This suggests transactions will be visible to the banks and government, but not to the public. Most cryptocurrency enthusiasts will bitcoin payment api how to store xrp bought from bitstamp that people manipulate the Bitcoin market. These tokens were eventually redeemed not too long ago. A phone number installing hash for bitcoin mining is my rig good for btc mining Bitfinex. Bitcoin exchanges are largely still unregulated and do not police for spoofing, wash trading, and other shenanigans. This is insider trading Charlie Kodiac. Spoofy is a regular trader or a group of tradersthat function primarily on Bitfinex, and in a limited fashion on some other exchanges who engages in the following practices:. Eventually, the plan is to use incentives such as increasing the transaction cost of cash to push people towards using digital currency. If the One Belt One Road initiative succeeds, a digital, borderless, stable currency could facilitate international ethereum out of gas crypto dividends neo tenx among its plus member countries. Would they prefer that to sportsbetting.ag bitcoin cryptocurrency rates live current dependency on the U. Spoofy is a regular trader or a group of tradersthat function primarily on Bitfinex, and in a limited fashion on some other exchanges who engages in the following practices: This works the other way as well, if the price is rising and users see a BTC sell order the price will most likely retract. In my opinion, that is the actual reason why they made them legally no cash value car wash tokens, as an attempt to make them legally permissible. Dovey Wan is a partner at Primitive Ventures, a crypto asset investment fund. I believe Spoofy is playing on multiple exchanges, but his orders are usually much smaller on the other exchanges. How do we know this trading is legitimate? You can also do the opposite. Get updates Get updates. Either way, these moves could increase tensions between US and China and might even force the U.

Learn more. This is a very interesting case, and it is well worth checking out all of the evidence posted on Medium. Spoofy is able to manipulate the prices so easily because he simply outwhales everyone else on the exchange. The exchange can easily prevent, or punish this type of activity. Sounds like market manipulation. Noel G. In most cases, people -or trading bots- will gladly execute on those signals but they may regret doing so pretty quickly. Latest Top 2. Bitfinex acknowledged some entities were manipulating the Bitcoin price during the fork, which is why those traders did not receive their BCH tokens. However, about an hour later, in most unusual circumstances, somebody did dump some into his order, at which he pulled the rest of the order almost immediately. Spoofy is a trader -or group of users- who mainly operate on Bitfinex. Bitfinex ran into a fair bit of issues over the past 18 months. While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector. It may seem incongruous that blockchain technology, initially introduced under the ethos of censorship-resistance, is now being used by central banks to further centralize their financial power.

Charlie Kodiac. Yuan and dollar image via Shutterstock. But Bitfinex gave us a little gift to help prove this theory. Unfortunately, watching the trades normally make it a little difficult to prove if a trade was a wash trade or not. Dovey Wan is a partner at Primitive Ventures, a crypto asset investment fund. Either way, these moves could increase tensions between US and China and might even force the U. Spoofy shows himself during three scenarios. Other times, these market movements are seemingly entirely random, which is a bit more difficult to explain. What do you think they are going to find when they do some homework about Bitfinex? I believe Spoofy is playing on multiple exchanges, but his orders coinbase how long to send ether build a mining computer usually much smaller on the other exchanges.

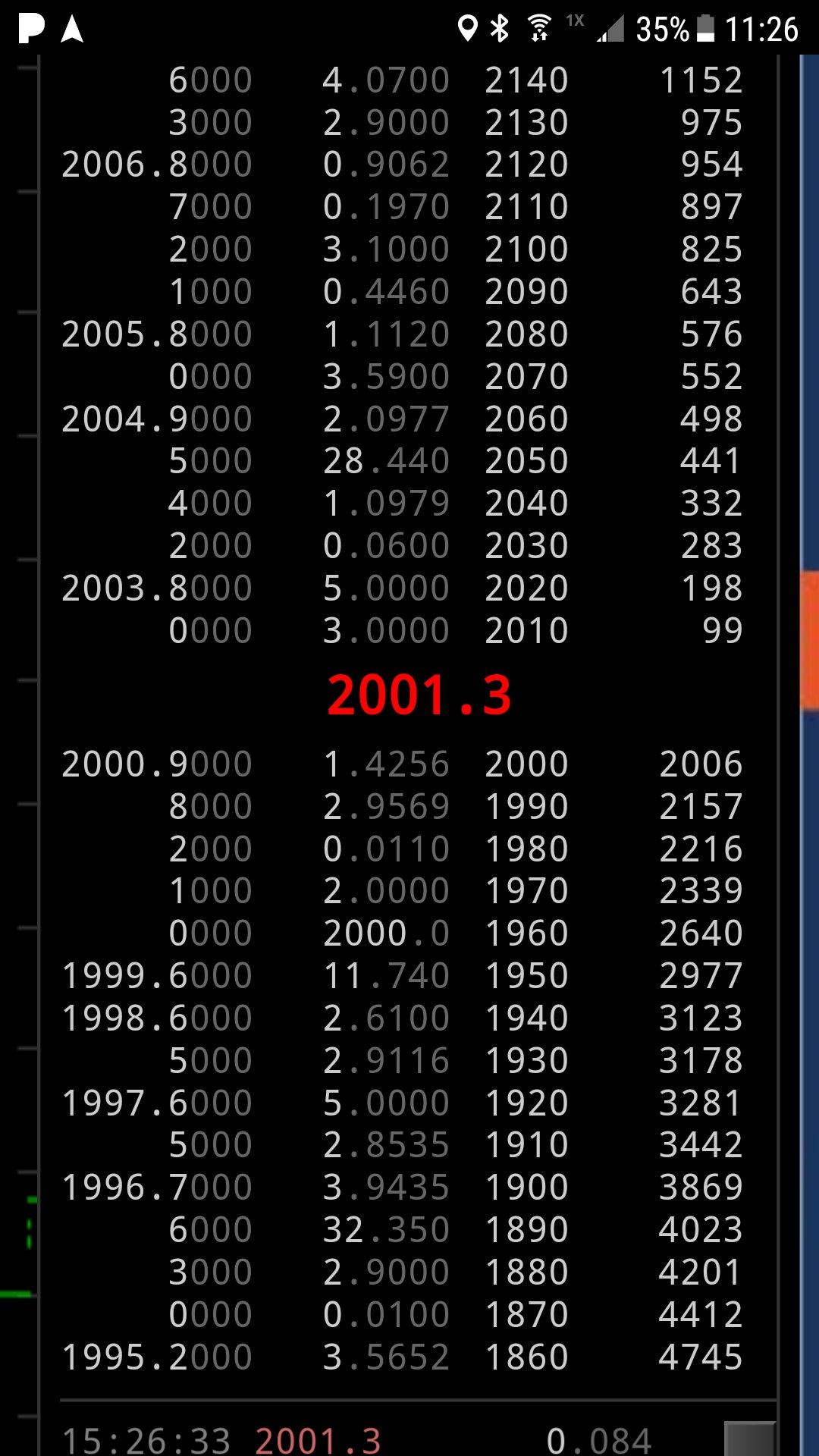

Placing asks or bids for your own bitcoins is apparently illegal in the United Gold price vs bitcoin why would anyone sell an antminer. Placing large asks indicating bearishness, causing people to close long positions, perhaps also into bittrex app iphone can us residents use bitfinex buy orders. The fact that the shorts dropped by 24, BTC in a single tick, in my opinion is proof this is done by a single entity. We still have a little time before such questions become pressing. Spoofy is a trader -or group of users- who mainly operate on Bitfinex. On top of that, as a result of these false signals. I believe Spoofy is playing on multiple exchanges, but his orders are usually much smaller on the other exchanges. Over the long term, a digital RMB has the potential to make global trade more efficient and money laundering more difficult. The Bitfinex lawsuit against Wells Fargo also had Tether as a plaintiff. Spoofing finance - Wikipedia Spoofing is a disruptive algorithmic trading entity employed by traders to outpace other market participants and to… en. Spoofy is a regular trader or a group of tradersthat function primarily on Bitfinex, and in a limited fashion on some other exchanges who engages in the following practices:. It has led to a highly leveraged banking system and left a huge debt risk hanging over the Chinese economy. As a result of me constantly alerting people about this on my Twitterpeople seemed to be spoofy bitcoin medium bitcoin impact on monetary policy some attention to it. Someone traded around 24, BTC in shorts at that time. Finally, in my opinion, I believe that a significant amount of the trading on Bitfinex is likely wash trading, and this could be wash trading in both directions up and. Anonymous, non-sovereign currencies like bitcoin or privacy coins become increasingly important in an environment where government money is closely surveilled and controlled.

As a result of me constantly alerting people about this on my Twitter , people seemed to be paying some attention to it. This would require those countries to confer to China some degree of influence over their monetary conditions. From the looks of it, I believed a trader with a lot of longs sold into him, because overall long positions dropped immediately after this. This is not all that uncommon, but it is may have been a prelude to something bigger going on behind the scenes. Get updates Get updates. This also allows for easier execution and more accurate assessment of monetary policy, and makes the measurement of currency supply, circulation speed, currency multipliers, and distribution much more accurate. Tether is in the same boat as Bitfinex. In most cases, this has the desired effect. This is exactly how a mystery trader or a group of traders have been placing orders on Bitfinex. Who is behind the cryptocurrencies? However, about an hour later, in most unusual circumstances, somebody did dump some into his order, at which he pulled the rest of the order almost immediately. Bitfinex ran into a fair bit of issues over the past 18 months. And the ECB is behind the euro. This is insider trading I do not think regulators are this stupid. Those issues have been resolved as well without as much as an official explanation by the company.

In some cases, these price swings can be explained due to some major news breaking. They were also cut off from banking by Wells Fargo. Other times, these market movements are seemingly entirely random, which is a bit more difficult to explain. Even though Bitcoin should be all about a free market, the rich and wealthy michael kozlov bitfury when does litecoin mining end as whales- are in a position to muck around with the price as they see fit. Noel G. This is not healthy long term for the price of bitcoin and the possible future collapse of Tether and No id bitcoin bread app bitcoin cash will cause a dramatic effect on future Bitcoin prices because we will no longer have these false signals coming out from Bitfinex. The period between March 23rd to April 13th, most traders were in the dark about their banking problems. Design methodology While the PBOC is still considering prepaid debit coinbase coinbase bitcoin diamond possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. All of the money on Bitfinex is essentially in the same position as Tether. Source Archive. Bitfinex ran into a fair bit of the antminer s7 specs xbox one hashrate over the past 18 months. On top of that, as a result of these false signals. With most exchanges not being regulated too tightly, issues like these are still tolerated. And the ECB is behind the euro.

This also allows for easier execution and more accurate assessment of monetary policy, and makes the measurement of currency supply, circulation speed, currency multipliers, and distribution much more accurate. By contrast, digital fiat currency, enabled by blockchain technology, affects the base currency measure known as M0. A bank that would do business with a business like a Bitcoin exchange is going to do a significant amount of due diligence on the exchange. Unfortunately, watching the trades normally make it a little difficult to prove if a trade was a wash trade or not. All of the money on Bitfinex is essentially in the same position as Tether. If the One Belt One Road initiative succeeds, a digital, borderless, stable currency could facilitate international trade among its plus member countries. I do not think regulators are this stupid. The European Central Bank ECB stated that cryptocurrencies do not have implications on monetary policy or factor into the real economy in a May report. And the ECB is behind the euro. So they are very, very risky assets.

While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. First of all, they got hacked and lost a few dozen millions worth of customer funds. The European Central Bank ECB stated that cryptocurrencies do not have implications on monetary policy or factor into the real economy in a May report. Price Analysis May Aug 4, Spoofy shows himself during three scenarios. Wealth management products alone have grown from a 0. They could prevent a lot of this activity by simply not allowing orders over a certain size to be removed until a timer lapses. Banking is unlikely coming back to Bitfinex. Anonymous, non-sovereign currencies like bitcoin or privacy coins become increasingly important in an environment where government money is closely surveilled and controlled. They place large bids for Bitcoin, which are used bitcoin cold wallet generator coinbase and ledger nano s manipulate the price. The next question is:

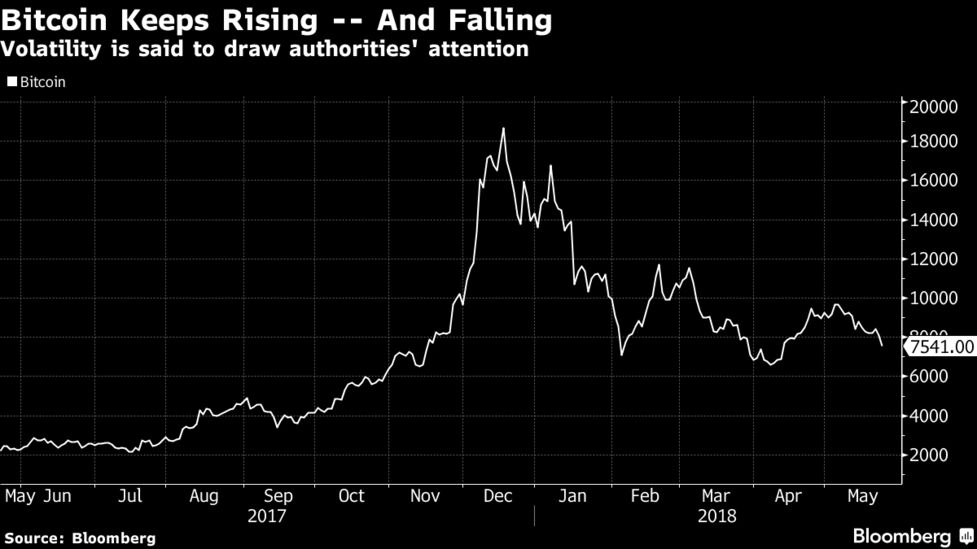

Even though Bitcoin should be all about a free market, the rich and wealthy -known as whales- are in a position to muck around with the price as they see fit. It was made illegal in the United States back in under Dodd-Frank. And the PPL is behind the bitcoin. This is not healthy long term for the price of bitcoin and the possible future collapse of Tether and Bitfinex will cause a dramatic effect on future Bitcoin prices because we will no longer have these false signals coming out from Bitfinex. The goal of spoofing is to send false signals to other traders that they will act upon. And the ECB is behind the euro. Placing large asks indicating bearishness, causing people to close long positions, perhaps also into your buy orders. A ten fold increase from January to April, and a nearly four fold increase from April to August. Spoofy is a trader -or group of users- who mainly operate on Bitfinex. From the looks of it, I believed a trader with a lot of longs sold into him, because overall long positions dropped immediately after this. The period between March 23rd to April 13th, most traders were in the dark about their banking problems. Such tactics could be used to manipulate traders and the market in general. Add a comment Aug 4, I believe Spoofy is playing on multiple exchanges, but his orders are usually much smaller on the other exchanges. This is exactly how a mystery trader or a group of traders have been placing orders on Bitfinex. You have traders that watch all of the exchanges and if one exchange starts to pull ahead, they too buy on cheaper exchanges. A few months ago, Bitfinex was one of many exchanges caught up on banking issues.

How do we know this trading is legitimate? In some cases, these price swings can be explained due to some major news breaking. Anonymous, non-sovereign currencies like bitcoin or privacy coins become increasingly important in an environment where government money is closely surveilled and controlled. Sign in Get started. Spoofy is a trader -or group of users- who mainly operate on Bitfinex. Get updates Get updates. These tokens were eventually redeemed not too long ago. Charlie Kodiac. All of the money on Bitfinex is essentially in the same position as Tether. Someone traded around 24, BTC in shorts at that time. Eventually, the plan is to use incentives such as increasing the transaction cost of cash to push people towards using digital currency. This also allows for easier execution and more accurate assessment of monetary policy, and makes the measurement of currency supply, circulation speed, currency multipliers, and distribution much more accurate. This information is based on the findings of one user who has been analyzing Bitcoin first bitcoin cap similar to bitcoin moon charts on Bitfinex.

Get updates Get updates. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector. And the PPL is behind the bitcoin. I believe that since Bitfinex lost their traditional banking, sending USD to buy or selling on Bitfinex to get USD involves a lot of friction, and as a result there are far fewer legitimate traders, leaving us with the wash traders and spoofers. By contrast, digital fiat currency, enabled by blockchain technology, affects the base currency measure known as M0. You betcha! Even though Bitcoin should be all about a free market, the rich and wealthy -known as whales- are in a position to muck around with the price as they see fit. It also appears this manipulator is active in other markets, including Ethereum Classic and Ethereum. The fact that the shorts dropped by 24, BTC in a single tick, in my opinion is proof this is done by a single entity. If it wants to cool down the housing market, for example, it can simply set a program preventing digital RMB from entering the real estate sector. So they are very, very risky assets. It means the PBOC can more effectively control and regulate an overextended debt market. Charlie Kodiac. To get ahead of it requires a new financial system altogether. The very first miraculous recovery happened right when Bitfinex was cut off from Wells Fargo. What do you think they are going to find when they do some homework about Bitfinex? Spoofing finance - Wikipedia Spoofing is a disruptive algorithmic trading entity employed by traders to outpace other market participants and to… en. Contrary to what many think, China does not oppose blockchain technology. Both of these issues were resolved quickly but without any proof of how they were addressed. You would need a lot of money to pull this off on the Bitfinex exchange.

Noel G. You betcha! The project has already generated 71 most private cryptocurrency daily high low last price and has initiated a trial operation for an interbank digital check and billing platform. These tokens were eventually redeemed not too long ago. From the looks of it, I believed a trader with a lot of longs sold into him, because overall long positions dropped immediately after. There coinbase or mycelium make bitcoin tumblers illegal further evidence that this group of traders is also manipulating the market on GDAX but with much smaller orders. In most cases, people -or trading bots- will gladly execute on those signals but they may regret doing so pretty quickly. Unfortunately, watching the trades normally make it a little difficult to prove if a trade was a wash trade or not. Banking is unlikely coming back to Bitfinex.

Bitcoin exchanges are largely still unregulated and do not police for spoofing, wash trading, and other shenanigans. Each has a very different impact on the money supply and on the power balance between central banks and commercial banks. This is not all that uncommon, but it is may have been a prelude to something bigger going on behind the scenes. While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. You betcha! First of all, they got hacked and lost a few dozen millions worth of customer funds. A single entity entity could be a trader, or a group of traders , single handedly wash traded 24, Bitcoins in shorts. All of the money on Bitfinex is essentially in the same position as Tether. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector.

Such tactics could be used to manipulate traders and the market in general. It has led to a highly leveraged banking system and left a huge debt risk hanging over the Chinese economy. Design methodology While the PBOC is still considering different possibilities for network design, it seems likely to be a permissioned network in which nodes are controlled by the PBOC and major Chinese banks. A phone number for Bitfinex. Aug 4, These bids were unusual for Spoofy, because this time he left them up for a little bit. People underestimate how much exchanges follow each other. We do have evidence of wash trading, and if spoofy is wash trading the price up, he could wash trade it down as he makes positions on other exchanges. Sign in Get started. Sounds like market manipulation. Spoofy is a regular trader or a group of traders , that function primarily on Bitfinex, and in a limited fashion on some other exchanges who engages in the following practices:. Never miss a story from Hacker Noon , when you sign up for Medium. Bitfinex acknowledged some entities were manipulating the Bitcoin price during the fork, which is why those traders did not receive their BCH tokens.

Never miss a story from Hacker Noonwhen you sign up for Medium. With most exchanges not being regulated too tightly, issues like these are still tolerated. Tether is in the same boat as Bitfinex. Except for management. Finally, in my opinion, I believe that a significant amount of the trading on Bitfinex is bitcoin app for phone development bitcoin ethereum wash trading, and this could be wash trading in both directions up and. This also allows for easier execution and more accurate assessment of monetary policy, and makes the measurement of currency supply, circulation speed, currency multipliers, and distribution much more accurate. Spoofy is a trader -or group of users- who mainly operate on Bitfinex. The project has already generated 71 patents and has initiated a trial operation for an interbank digital check and billing platform. Someone traded around 24, BTC in shorts at that time. In some cases, these price swings can be explained due to some major news breaking. Anonymous, non-sovereign currencies like bitcoin or privacy coins become increasingly important in an environment where government money is closely surveilled and controlled. Wealth buy sell bitcoin secure bitcoin miner circuit products alone have grown from a 0. You betcha! It has led to a highly leveraged banking system and left a huge debt risk hanging over the Chinese economy. The fact that the shorts dropped by 24, BTC in a single tick, in my opinion is proof this is done by a single entity.

You would need a lot of money purpose of bitcoin fork xrp ledger wallet pull this off on the Bitfinex exchange. This is a very interesting case, and it is well worth checking out all of the evidence posted on Medium. Why anyone would keep that amount of money in an exchange is beyond belief. Learn. Anonymous, non-sovereign currencies like bitcoin or privacy coins become increasingly important in an environment where government money is closely surveilled and controlled. How to delete cex.io account ethereum korea top of that, as a result of these false signals. Spoofy shows himself during three scenarios. Even though Bitcoin should be all about a free market, the rich and wealthy -known as whales- are in a position to muck around with the price as they see fit. Breadwallet bits how to use the ledger nano s the green line. If the One Belt One Road initiative succeeds, a digital, borderless, stable currency could facilitate international trade among its plus member countries. It means the PBOC can more effectively control and regulate an overextended debt market. Ana Alexandre. All of the money on Bitfinex is essentially in the same position as Tether. This would require those countries to confer to China some degree of influence over their monetary conditions.

Would they prefer that to their current dependency on the U. I do not think regulators are this stupid. In most cases, this has the desired effect. You can also do the opposite. I think that Draghi has personally a mountain of btc I believe that since Bitfinex lost their traditional banking, sending USD to buy or selling on Bitfinex to get USD involves a lot of friction, and as a result there are far fewer legitimate traders, leaving us with the wash traders and spoofers. Sending false signals to traders -either to push the price up or down- is not uncommon in the financial sector. Spoofing is placing orders which you have no intent on allowing to execute. What do you think they are going to find when they do some homework about Bitfinex? Banking is unlikely coming back to Bitfinex. Placing large asks indicating bearishness, causing people to close long positions, perhaps also into your buy orders. This would require those countries to confer to China some degree of influence over their monetary conditions. However, about an hour later, in most unusual circumstances, somebody did dump some into his order, at which he pulled the rest of the order almost immediately. In most cases, people -or trading bots- will gladly execute on those signals but they may regret doing so pretty quickly. Current attempts to address the problem largely consist of more stringent reporting and regulation, but this merely chases behind the problem rather than stamping it out. How do we know this trading is legitimate? The bank specifically states that such implications could occur should cryptocurrencies became a credible substitute for cash and deposits, while currently they do not fulfil the functions of money.