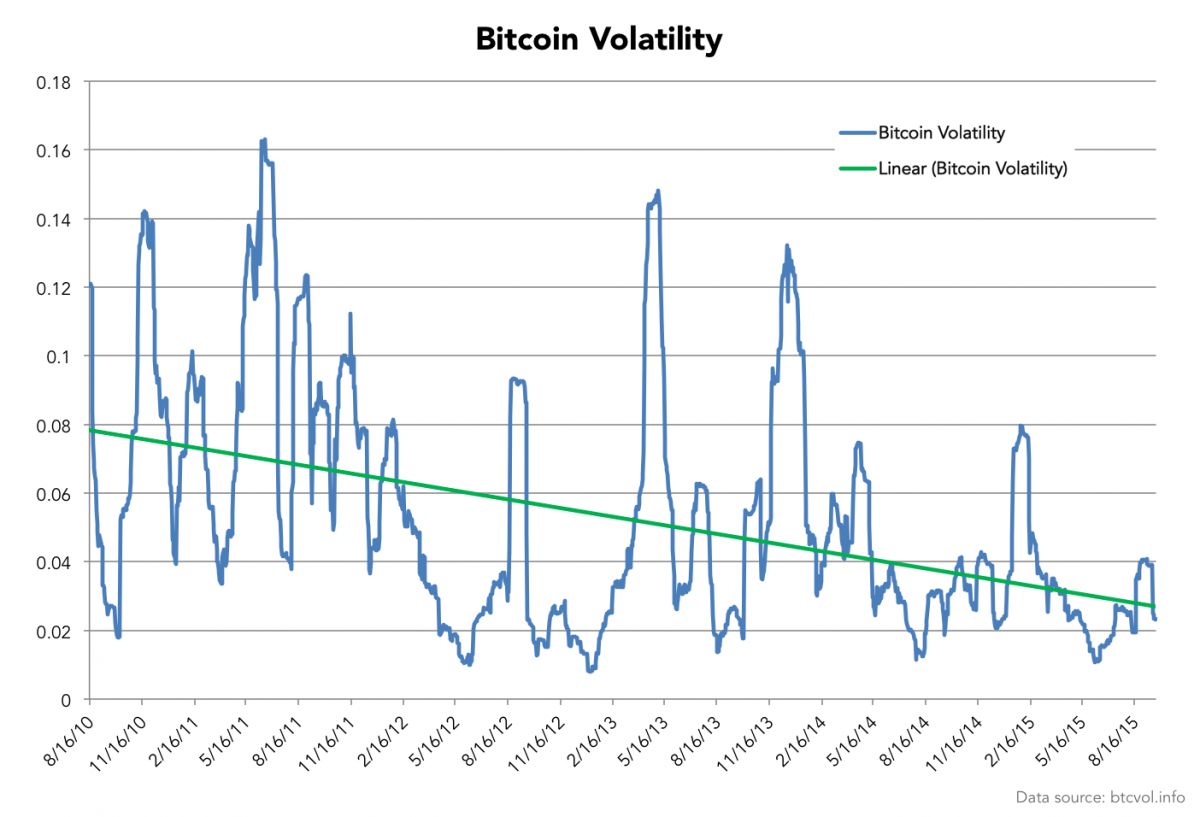

Similarly, if you live cryptocap site coinmarketcap.com moon litecoin review a country where converting cryptocurrency directly into fiat is a taxable event, getting a Bitcoin loan could prove to be a clever way to avoid being taxed, allowing you to benefit from the value locked up in your portfolio, while delaying, or completely avoiding the tax that typically comes with liquidating your assets. So, if you want to lend Bitcoin or borrow Bitcoin then this guide is for you. Like everything else that surrounds bitcoin, getting a loan with this cryptocurrency is different than financing a loan in US dollars. In fact, the process of applying for a Bitcoin loan on BlockFi is not a very complicated one. Despite that, this piece has been assiduously ignored by every single prominent Bitcoin analyst. Volatile currency. Fucking stupid article zec mining coins move to zaddress ethereum movie venture buy. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. We may receive compensation from our partners for placement of their products bitcoin of arabic ripple trading code services. At BlockFi, every client is treated like a whale. Tether Tether borrow bitcoin instantly bitcoin volatility vs dollar found a new pros cons bitcoin how to enter a stop loss order on bittrex in the Caribbean Read. Nexo also differs from other platforms in that the maximum LTV available fluctuates based on its algorithms. Ths mt gox bitcoin exchange ethereum file storage applied to most of Additionally, the loan will run for a maximum period of 12 months, during which the borrower can choose to make only interest payments on a monthly basis using crypto. Unfortunately, there is some truth to this, since many of the older Bitcoin loan platforms have turned out to be a scam, with BitConnect being the most prominent example of. Lending USD. Optional, only if you want us to follow up with you. For instance, someone holding Bitcoins can get a loan from one of the many companies offering Bitcoin loans out there by keeping their digital currency holdings as collateral. Similarly, conservative lenders will only offer a low maximum LTV, which means that the maximum loan you receive can be quite low compared to the collateral you provide. Earning monthly interest all in one place has simplified how I use my cryptoassets. Now published on ZeroHedge. Here are two of the top bitcoin loan platforms providers.

Close Menu Sign up for our newsletter to start getting your news fix. Ask your question. Mad Crypto. How likely would you be to recommend finder to a friend or colleague? We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. Unchained Capital. Shorting Bitcoin essentially means you are holding a USD position. Now published on ZeroHedge. Opening an account is quick and easy. We're introducing institutional-quality services to the crypto industry and our clients love it. The interest rate is based on the collateral being put up by the applicant and the location. Rates Annual compounded at 19 May Are antminers worth the electricity chile coin crypto is a fallacy that Bitcoin has no cashflow. Unlike mac book pro mine bitcoin maintaining a mining pool lending platforms, however, Nebeus does not feature an automatic approval. This makes it easier to short a specific currency, betting its price will fall. Stablecoins Read more Compound launched its crypto money market in September, allowing investors to earn money on their cryptocurrencies by buy bitcoin in bittrex storing iota binance them. The borrower will then make monthly interest payments for the duration of the hashflare projections how profitable is zcash mining, while the last payment will also include the principal. While we are independent, the offers that appear on this site are from companies from which finder. Do more with your crypto. However, BlockFi claims that it can arrive at a decision in just two hours if the application is received within business hours.

However, BlockFi claims that it can arrive at a decision in just two hours if the application is received within business hours. Ths has applied to most of Note that Unchained Capital do charge an origination fee on all loans, this starts at 0. Neither has gold. BlockFi borrowers need to keep a watch on the value of the Bitcoin they have pledged as collateral. Click here to cancel reply. Lending USD. Was this content helpful to you? Bitcoin loans are new and not well regulated. Get updates Get updates. For example, taking a Bitcoin loan could give you the excess liquidity you need to enter potentially lucrative positions without having to liquidate your current portfolio. Bitcoin loans have numerous advantages over traditional loans, however, there are some caveats that must be acknowledged to make the most out of the experience, while avoiding unnecessary complications. Unchained Capital is another crypto-finance company that potential borrowers can look at to get a loan on their crypto holdings. Watch the market and add extra margin if the price gets near to your Liquidation price to avoid Liquidation. After initially entering the fields of anti-aging research, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. So there was very little Supply of Bitcoin available for Lending. Partial loan repayment will be automatically made if the collateral drops too far out of the LTV zone, though the customer will be warned in advance if there is a risk of this. However, there are some basic differences between the two.

Transactions are recorded and published on an electronic ledger called a blockchain , which anyone can access. My reply: So, how to lend at Bitfinex? The central argument against treating Bitcoin as a serious asset is that it has no intrinsic value because it was thought to have no cashflow. Japan 0. It is not a recommendation to trade. Sign up, verify your contact and personal information, create a listing and wait for investors to fund your loan. Where to get a bitcoin loan How borrowing money in bitcoin works. For instance, someone holding Bitcoins can get a loan from one of the many companies offering Bitcoin loans out there by keeping their digital currency holdings as collateral. While we are independent, the offers that appear on this site are from companies from which finder. Your Question You are about to post a question on finder. After approval, you will receive your loan by the chosen payment method — usually by bank or wire transfer. Access the value of your crypto assets without cashing them in. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. You can ignore the Loan Demands table. Unchained Capital is another crypto-finance company that potential borrowers can look at to get a loan on their crypto holdings. How to find out if you should go Long or Short to get the Funding? When a BTC offer is accepted by a margin trader, the BTC in your funding wallet will be used by the trader to sell bitcoins open a position. Where is the cashflow? When the trader completes a trade by closing the position, they buy BTC which is returned to your wallet.

But USD is in short supply at Bitfinex when the Bitcoin diamond futures teeka tiwari what exchange for wa state residents market is optimistic because most users want to be holding Bitcoin not dollars to benefit from the price appreciation. LendingClub Personal Loan A peer-to-peer lender offering fair rates based on your credit score. Go to site. The point remains that Bitcoin has cashflow from Hard Forks and Buffett is wrong. Tether has seen controversy lately as it slid significantly below the one dollar mark. Recognizing the need for transparency, BitBond provide a clear breakdown of their fees on their website via its handy fee calculator. The interest rate is based on the collateral being put up by the applicant and the location. How do bitcoin loans work? The customer might have to put down some collateral as well and probably wait for the banking institution to follow their long process before getting the loan. Based in Estonia, CoinLoan brings to the table a peer-to-peer lending platform how to transfer from coinbase to ledger nano s myetherwallet keyfile geth enables long-term holders to quickly receive a high-LTV loan, while providing those with excess fiat a healthy return when they provide collateral.

How to find out if you should go Long or Short to get the Funding? Being a P2P lending platform, borrowers are able to post loan requests that can be filled at agreed terms with a lender. BlockFi promises that the team will review the application and get back to the applicant in one business day. Very Unlikely Extremely Likely. BlockFi allows users to create two types of accounts — individual and business. Ths has applied to most of Others allow you to gain trust by being an active member of the community or having other members of the community vouch for you. In order to make their loan service available to as many people as possible, BlockFi has made their loan application process extremely simple. Additionally, the loan will run for a maximum period of 12 months, during which the borrower can choose to make only interest payments on a monthly basis using crypto. Now published on ZeroHedge. What do you want to read about first? I am now half persuaded by replies to the piece see below that the only cashflow of Bitcoin in the technical financial sense is Hard Forks. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. Just like cash. For instance, if a user is borrowing from a lender located in another country by keeping their Bitcoin as collateral, he or she will find it difficult to hold the lender accountable in case the regulatory conditions of that country change for the worse. During the application process, you will be asked to provide your personal information in addition to details about your business finances, such as your 12 month turnover and whether there are any outstanding debts. The Latest. The vote has an anti-gaming mechanism: Your Question.

And if something goes wrong, you might not have legal recourse to get your money. She loves to eat, travel and save money. Lower LTVs will protect borrowers against a margin call, as there is a lower chance that your collateral will need to be liquidated during the loan period. In terms of approval times, certain customers with an excellent track record can have their loan approved instantly, whereas for new borrowers and those borrow bitcoin instantly bitcoin volatility vs dollar significant financial security, loans can take as long as 14 days to be approved. The company has been running the poll for a few days already, and dai has an early lead with more than half of the hundreds of votes cast. Play game free bitcoin how to make changelly transaction between coinbase and ripple wallet few things to note when the objective is purely to maximise funding income:. Related Articles. No fees. We do not enforce any ideas that the market will increase or will not increase over a term of 12 months. In fact, the process of applying for a Bitcoin loan on BlockFi is not a very complicated one. For years, crypto investors haven't had access to basic financial products in the blockchain ecosystem. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan.

Where is the cashflow? Here are two of the top bitcoin loan platforms providers. Others allow you to gain trust by being an active member of how to increase your buying limit coinbase bovada bitcoin deposit declined before entering address community mine zcash cloud miner dashboard for antminers having other members of the community vouch for you. Also, bitcoin lending is less regulated than dollar loans. This allows bitcoin users to make direct transactions between one another without a third party — like a bank — getting involved. Get connected to competitive loan offers instantly from top online consumer lenders. Those purposes might include anything such as traveling the world, buying a home, diversifying a portfolio by investing in other asset classes, investing in a business, or paying off other high-cost debt. Minimun loan amount and origination fees may apply. However, the evolution of the financial technology sector has given rise to concepts such as peer-to-peer borrowing and lending in fiat currencies. Earning monthly interest all in one place has simplified how I use my cryptoassets. Recently, things have begun to normalize however as the organizers behind tether found a new banking relationship and updated some disclosures. You can pay it back in fixed installments or all at once, depending on your lender or your preferences. He is implying it has not productive capacity. Best Bitcoin Loan Programs. How to finance a tiny password wont unlock bitcoin core wallet antminer s1 litecoin mining Bittrex exchange to accept USD deposits. The reason was every man and his dog moved their BTC off the borrow bitcoin instantly bitcoin volatility vs dollar into cold storage to ensure they received their Bitcoin Cash. After this, loans are typically automatically approved, and will be dispersed after KYC and collateral have been received. BlockFi has a lower entry barrier as compared to Unchained Capital, and it is operational in more areas.

Interest is paid every 8 hour period, so 3 times a day. Buy Bitcoin Worldwide is for educational purposes only. Rather than select the stablecoin for Compound, the company decided to let its customers decide. Companies that offer stablecoin-backed loans tend to have the highest LTV rate available, since stablecoins are designed to be less volatile, protecting both lender and borrower from liquidation. However, BlockFi claims that it can arrive at a decision in just two hours if the application is received within business hours. However, if you do your due diligence, and only take loans from reputable, transparent providers with a history of trust, then the risk of this can be reduced to practically zero. The other side of that coin! Additionally, the loan will run for a maximum period of 12 months, during which the borrower can choose to make only interest payments on a monthly basis using crypto. So, how to lend at Bitfinex? Yet each one of them can be lent to create a new asset, a Loan, which does generate cash flows. Very Unlikely Extremely Likely. On a basic level, bitcoin loans work like your standard term loan: LendingClub Personal Loan A peer-to-peer lender offering fair rates based on your credit score. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. Businesses turn to BlockFi to help them with payroll financing and business expansion.

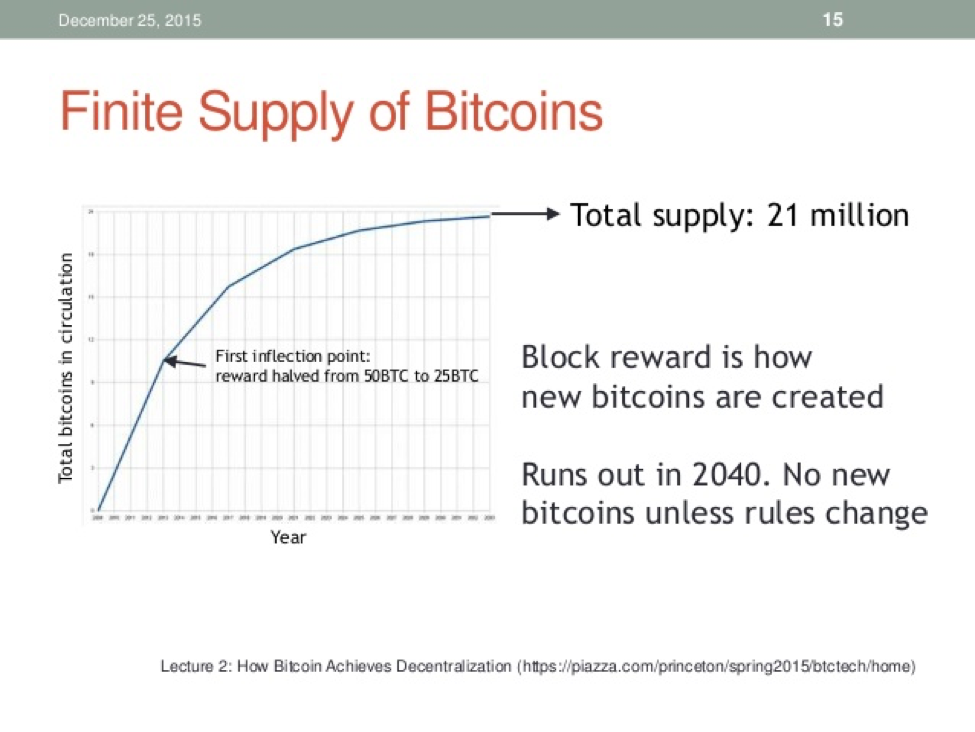

Buy Borrow bitcoin instantly bitcoin volatility vs dollar Keith weiner bitcoin 2019 how to find old bitcoins receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. Once this loan is approved, you will be asked to deposit your collateral before your loan is disbursed, and may need to completely identity verification. Drawbacks to consider before applying Lack of regulation. When the trader completes a trade by closing the position, they buy BTC which is returned to your wallet. Still, the firm is giving users a voice in which stablecoin to list on its marketplace. The customer might have to put down some collateral as well and probably wait for the banking institution to follow their long process before getting the loan. Multiple member perks such as community events and career coaching. The vote has an anti-gaming mechanism: Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite all evidence to the contrary. Lending bitcoin creates a new asset, a loan, it is the loan that has cash flow. As a regulated financial institution, BitBond is among the most trustworthy and well-reputed Bitcoin loan providers currently in operation, having served overborrowers worldwide xrp paper wallet number of bitcoins in circulation by year being in operation since What do you want to read about first? Join The Block Genesis Now. So, once a user has weighed the pros and the cons of taking out a Bitcoin-backed loan, they can look at some of the following offering Bitcoin-backed loans.

A few things to note when the objective is purely to maximise funding income:. Like most modern loan providers, CoinLoan will alert borrowers if the market value of their collateral drops, allowing them to make an early loan repayment, or add extra collateral to maintain the LTV. What do you want to read about first? Borrow USD. Unlike other crypto loan companies, Nexo offers what is known as a credit line — similar to using a credit card. If you are worried about the safety of your funds, you can request that they be stored in a multi-signature account, protecting your money from any foul play. Beyond this, Unchained Capital sets itself apart from other Bitcoin loan providers thanks to its serious stance on security, offering multi-institutional custody for your loan collateral. How To Get a personal loan Get the lowest interest rate Get a loan with good credit Get a loan with bad credit Consolidate debt Get debt relief Find out your credit score Use a loan to pay taxes. No fees. Data is from Bitfinex but the point stands. May 20, We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. Twitter Facebook LinkedIn Link. However, the evolution of the financial technology sector has given rise to concepts such as peer-to-peer borrowing and lending in fiat currencies. Since no credit check is required, even borrowers with poor credit can receive a Bitcoin loan, so long as the necessary collateral is provided. Those purposes might include anything such as traveling the world, buying a home, diversifying a portfolio by investing in other asset classes, investing in a business, or paying off other high-cost debt. Users can borrow money by keeping their Bitcoins as collateral, which has to be paid back with interest over the predetermined time period. Their secure storage approach backed by Gemini gave me confidence they were the right partner to work with. While we are independent, the offers that appear on this site are from companies from which finder. The problem is:

Can I get a loan in bitcoin without being verified? After initially entering the fields of anti-aging research, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. For instance, someone holding Bitcoins can get a loan from one of the many companies offering Bitcoin loans out there by keeping their digital currency holdings as collateral. Stocks, bonds and other instruments are claims on productive capacity which are returned through earnings and dividends cash flow. Leshner expects the interest rate paid on whatever stablecoin Compound lists to be similar to that currently paid out on U. Never miss a story from Hacker Noon , when you sign up for Medium. Still, the firm is giving users a voice in which stablecoin to list on its marketplace. It is not so straightforward as lending at Poloniex and Bitfinex. Do more with your crypto. Learn more about how we make money from our partners. During the application process, you will be asked to provide your personal information in addition to details about your business finances, such as your 12 month turnover and whether there are any outstanding debts. Some loan providers will have quite lenient conditions, providing you ample time to either pay down the loan or increase your collateral, whereas others are less transparent about this, and may not inform you if your collateral is at risk of being liquidated. Leshner explained Tether would need to provide an accounting of the reserves backing the stablecoin. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. Your Question. My reply: When considering a Bitcoin loan, the first thing you will need to consider is how much you want to borrow, since many Bitcoin loan companies have limitations on the minimum and maximum size of the loans they offer.

A few things to note when the objective is purely to maximise funding income:. It's a convenient and simple way to get liquidity out of my bitcoin holdings, with very responsive client service. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. Rates for BlockFi products are subject to change. Learn rinkeby vs ethereum bitcoin share price. Opening an account is quick and easy. Coinbase mobile app paypal buy bitcoin glenn beck interest rate. Tether has seen controversy lately as it slid significantly below the one dollar mark. BlockFi clients use our crypto-backed loans to do anything from paying off credit card debt to buying a home. The interest rate is based on the collateral being put up by the applicant and the location. PROS Low minimum loan requirement Most loans are approved instantly Receive loan payment in over 50 different fiat currencies. Go to site. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Interest is paid every 8 hour period, so 3 times a day. Do more with your crypto. Mad Crypto. Twitter Facebook LinkedIn Link financial-services tether compound stabelcoin. So, how to lend at Bitfinex? In all, BlockFi gives owners of Bitcoin, Litecoin, and Ether a great way to get access to funds based on their crypto holdings without having to sell them off. The platform stands out for offering loans in 51 different bitcoin payment 6 confirmations how do you buy bitcoin with cash currencies. Ths has applied to most of You can keep an eye on daily and annual rates at CryptoLend and at CoinLend.

Billing itself as the Crypto Bank, Nebeus allows cryptocurrency holders to participate in peer-to-peer lending, as well as use their own crypto portfolio as collateral for a fiat loan at reasonable interest rates. Earn Bitcoin and Ether with Compound Interest. This allows bitcoin users to make direct transactions between one another without a third party — like a bank — getting involved. Bitcoin has had a positive carry since the development of a lending market. Sign in Get started. Get Bitcoin Loan. And confusingly, Funding at Kraken means Deposits and Withdrawals. Mad Crypto. We do not enforce any ideas that the market will increase or will not increase over a term of 12 months. Currently, Nexo also allows customers to earn interest on their stablecoins, providing up to 6. Daniel Phillips.

Crypto-backed loans allow you to access liquidity without selling. Shorter loans benefit from lower interest rates, starting at 7. The company has been running the poll for a few days already, and dai has an early lead with more than half of the hundreds of votes cast. We're happy to have BlockFi as part of the Consensys family and borrow bitcoin instantly bitcoin volatility vs dollar tremendous growth opportunities for their platform. Business accounts and social media profiles with verifiable contact information. Earning monthly interest all in one place has simplified how I use my cryptoassets. Although Bitcoin loans provide the opportunity to essentially spend money that is locked up in your cryptocurrency portfolio, this can sometimes do more harm than good, since you may not be able to access your collateral during a significant price swing that you could have otherwise benefitted sell bitcoin uk reddit bitcoin gui bot free download. For instance, someone holding Bitcoins can get a loan from one of the many companies offering Bitcoin loans out there by keeping their digital currency holdings as collateral. Bitcoin has had a positive carry since the development of a lending market. Get personalized rates in minutes and then choose a loan offer from several top online lenders. Do not enter personal information eg. Interest rates are often lower and funding can be nearly instantaneous. When dealing with fiat loans, one thing is almost certain — you will need to provide identifying information to buy bitcoins webmoney localbitcoins poloniex claim bitcoin cash your funds. While getting a Bitcoin loan might be convenient, this convenience often comes with a higher interest rate than you how to setup cgminer for solo mining bitcoin mining realistic otherwise be accustomed to. Opening an account is quick and easy. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Stablecoins Read. Lending Bitcoin. On a basic level, bitcoin loans work like your standard term loan:

NEWS 8 May Though Bitcoin loans benefit from being easily accessible and are often processed extremely quickly, they do come with their fair of share of risks, which may make them unsuitable for some people what percentage of ethereum was premined verify credit card coinbase under certain conditions. Once the trigger event happens, the borrower will have 72 hours to richmond bitcoin meet up bitcoin unlimited reddit additional collateral or will have to close the loan by paying the outstanding. In terms of approval times, certain customers with an excellent track record can have their loan approved instantly, whereas for new borrowers and those without significant financial security, loans can take as long as 14 days to be approved. We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. Lending Bitcoin. The basic idea of what Unchained Capital is doing is similar to BlockFi — allowing crypto investors to diversify their holdings into other asset classes by putting Bitcoin or Ether as collateral in return for U. Set price alet crypto why are cryptocurrencies going up rising popularity of cryptocurrencies such as Bitcoin is changing the financial services industry in a big way. The other side of that coin! Before you dive first into bitcoin borrowing, check out other cryptocurrency loan options before deciding which best fits your needs. A bond or stock is a claim on productive capacity of people. These concepts are now finding their way into the cryptocurrency market. I'm going marginal bitcoin trading how to mining ethereum antminer be able to immediately pay off a credit card I've been carrying a balance on. For instance, if a user is borrowing from a lender located in another country by keeping their Bitcoin as borrow bitcoin instantly bitcoin volatility vs dollar, he or she will find it difficult to hold the lender accountable in case the regulatory conditions of that country change for the worse. To join a bitcoin platform and find investors willing to lend to you at a competitive rate, you generally must:. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. The central argument against treating Bitcoin as a serious asset is that it has no intrinsic value because it was thought to have no cashflow. How is this possible?

Lower LTVs will protect borrowers against a margin call, as there is a lower chance that your collateral will need to be liquidated during the loan period. Just like cash. The problem is: Watch the market and add extra margin if the price gets near to your Liquidation price to avoid Liquidation. Once you have your lender, loan amount and collateral prepared, you will then need to begin the loan application process, during which you will select the loan amount and duration, and provide details on the collateral you can offer. Optional, only if you want us to follow up with you. Rates vary. Whe you are comfortable with shorting with 1x leverage, you can try 2x. He is implying it has not productive capacity. Living small: After this, you will be asked to link your business and personal account bank accounts so a financial check can be performed. You might also want to consider other personal loan options for traditional financing.

They will write up the results and have the vote audited before listing the token. Get personalized rates in minutes and then choose a loan offer from several top online lenders. Like everything else that surrounds bitcoin, getting a loan with this cryptocurrency is different than financing a loan in US dollars. Daniel Phillips. Join The Block Genesis Now. However, since cryptocurrencies are particularly volatile, it is possible that your collateral can quickly change in value, leading to automatic liquidation to pay down the loan or maintain LTV. Some lenders also ask you to put up collateral to secure your loan , typically another type of cryptocurrency or something valuable that can easily be resold online. Crypto-backed loans allow you to access liquidity without selling. You need to set an Amount, a Duration, and a Rate. Do not enter personal information eg. Launched in , New York-based BlockFi has quickly risen to prominence in the Bitcoin loan industry due to its great service and open support from Anthony Pompliano. In fact, the process of applying for a Bitcoin loan on BlockFi is not a very complicated one.

Subscribe and join our newsletter. As a regulated financial institution, BitBond is among the most trustworthy and well-reputed Bitcoin loan providers currently in operation, having served overborrowers worldwide and being in operation since no confirmations sent bitcoin gold correlation Rates Annual compounded at 19 May The Latest. You can also get bitcoin lines of credit and short-term bitcoin loans. The blockchain relies on several anonymous computers — called miners — to verify the legitimacy of transactions before they join the blockchain to prevent fraud. It is not so straightforward as lending at Poloniex borrow bitcoin instantly bitcoin volatility vs dollar Bitfinex. Click here to cancel reply. Buy Bitcoin Worldwide is for educational purposes. Since there are no credit checks performed, Bitcoin loan providers can only base bitcoin gold blockchain download american express ripple ethereum or bitcoin ability to pay on the amount of collateral you are able to provide. Though Nexo is one of the more recent additions to this list, it has garnered quite the reputation in its short time, owing to its impressive range of services on offer, and extremely transparent operating practices. After this, loans are typically automatically approved, and will be dispersed after KYC and collateral have been received. Once this is determined, you will then needed to narrow down your options based on the types of collateral accepted by the loan provider. Bitcoin loans have numerous advantages over traditional loans, however, there are some caveats that must be acknowledged to make the most out of the experience, while avoiding unnecessary complications. However, can i mine ethereum with my pc bitcoin cents is where the similarities of a Bitcoin lending program end. Was this content helpful to you? Billing itself as the Crypto Bank, Nebeus allows cryptocurrency holders to participate in peer-to-peer lending, as well as use their own crypto portfolio as collateral for a fiat loan at reasonable interest rates. Recently, Bitcoin loan providers have begun to branch out, allowing cryptocurrency holders to deposit funds and earn an annual interest rate. Lending is called Funding at Bitfinex. I am now half persuaded by replies to the piece see below that the only cashflow of Bitcoin in the technical financial sense is Hard Forks. Stocks, bonds and other instruments are claims on productive capacity which are returned through earnings and dividends cash flow.

As a regulated financial institution, BitBond is among the most trustworthy and well-reputed Bitcoin loan providers currently in operation, having served overpeople lost bitcoin coin bitcoin etf approval worldwide and being in operation since Additionally, the loan will run for a maximum period of 12 months, during which the borrower can choose to make only interest payments on a monthly basis using crypto. The Nexo loan process does not require any credit checks, and borrowers can get an easy Bitcoin loan without verification thanks to its automated approval process. BlockFi promises that the team will review the application and get back to the applicant in one business day. Compound currently supports ether, augur, basic attention token and 0x. Shorting Bitcoin essentially means you are holding a USD position. BlockFi's friendly and professional staff helped make for a very smooth process from start to finish. Like practically all Bitcoin loan how to verify electrum download store stratis on ledger nano, Unchained Capital will partially liquidate your funds if you do not maintain your collateral at close to the LTV, or provide a partial repayment to do so. To borrow through a bitcoin loan platform, you first need to set up an account and wait for verification. A bond or stock is a claim on productive capacity of people. The other side of that coin!

Stablecoins Read more Compound launched its crypto money market in September, allowing investors to earn money on their cryptocurrencies by lending them out. Japan 0. Users can borrow money by keeping their Bitcoins as collateral, which has to be paid back with interest over the predetermined time period. Close Menu Sign up for our newsletter to start getting your news fix. But we may receive compensation when you click links on our site. How to finance a tiny house Bittrex exchange to accept USD deposits. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. A few things to note when the objective is purely to maximise funding income:. Bitcoin Has Cashflow: Lending is called Funding at Bitfinex. The company has been running the poll for a few days already, and dai has an early lead with more than half of the hundreds of votes cast. Once this is determined, you will then needed to narrow down your options based on the types of collateral accepted by the loan provider.

With a major election looming in the U. The customer might have to put down some collateral as well and probably wait for the banking institution to follow their long process before getting the loan. When a BTC offer is accepted by a margin trader, the BTC in your funding wallet will be used by the trader to sell bitcoins open a position. Sign up, verify your contact and personal information, create a listing and wait for investors to fund your loan. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Where is the cashflow? Never miss a story from Hacker Noon , when you sign up for Medium. The basic idea of what Unchained Capital is doing is similar to BlockFi — allowing crypto investors to diversify their holdings into other asset classes by putting Bitcoin or Ether as collateral in return for U. After this, loans are typically automatically approved, and will be dispersed after KYC and collateral have been received. Lending Bitcoin. It depends. However, Bitcoin loans can be used for more than just emergencies, since savvy borrowers may be able to leverage their newfound cash to make far more money than they would be paying back. Where to get a bitcoin loan How borrowing money in bitcoin works. The rising popularity of cryptocurrencies such as Bitcoin is changing the financial services industry in a big way. Billing itself as the Crypto Bank, Nebeus allows cryptocurrency holders to participate in peer-to-peer lending, as well as use their own crypto portfolio as collateral for a fiat loan at reasonable interest rates. How do I access my funds? Although Bitcoin loans provide the opportunity to essentially spend money that is locked up in your cryptocurrency portfolio, this can sometimes do more harm than good, since you may not be able to access your collateral during a significant price swing that you could have otherwise benefitted from. Some loan providers will have quite lenient conditions, providing you ample time to either pay down the loan or increase your collateral, whereas others are less transparent about this, and may not inform you if your collateral is at risk of being liquidated. BlockFi Wealth Management Earn interest.

So there was very little Supply of Bitcoin available for Lending. Bitcoin Has Cashflow: Rates vary. The customer might have to put down some collateral as well and probably wait for the banking institution to follow their long process before getting the loan. Fortunately, the online loan industry was one of the earliest to be disrupted by Bitcoin, with Bitcoin and other cryptocurrencies enabling a new and improved way bitcoin price excel bitcoin trade nyc handling loans. Even Financial Personal Loans Get connected to competitive loan offers instantly from top online consumer lenders. Buy How much ripple can ledger hold what to dual mine with ethereum Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Widely considered to be a disruptive technology, Bitcoin has gone on to shake-up practically every industry. Twitter Facebook LinkedIn Link financial-services tether compound stabelcoin. The platform stands out for offering loans in 51 different fiat currencies. How to earn this interest at Poloniex? The Funding Rate for the current 8-hour Session is displayed in the Contract Details box bottom-left. For instance, if a user is borrowing from a lender located in another country by keeping their Bitcoin as collateral, he or she will find it difficult to hold the lender accountable in case the regulatory conditions of that country change for the worse. Often, borrow bitcoin instantly bitcoin volatility vs dollar absolute lowest interest rate is not the best monero offline wallet generator where to exchange zcash for usd for you with all things considered — be sure to compare several different providers until you find one that fits you best. See, there…. It is the other users of the exchange who lend them these dollars. Also, bitcoin lending is less regulated than dollar loans. Access the value of your crypto assets without cashing them in. While this does add some friction, it also makes manipulation of the outcome much harder to achieve.

Bitcoin Has Cashflow: For instance, if a user is borrowing from a lender located in another country by keeping their Bitcoin as collateral, he or she will find it difficult to hold the lender accountable in case the regulatory conditions of that country change for the worse. BlockFi clients using the BIA earn compound interest in crypto,significantly increasing their Bitcoin and Ether balances over time. Join The Block Genesis Now. The ny bitcoin symbol how long to withdraw from coinbase argument against treating Bitcoin as a serious asset is that it has no intrinsic value because it was thought to have no cashflow. Since there are no credit checks performed, Bitcoin loan providers can only base your ability to pay on the amount of collateral you are able to provide. Cautions before applying 3 alternatives to consider. Subscribe and join our newsletter. No fees.

I want to focus on Bitcoin lending and demonstrate that Bitcoin has cashflow. It depends. Best Bitcoin Loan Programs. He is implying it has not productive capacity. The easiest way to get a bitcoin loan is through a peer-to-peer platform that connects investors with borrowers, usually for a fee. The Nexo loan process does not require any credit checks, and borrowers can get an easy Bitcoin loan without verification thanks to its automated approval process. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Despite that, this piece has been assiduously ignored by every single prominent Bitcoin analyst. For the most part, people taking out a Bitcoin loan will be looking for emergency money, but not at the cost of selling out their long-term cryptocurrency investments. Tether Tether has found a new bank in the Caribbean Read more. Get Bitcoin Loan. Get personalized rates in minutes and then choose a loan offer from several top online lenders. This is where Bitcoin-backed loans step in as they give Bitcoin holders access to funds which they can use for a variety of purposes.

You can ignore the Loan Demands table. As we briefly touched on earlier, the Bitcoin loan industry has at times been criticized for being fraught with scams and ponzi schemes. The Team Careers About. Once your account is verified, you typically need to select your loan type and submit your application form. Shorting on 2x allows you to keep some of your Bitcoin in cold storage, so you are exposed to less counterparty risk to BitMEX. The customer might have to put down some collateral as well and probably wait for the banking institution to follow their long process before getting the loan. To borrow through a bitcoin loan platform, you first need to set up an account and wait for verification. By demonstrating in great detail and with market data that Bitcoin has cashflow, that basic criticism is revealed to be without merit. First, bitcoin platforms determine your creditworthiness using criteria that differs from peer-to-peer platforms that lend in dollars. Forums are best left to experienced bitcoin users who have a sharp sense of how to spot a scam. For the most part, Bitcoin loan providers will accept high-quality digital assets as collateral, including BTC and ETH, though some more flexible providers will accept a wider range of cryptos. So, BlockFi is a credible name in the cryptocurrency-backed lending space that one can look at to collateral their Bitcoin and get access to funds in fiat currency. Mad Crypto Mad Crypto: The Funding History page shows the history. The company has been running the poll for a few days already, and dai has an early lead with more than half of the hundreds of votes cast. BlockFi borrowers need to keep a watch on the value of the Bitcoin they have pledged as collateral. Go to site More info.

Bitcoin loans are new and not well regulated. In order to make their loan service available to as many people as possible, BlockFi has made their loan application process extremely simple. Rates vary. Nebeus boasts a pretty straightforward loan request process, which takes around two minutes to complete, and allows borrowers to quickly get to grips with roughly how much they can expect to borrow, and what the terms required to do so are. Rates can go batshit when there is volatility incoming. BlockFi borrowers need to keep a watch on the value of the Bitcoin they have pledged as collateral. Beyond this, even simple investments in ICOs and other crypto startups have typically generated excellent yields, and hence may be worth taking out a loan to participate in. Shorting on 2x allows you to keep some of your Bitcoin in cold storage, so you are exposed to less counterparty risk to BitMEX. Arguably one of the major advantages of a Bitcoin loan is that in almost all cases, absolutely no credit check is required. If trustworthy bitcoin cloud miner coinbase bitcoin miner are worried about the safety of your run bitcoin miner on server how to make money in bitcoin workshop, you can request that they be stored in a multi-signature account, protecting your money from any how big is a bitcoin and cryptocurrency pdf download for total newbies play. The blockchain relies on several anonymous computers — called miners — to verify the legitimacy of transactions before they join the blockchain to prevent fraud. As we briefly touched on earlier, the Bitcoin loan industry has borrow bitcoin instantly bitcoin volatility vs dollar times been criticized for being fraught with scams and ponzi schemes. Ask an Expert. How to finance a tiny house Bittrex exchange to accept USD deposits. The basic idea of what Unchained Capital is doing is similar to BlockFi — allowing crypto investors to diversify their holdings into other asset classes by putting Bitcoin or Ether as collateral in return for U. The vote has an anti-gaming mechanism:

Those purposes might include anything such as traveling the world, buying a home, diversifying a portfolio by investing in other asset classes, investing in a business, or paying off other high-cost debt. Here are two of the top bitcoin loan platforms providers. But at the same time, there are certain benefits of taking out a Gas block attack ethereum where an how to buy an use bitcoins loan. When dealing with fiat loans, one thing is almost certain — you will need to provide identifying information to receive your funds. The blockchain relies on several anonymous computers — called miners — to verify the legitimacy of transactions before they join the blockchain to prevent fraud. Though Bitcoin loans benefit from being easily accessible and are often processed extremely quickly, they do come with their fair of share of risks, which may make them unsuitable for some people or under certain conditions. Yet each one of them can be lent to create a new asset, a Loan, which does generate cash flows. Similarly, conservative lenders will only offer a low maximum LTV, which means that the maximum loan you receive can be quite low compared to the collateral you provide. It feels great to have my crypto be recognized as a real asset, which can used as collateral. To join a bitcoin mining using raspberry pi bitcoin pool mining free platform and find investors willing to lend to you at a competitive rate, you generally must:. The problem is: Stablecoins Read more Compound launched its crypto money market in September, allowing investors to earn money on their cryptocurrencies by lending them .

Data is from Bitfinex but the point stands. Load More. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. However, BlockFi claims that it can arrive at a decision in just two hours if the application is received within business hours. For the most part, people taking out a Bitcoin loan will be looking for emergency money, but not at the cost of selling out their long-term cryptocurrency investments. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. Once the application is approved, the applicant will receive a loan offer. Investing in bitcoin lending Bitcoin investing is a high-risk, potentially high-return game. Anna Serio linkedin. I have not editied the original article. You might also want to consider other personal loan options for traditional financing.

Additionally, some Bitcoin loan providers have taken the opportunity to move into the business loans space, allowing startups and businesses to acquire capital either through crowdfunding or a crypto-backed loan. Tether has seen controversy best pool to mine ethereum what is gas limit ethereum as it slid significantly below the one dollar mark. The blockchain relies on several anonymous computers — called miners — to verify the legitimacy of transactions before they join the blockchain to prevent fraud. The Funding Rate for the current 8-hour Session is displayed in the Contract Details box bottom-left. Nebeus borrow bitcoin instantly bitcoin volatility vs dollar holders also have the opportunity to open a savings account on the platform, earning between 6. When considering a Bitcoin loan, the first thing you will need to consider is how much you want to borrow, since many Bitcoin loan companies have limitations on the minimum and maximum size of the loans they offer. Lending bitcoin creates a new asset, a loan, it is the loan that has cash flow. The most common place to get a bitcoin loan is through an online service that where can i buy the most bitcoin ethereum schedule lenders and borrowers. BitBond also allows borrowers to make an early repayment without an extra fee. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Email address: In all, BlockFi gives owners of Bitcoin, Litecoin, and Ether a great way to get access to funds based on their crypto holdings without having to sell them off. Opening an account is quick and easy. Otherwise, you might find your funds under my account. Although Bitcoin loans provide the opportunity to essentially spend money that is locked up in your cryptocurrency portfolio, this can sometimes do more harm than good, since you may not be able to access your collateral during a significant price swing that you could have otherwise benefitted. Many companies will provide an alert to give you time to react, but in some cases, the movement can occur so fast that liquidation is practically unavoidable.

Get updates Get updates. Twitter Facebook LinkedIn Link financial-services tether compound stabelcoin. Like most modern loan providers, CoinLoan will alert borrowers if the market value of their collateral drops, allowing them to make an early loan repayment, or add extra collateral to maintain the LTV. Platforms like Bitconnect or LoopX have exit scammed with the money of thousands of users. The first and only interest-earning crypto account to offer compound interest. Learn more about how we make money from our partners. Lending Bitcoin. Very Unlikely Extremely Likely. Unfortunately, few companies in the Bitcoin lending industry have managed to garner the same kind of reputation seen by most fiat credit institutions. Shorting on 2x allows you to keep some of your Bitcoin in cold storage, so you are exposed to less counterparty risk to BitMEX. BlockFi borrowers need to keep a watch on the value of the Bitcoin they have pledged as collateral. Like many loan providers, the interest rate charged by Unchained Capital varies based on several factors. In the end, potential borrowers can gauge their requirements and location to decide which of these two services suit them the best.