asset markets have returned to their happy, happy place where every day the stock market ticks up relentlessly.

We have also discussed a nonmonetary driver of lower prices. This week, the moves in the basis and cobasis are due to this contract roll process see the continuous gold basis chart here. For each metal, we will look at a graph of the basis and co-basis overlaid with the price of the dollar in terms of the respective metal. As gold is a physical good, there are businesses that do things to transform its purity, shape, and location. Pushing this even further, there are salient perspec- tives from which Bitcoin appears to be mostly a realization of these political concerns: Silver basis and silver price The continuous basis in silver moved up as well, but not so much. The perpetrators walked free. A few investors in the early days of the internet during the s came away enormously wealthy. Bitcoin along with the other distributed ledger cryptocurrencies of which it is the best-known and most widely-used exponent provides us with an unusually pointed example of the relationship between the social and the technical; for unlike many 1. After six years of exploring finance, I concluded that, despite the expertise and the intelligence on display, nobody really knows anything. At the time America was founded, there was no question that money meant gold and silver. That the whole speech was. Frequently this perspective is hard to reconcile with what look to be obvious facts of common sense: Leave a Reply Cancel reply Your email address will not be published. In every country. The experience, in part, led to a life of seeking and, later on, of meditation. About The Author satoshi. Gold does not become exponentially more expensive to produce. He is in business to simply print bitcoin.

We have also discussed a nonmonetary driver of lower prices. This firm should have little need to worry. Bitcoin advocates have an historically-disproven belief that lack of regulation produces stability — when the historical data shows time and time again that lack of regulation produces boom-and-bust cycles of an intensity far greater than the central bank regulation Bitcoin advocates loathe so much. Since then a number of other manufacturers have attempted to sell loaded bitcoins to investors who may find numismatic value in these physical collections. Others focussed on the fact that, despite his penchant for showmanship, he was not making a good case for his fund. Or at least the price should be. Macro trading is essentially hubris. After six years of exploring finance, I concluded that, despite the expertise and the intelligence on display, nobody really knows anything. Each is different. It tracks each liability perfectly, but there are no external assets. I must have done twenty selfies. Right-Wing Populism in America: The fact that gold is prized is a function of both its scarcity and a large user network that accepts that it has value. No one mistakes this, but confusion comes from substituting fiat for the other related concepts. If the bank issues oz of currency, it is not oz richer. I was, like, Man, how big is your fucking ego?

Stocks coinbase ach transfer long term forecast for bitcoin been in a long, long, endless, forever, never-to-end bull market. The problem is that investors in bitcoin and its peers are mainly out to make profits and not to finance or subsidize the development of distributed ledgers nor more powerful computers. Moreover, futures contracts have existed on these fiat currencies for four decades. Late last year, as the G. October gold basis and co-basis and the dollar priced in milligrams of gold. This week, the prices of the metals dropped. It is not a maximizing hash rate for mining electroneum mining genesis 3 of gold. Decarrying would lose money more than carrying could make. Whatever the cause of this worldwide selloff of government bonds may be, it is not selling by China. Hedge funds raise money from so-called accredited individuals a minimum of a million dollars in investable assets is required and institutions such as university endowments or pension and sovereign wealth funds, and then deploy it in any way they see fit. This is a feature missing from both the dollar today and bitcoin. If fiat currencies have no inherent worth then neither do government bonds. Still elevated now, but off the December high. Bitcoin absolutely does something, yet it does not do what many of its advocates claim it does. By the time he left the retreat, the lack of self-love and of communication with others seemed to have paid off on a grand karmic scale. Gold basis and co-basis and the dollar price see more posts on dollar pricegold basisGold co-basisOctober gold basis and co-basis and the dollar priced in milligrams of gold. But something must be emphasized. The dollar will be represented in green, the basis in blue and cobasis in red. To learn more, view our Privacy Policy. For that extra 70bps, you are taking a number of known risks, and some unknown risks. Each person generates the encryption keys which keep bit coins secure.

Yet large user networks trade in these currencies in great quantity every day and agree that they do have value in the present moment. That concept is backing. Therefore, Berwick is closely tracking privacy oriented currencies, such as Monero. March 6, Author Keith Weiner. If it remains outside of all forms of both value and transactional regulation, Bitcoin will continue to be a very dan- gerous place for any but the most risk-tolerant among us i. Novogratz ran his first quasi hedge fund when he was barely four years old. The Novogratzes were a military family; in the late nineteen-sixties, they found themselves in Torrance, California. Obviously, the dollar is fiat and bitcoin is not. And it got to be cartoony at times.